Accounting technology has always played a role in making the accountant’s life that little bit easier. It’s one of those professions that involve a lot of numbers, paper, and thinking. However, technology has enabled accounting firms to take their pursuits to the next level with enhanced analytics and more effective data interpretation.

In today’s age of digital transformation, we’re all pretty used to technology rapidly advancing right before our eyes. It’s essential for accounting professionals to be familiar with the biggest trends in accounting technology.

From cloud-based communications solutions to mobile accounting, leveraging the power of such technology can not only boost productivity and efficiency, but streamline the entire process of corporate finance management.

In this article, we’ll examine the top eight essential technologies for accounting businesses and how they can benefit firms. Skip ahead if you’d like:

- Technology for accounting businesses: A quick primer

- The top 8 essential technologies for accounting businesses

🤔 How can RingCentral’s advanced technology help position your accounting business for success? Find out with our free accounting brief.

Technology for accounting businesses: A quick primer

Technology has always played a role in accounting. Before we dive into our top eight accounting technology trends, let’s take a look at how those technologies have developed, to better understand what accountant technology means today.

How accounting technology changed

From the invention of the abacus to the debut of the calculator, accountants and technology go way back. As technology became more advanced, so too did accountants.

Technological developments enabled accountants to work faster, more efficiently, and with increased abilities. Still, accountants had to produce meticulously detailed records featuring strings of numbers and written statements. Financial matters were identified, measured, and communicated using paper. (And there was a lot of it.)

It wasn’t until the end of the 20th century that the accounting profession began to reach increased levels of functionality. With computers and novel accounting software, account technology took on a whole new meaning. We’re sure the employees at the IRS were over the moon!

Microsoft Excel’s electronic spreadsheet empowered accountants to work electronically. Calculators, ledgers, and stationary no longer cluttered accountants’ desks! The work was simplified and more efficient. Accountant technology has certainly sped up the process of bookkeeping and interacting with clients, but it doesn’t stop there!

Why it’s important to keep up with shifts in accountant technology

In today’s digital world, information technology is constantly evolving to offer improved functionality. As accounting firms become more efficient and productive, client expectations continue to grow.

Clients expect accountants to provide automated services that meet their needs in the least time possible. They expect robust information systems, excellent communication, and an online presence just like any other business.

To stay on top of client expectations and stand out among competitors, anyone in the accounting profession must ensure they stay on top of accounting technology trends and learn the new skills required to use the new technologies effectively to achieve long-term success.

Top 8 essential technologies for accounting businesses

1. Cloud-based communication platforms

Cloud-based communication platforms allow for not only a better way of communicating with clients, but also a less clunky way to store and access an ever-growing amount of data online in “the cloud.” The cloud is essentially what allows you to work from anywhere.

Don’t want to be stuck at your office desk all day? Have clients that live outside your immediate local area?

Then having a good communication platform that’s on both a desktop and mobile app is key. This will let you take client calls, set up sophisticated call forwarding routes, save call recordings, and even share your screen—from anywhere.

This not only allows you and your team to be more flexible and mobile, but also creates a more connected remote workforce culture for your accounting firm.

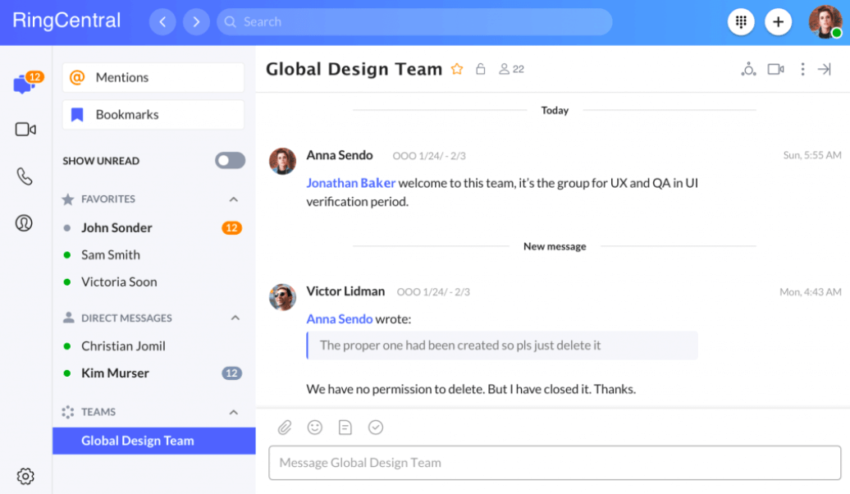

For example, RingCentral integrates messaging, video conferencing, a phone service, and file sharing—all in one convenient app:

This allows accounting firms to stay accessible to their clients efficiently and securely. And more importantly, it allows you to do this, even if you have a small team. Only have one or two people? Not a problem. The RingCentral app has features like these that are specifically designed to make your job easier:

- Voicemail — This isn’t just your average phone voicemail. With RingCentral, you can have visual voicemail (for when it’s more convenient to read your voicemails instead of listen to them) and even get your voicemails automatically sent to your inbox.

- A business caller ID — Using your personal phone to make client calls? This will shield your personal number and display your business number!

- Call forwarding — Route incoming calls to any (or all!) of your devices, any department, and any location—ringing them sequentially or simultaneously. You’ll never miss a call again.

- Auto-attendant — No receptionist? No problem. The auto-attendant acts as a virtual receptionist service, greeting your callers and routing them directly to other people on your team.

- And more…

Cloud storage is an important feature to look for because it allows you to share files and documents with clients and teammates from anywhere in the world. This gives you much more freedom—want to work from home? Or a coffeeshop? Or a beach? As long as you have internet access, cloud storage allows you to access information easily and securely.

When it comes to doing business online, security and accessibility are the main concerns for all businesses dealing with client information. This is particularly salient among remote workforces, where employees can be working from anywhere in the world on multiple internet connections. This need for business continuity is why many of the leading cloud providers feature backup servers to make sure businesses still have access to their information in case the server goes down or a disaster occurs.

By moving to a cloud-based communication solution, you’ll get benefits like:

- Lower upfront costs with cloud accounting solutions on monthly payment schemes

- Little to no hardware and maintenance costs

- Enhanced cybersecurity, data transfers with encryptions and backups

Accounting with a cloud-based communications solution—can it really work?

The global coronavirus pandemic that shaped 2020 resulted in a sudden shift towards remote working. Businesses had to learn quickly how to continue business operations outside of the office. Luckily, communications technology made this possible.

Today, more businesses than ever before are operating with a distributed workforce.

Doctors are treating patients online. Marketing teams are dispersed across time zones and countries—and still running campaigns just as efficiently as they used to—thanks to cloud-based communication channels and project management tools. It’s safe to say that the accounting profession is heading in the same direction.

Of course, when it comes to discussing finances, we’re used to an in-person approach. That being said, accounting clients are becoming more comfortable with virtual meetings and consultations—and the convenience of doing a tax return online is hard to deny. Then there are the benefits of having a distributed team.

Regardless of what is driving your remote-working accounting firm to the cloud, you’ll still need a reliable solution in order to maintain personal connections with clients when dealing with money matters. This is where UCaaS platforms come in.

How can cloud-based communications solutions and related technologies improve accounting operations?

These types of solutions are designed to integrate different communication channels for enhanced and cohesive functionality. As opposed to having one app for video conferencing, another for messaging, and so on, a unified cloud-based communication platform should be versatile.

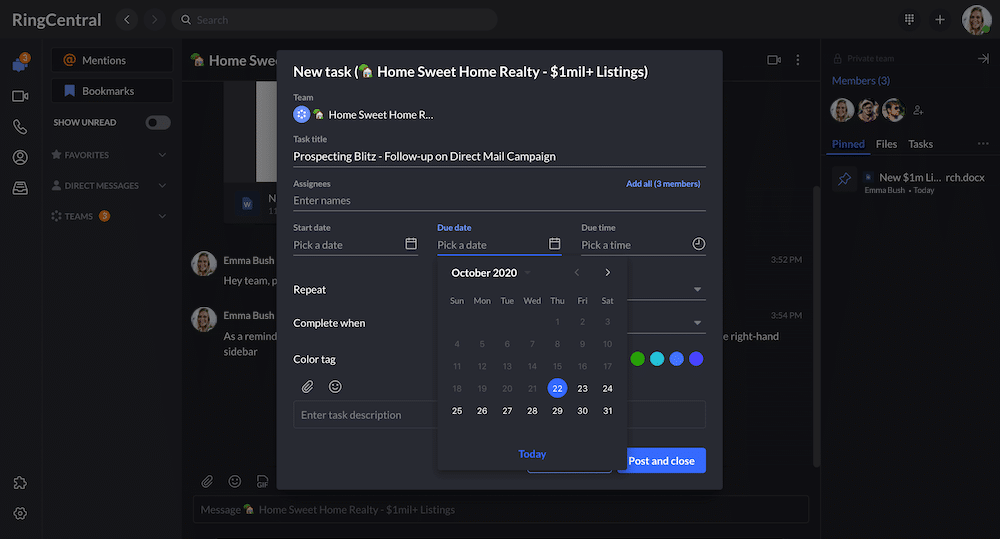

Fo example, the RingCentral desktop and mobile app includes:

- File sharing

- Task management

- Integrations with other business apps like Salesforce and HubSpot

With a UCaaS solution, you can integrate financials, project management tools, and client relationship information all in one place. Over the long run, this will streamline operations, and ultimately save you time and money.

Regardless of where the accounting industry is headed though, the phone isn’t going anywhere—clients will expect to be able to call you. UCaaS has that covered too. Most use VoIP to give you voice and video conferencing, so that you can do your account tasks and connect with clients anywhere in the world, on any device. If you’re planning to make a long-term shift to working remotely, it’s a critical tool.

See how Mowery & Schoenfeld, LLC, an accounting firm, switched from their legacy phone system to a cloud-based solution—and were rewarded with the freedom and flexibility they need to better serve clients.

RingCentral integrates with hundreds of popular apps for accountants, including automated accounting software and CRMs. What’s more, it’s a secure solution that meets the regulatory and compliance requirements set forth by the American Institute of Certified Public Accountants (AICPA).

🕹️ Get a hands-on look at how RingCentral works by booking a product tour:

💰 You can also use this calculator to see roughly how much your business could save by using RingCentral to support your team’s communication with each other—and clients.

2. Blockchain

Blockchain is a technology that’s rapidly gaining traction in the accounting business. If you know how to use it, it can be a powerful tool to help you stand out among your competitors.

Blockchain refers to the distribution and decentralization of database technology and protects encrypted data while recording and adding transactions to participants’ ledgers.

Contemporary accounting functions via a double-entry bookkeeping system, where the accountant and auditor manually input and verify a company’s transactional history. When more than one party is involved in a transaction, and all keep their own records, the process becomes convoluted and inefficient, often resulting in disparities between records.

Blockchain technology mitigates these issues, as the data can be verified without another party’s involvement. It allows complete and automated auditing for each and every transaction in a shared ledger. That’s even as individual accountants, auditors, and companies keep their own records in a private database.

So how might an accounting team implement blockchain into their day-to-day work?

Blockchain software is a third-party cloud infrastructure that allows companies to build and operate blockchain apps. By integrating blockchain software with business operation systems, accountants will see big changes in their everyday operations. By automating recordkeeping processes with blockchain, CPAs will see changes in:

- How transactions are processed, authorized, recorded, and reported

- Back-office tasks

- Their role and skillsets as traditional processes give way to blockchain techniques and procedures

Benefits of blockchain

Blockchain provides the potential to enhance accounting with reduced costs and improved certainty over history and ownership of assets. Accountants can gain increased clarity regarding the resources and obligations required by their organizations.

What’s more, by removing redundancies, blockchain can free up resources and enable CPAs to focus on planning and valuation instead of repetitive, time-consuming tasks.

When implemented along with other tech trends like machine learning and integrated with a cloud PBX, blockchain opens up space for transactional accounting to be carried out autonomously. This means that accountants can focus on the economic interpretation of blockchain transactional records and aligning them with economic reality and valuation.

3. Automation and machine learning

As the business world grapples to balance employee expectations with artificial intelligence, it’s the right moment for CFAs to consider how the two can work alongside each other to streamline business operations. Accounting is moving towards being codeless, which means that soon enough, time-consuming data-entry tasks will be redundant.

Accounting automation systems make accountants’ lives much more efficient. With manual task automation, businesses can cut down time spent on manual data entry and let machines handle the number crunching and transaction handling. Not only does this mean more productive employees, but it also results in cost-savings and reduces the possibility for human error.

Where some might see automation as a threat to the accounting profession, we consider it to be role-redefining. When balancing humans and machines, it’s important to consider the lucrative potential of artificial intelligence and machine learning in automating common tasks like tax preparation, auditing, and payroll. Then, to imagine where all that extra time can go.

CPAs can use the latest automation technologies to streamline accounting processes, so they can spend more time analyzing, strategizing, and making human connections.

4. Financial forecasting

Financial forecasting is about looking to the future to predict financial outcomes using data gleaned from past results and expected non-financial factors. The forecast enables accounting firms to better understand where they’re likely to be at a certain time down the line. But why are predictive analytics and financial forecasting important?

Depending on the scale of your business, financial forecasting can provide valuable insights into whether you’re on track to achieving your business goals. It can identify trends in internal and external data to inform data-driven decisions regarding the business’s financial future.

5. Client relationship management software programs

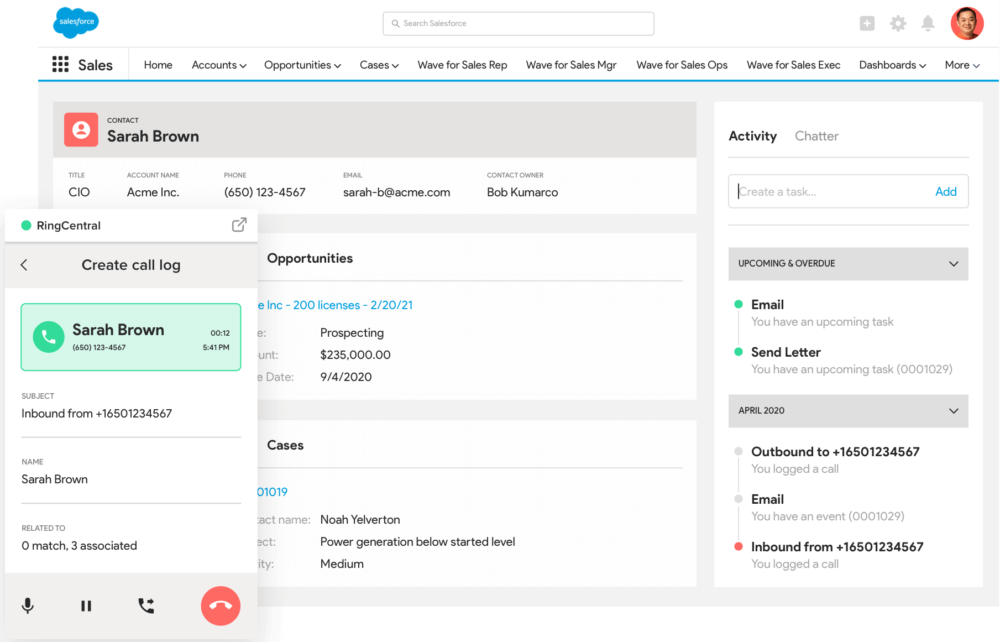

A client relationship management solution is an essential technology for accounting firms to organize customer data in one place. By combining CRM apps with accounting software, businesses can maximize productivity and efficiency by centrally storing accounting information that can be accessed instantly.

When it comes to choosing the right CRM for your accounting firm, integrations with the rest of your tech stack are imperative. The data from your CRM can be used to inform strategies and customer interactions across multiple departments, from sales and marketing to customer support. What’s more, it should be intuitive and easy to use.

Integrating your CRM (like HubSpot or Salesforce) is simple with RingCentral. It’ll let you use customer data to your advantage by ensuring you’re are always armed with the client information you need to effectively communicate and manage their finances:

6. Enterprise resource planning (ERP) systems

ERP system software is used by organizations to manage day-to-day activities such as accounting, risk management, project management, and supply chain operations. Managing everything from financial reports to travel expenses can lead to chaos in an accounting firm, if not done properly.

With an ERP system, accounting firms can:

- Get an overall picture of clients through a unified system

- Easily create reports and analyses

- Automate manual processes with AI and machine learning

- Stay in touch with clients and access the same database via the cloud

By staying connected across teams, accounting departments can dig deeper into company performance to provide fresh insights to clients and make better, data-driven decisions to grow as a business.

7. Social media

In today’s digitally connected world, clients expect to interact and engage with businesses across multiple touchpoints. Accounting firms aren’t exempt from those expectations. Social media is one such touchpoint that has become essential for firms that want to engage with current and potential clients while expanding their audience.

Social media is a tool that provides those in the accounting profession with a powerful sales and marketing platform to connect them with potential clients. Marketing is just as important to accounting firms as it is to any other industry, after all.

Integrating an effective social media strategy into an accounting firm’s long-term overall marketing strategies can impact business development, generate client leads, and amplify business growth and communication among a digital audience.

To remain competitive, accounting firms must leverage the power of social media to achieve business goals by reaching audiences on diverse platforms. Whether you’re seeking to increase the visibility of your newly established firm or boost brand awareness, social media is a powerful platform for reaching a massive audience. What’s more, social media can:

- Help you to achieve better search rankings and boost organic reach

- Identify industry trends to better understand your client’s expectations and competitors

- Humanize your firm

With RingCentral, all of your business communications and customer interactions are stored in the cloud. What’s more, social media integrations ensure seamless management and provide valuable data insights.

8. Mobile accounting

As a business in today’s world, you won’t get anywhere without adapting to mobile. Accountants are becoming increasingly reliant on mobile devices to access and share data in real time from remote locations. Mobile connectivity is pivotal for bridging the gap between accounts and clients, and managing operations on the go.

With RingCentral and the necessary software integrations, firms can manage and share data, update tax information, interact with clients, and conduct meetings from a mobile device.

Whether you’re traveling for work with a tablet or working from anywhere on your smartphone, mobile accounting is made possible with a cloud-based solution. With the right solution, it’s possible to handle finances from anywhere.

This mobility and flexibility give CFOs the real-time information they need to stay on top of financial matters and stay in touch with clients whenever, wherever.

Whether you’re an accountant for a small business, the CFO of a successful accounting firm, or a student completing a bachelor’s degree in accounting, you must stay on top of technology trends and advances.

There’s a reason why powerful businesses aren’t managing their accounts with a calculator and pencil in hand: it takes way too long! Embracing technology is the key to enhancing productivity, streamlining communications, and remaining competitive in today’s world.

Originally published Dec 10, 2020, updated May 22, 2024