Thanks to the availability of technology like video conferencing software, many professions are now able to work from pretty much anywhere they want.

Some doctors are moving to a telehealth model (at least partially), “see” their patients over video, and prescribe treatment at a distance.

And the shift is even easier for big tech companies like Twitter, which have pivoted to allowing their entire team to work from home permanently.1

So, what does this mean for you if you work at an accounting firm? Well, video conferencing isn’t just a trend in tech and health. It’s also a powerful remote working tool that helps you compete more effectively for new clients and employees—and hold onto both.

Bottom line: if you can adapt to this new normal, you’ll have a distinct advantage over those CPA firms that are slow to adjust.

In this post, we’ll cover:

- 6 major benefits of accounting via video conferencing

- Ready to take your accounting remote? Read this first

- How to set up your virtual CPA office in 5 easy steps

🤔 How can RingCentral help your remote accounting firm stay connected at all times? Find out with our free accounting brief.

6 major benefits of accounting via video conferencing

Now that we know businesses of all types can go remote, the question we should be asking is how can remote accounting benefit your business beyond COVID-19?

Maybe you’ve already seen some short-term rewards of accountants working from home in the past few months, and you’re wondering if you even need to go back to a traditional office arrangement. Maybe you’ve been keeping clients satisfied with phone calls during this time, but everyone misses that more personal, face-to-face approach when discussing important money matters. Whatever’s brought you to this post, here are some of the ways video conferencing can pay off for accounting firms:

1. Hold onto your hard-earned income

Outdated processes raise costs and lead to lost revenue over time. With the right cloud-based communication channels, you can integrate all of your financials, project management tools, and customer relations processes into one place, which saves you time and money.

2. Reach a wider audience of potential clients

Instead of drawing only clients from your limited local geography, you can bring in clients from anywhere with video conferencing. This opens a world of possibilities you might not have been able to access offering in-person services alone.

3. Stay competitive by meeting your clients’ changing expectations

We’re living in the Experience Economy, where people choose what they consume based on how they feel, even more so than how their wallet feels. And when it comes to people’s finances, knowing you’re there for them, wherever they are, is priceless. If you can offer safe, secure, remote video meetings with clients, you’ll make something in their life easier. And that always feels good.

What if you could easily set up recurring or ad-hoc meetings to talk about your clients’ financial needs, safely share sensitive documents back and forth, and even include other stakeholders who might need to be kept in the loop?

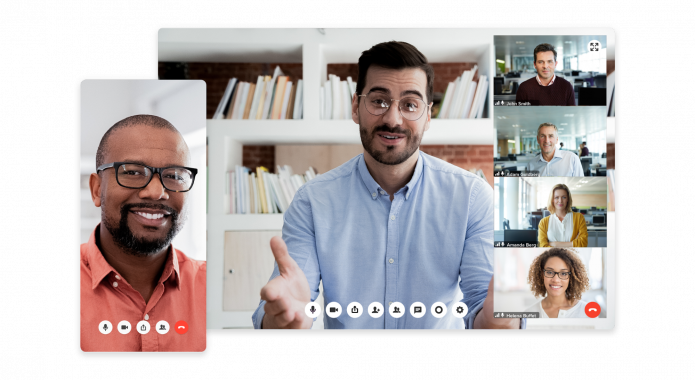

All of this adds up to a measurable competitive advantage for you over the firms who only take meetings on site. And you can do all of this with RingCentral Video:

4. Increase trust with a face-to-face connection

While phone calls to discuss your clients’ finances can work to some degree, humans are visual creatures. Ultimately, we want to see and be able to talk to someone face-to-face. If you’re looking to offer the convenience of accounting services delivered to your clients’ homes, you might need to include the option for video calls.

Video conferencing can help you increase trust both through letting your clients see your face more often, and also by being able to provide them more value in your calls by physically presenting client information. You and your clients can share presentations and your screens with each other as well as your smiling faces, so everyone is on the same page. (Learn more about different options for screen sharing software.)

Want more WFH tips? Download the Remote Work Checklist.

5. Retain more clients for the long haul

As generational shifts occur, it’s becoming more important than ever to put work into retaining your clients. Why? Millennials and Gen Z are two generations who have no problem walking away from a company that falls short on service:

The easier you can make life for your clients today, the more likely they’ll be to stick around. Offering the option to video conference about their taxes or other needs from the comfort of their homes, on any device, could be a big step in the retention direction.

6. Improve employee satisfaction and retention

Did you know it can cost anywhere from six to nine months of an employee’s salary to replace them if they quit?2 Similarly to when they’re shopping around for goods and services, people today want to feel good about the place they work. If they don’t, they’ll leave.

Creating a more flexible work/life balance for your accounting team might be one way to keep your best and brightest on hand while protecting your bottom line. With the right video conferencing software, your team can stay in touch with each other and their clients from anywhere, for greater job satisfaction. And as you know, happier employees usually make for happier customers.

Ready to take your accounting remote? Read this first

As an accounting pro, you might already be thinking about the security and safety of your clients’ private information when it comes to accountants working from home. And you’re right! Just any old communications software won’t do when it comes to a field as sensitive as finance.

If you want to offer your clients both convenience and peace of mind, be sure you find the most secure platform for your remote accounting team. One way to do so is to vet the platform in question for independent audits of their industry-specific security standards. For instance, RingCentral’s platform is regularly reviewed against the regulatory and compliance requirements set forth by the American Institute of Certified Public Accountants.

Setting up your virtual CPA office in 5 easy steps

Now comes the fun part: setting up your accounting firm for video conferencing. Follow these steps, and you’ll be on your way to offering even more delightful service to your customers and a more flexible work experience to your employees.

1. Find the right service for you and sign up

There are tons of video conferencing platforms for businesses out there for you to explore. For example, RingCentral Video lets you join video calls from your browser without needing to download anything at all, and we’ve already talked about the accounting-specific security standards our platform meets.

Plus, the app has a built-in phone system with all the features a good accounting firm needs, like:

- Voicemail — This isn’t just your average phone voicemail. With RingCentral, you can have visual voicemail (for when it’s more convenient to read your voicemails instead of listen to them) and even get your voicemails automatically sent to your inbox.

- A business caller ID — Using your personal phone to make client calls? This will shield your personal number and display your business number!

- Call forwarding — Route incoming calls to any (or all!) of your devices, any department, and any location—ringing them sequentially or simultaneously. You’ll never miss a call again.

- Auto-attendant — No receptionist? No problem. The auto-attendant acts as a virtual receptionist service, greeting your callers and routing them directly to other people on your team.

- And more…

🕹️ Get a hands-on look at how accounting firms are using RingCentral to provide a great client experience even while working remotely works by booking a product tour:

💰 You can also use this calculator to see roughly how much your business could save by using RingCentral to support your team’s communication with each other, clients, freelancers, and more.

2. Integrate the software with your calendar

If a new communication tool adds extra steps to your process, is it worth the hassle? We don’t think so. RingCentral integrates seamlessly with your calendar of choice (Outlook, Gmail, you name it) and is a breeze to get up and running:

3. Start scheduling those client meetings

Find a video conferencing software that plays nice with your calendar, so you have the option to add a video conference link to any new appointment you make with just one click. For example, here’s how easy it is to add a RingCentral Video meeting link to your email invite in Outlook:

4. Launch your meeting at the scheduled time

Get your e-documents in order and launch the meeting! Be sure to share your video for that in-person feeling your clients will appreciate. Use the “Share my screen” function to walk them through whatever financial documents need reviewing. And if you’re on RingCentral, you’ll experience HD video and sound, so nothing important is lost in translation:

5. Ask for feedback

As you roll out a new feature to your clients, it’s important to make sure they love it as much as you do. RingCentral comes with the ability to integrate with survey apps so you can find out what’s working, and what needs adjusting, with your remote accounting option.

Can accountants work from home? It’s possible, thanks to technology

As we’re forced to look more closely at our financial health in this challenging time, customers are searching for new ways of using technology to learn about issues, respond quickly, and communicate with financial advisors no matter where they are.

Video conferencing can be a helping hand extended to your clients as they navigate their own financial course, a service that sets you apart from your competitors and delights your accountants, too.

1techcrunch.com/2020/05/12/twitter-says-staff-can-continue-working-from-home-permanently2peoplekeep.com/blog/employee-retention-the-real-cost-of-losing-an-employee

Originally published Jul 13, 2020, updated Jul 24, 2024