As the saying goes “You’ve got to spend money to make money.” and, of course, it’s true. When you take into account the costs associated with an office or shop location, insurance fees, payroll, and even office supplies, the costs soon mount up.

But to really understand your bottom line, you have to organize and understand your operating expenses. So, we’re going to clear up exactly what an operating expense is, as well as what it isn’t, and tell you how you can calculate yours using a simple operating expense formula.

If you’re just here because you’re wondering, “What is the formula for operating expenses?”, then “How do you calculate operating expenses?” section is the one for you.

But if you also want to try to reduce your operating expenses, we’ve got five tips that you can use to do exactly that.

- What exactly are operating expenses?

- What is not included in operating expenses?

- How do you calculate operating expenses?

- 5 tips to reduce your small business operating expenses

💸 Discover how connected communications can transform your business operations and significantly boost your revenue with our latest eBook. Dive into practical strategies and expert insights that will enhance your communication systems and drive your business success—download today!

What exactly are operating expenses?

Operating expenses, sometimes abbreviated to “OpEx,” are the necessary costs that your business incurs to keep it running, but they aren’t related to the production of a product.

According to the IRS, these operating costs must be ordinary (common and accepted in the trade) and necessary (appropriate to the business) in order to qualify as operating expenses.

If your business files taxes in the United States, you’ll want to track and document your OpEx because they’re tax deductible!

Types of operating expenses

Expenses that your company incurs that aren’t directly related to goods and services can be classified as operating expenses. These can be divided into various types:

1. Sales and marketing expenses

2. The costs of marketing your products and services are classed as operating expenses. This includes the cost of things such as:

-

-

-

-

- Advertising and marketing

- Events

- Travel for sales-related purposes

- Product sampling

- Promotional materials, such as signage in shops

-

-

-

3. Compensation for staff

Of course, you need to factor in the cost of paying the people who keep your business running. This includes the amount you spend on:

-

-

-

-

- Salaries

- Paying freelancers’ invoices

- Pensions

- Employee benefits

-

-

-

4. Office expenses

The costs of anything that’s required to keep your office operating are also operating expenses. This includes things such as:

-

-

-

-

- Office supplies like pens, files, and paper for printers

- Furniture for your office

- Property taxes

- Rent and utilities

-

-

-

What is not included in operating expenses?

Most of what automatically comes to mind as you think about the costs of running a business qualify as operating expenses. But there are some technicalities to be aware of, and a few expenses don’t fall under this umbrella.

First of all, the cost of goods sold (including materials and manufacturing) doesn’t qualify as an OpEx, so remember to exclude those when using the operating expenses calculation formula we’re going to introduce you to shortly.

Capital expenditures like buildings or machinery also don’t come under an OpEx. Other non-operating expenses include:

- Depreciation

- Amortization

- Bank fees and interest charges

- Lawsuit settlements

- Currency exchange fees

- Restructuring costs

- Obsolete inventory

That doesn’t mean that these aren’t costs your business has to deal with—they absolutely are. But there’s a distinction in the way these costs are handled when you file your taxes, so it’s important to keep track of operating expenses separately.

Plus, as we’ll discuss later, when you’re looking to save money in business, the best way to do so is to actually look at your operating expenses separately from other expenses. These are usually the easiest to reduce to make a real impact on your bottom line.

But we’re getting ahead of ourselves. Now that we know what is and isn’t an operating expense, you’re ready to calculate your OpEx with a business operating expenses formula.

How do you calculate operating expenses?

Like all numbers in business, your operating expense total only makes sense within a larger context. Once you know your operating expenses, examine them within the context of your revenues.

To calculate operating expenses and find your operating expense ratio (OER), add your cost of goods sold (COGS) to your operating expenses. Then divide by your revenue to get a percentage of revenue that you’re spending on these expenses—an operating expense ratio.

Operating expense formula

To put it more simply, the total operating expense formula is:

COGS + OpEx/Revenue = OER

After using the operating expenses formula to calculate your OER, you can look up average operating expense ratios for your industry to see how your business is doing in comparison.

Does an increase in operating expenses signal trouble?

Yes and no. It depends on the context surrounding this increase. If your revenue is staying still or not increasing and your operating expenses are growing, that’s a sign of trouble because it signifies that your business might be making less profit.

On the other hand, an increase in your operating expenses can also be a sign that your company is growing. Your operating expenses may be increasing because you’re paying for more staff to deal with your business’ extra demand, for example.

What’s important to note is that looking at your operating expenses alone won’t show you a true picture of how your business is performing. Your OER is more useful when it comes to assessing your company’s performance.

A high OER is a sign that your business is performing well, whereas a low OER indicates that you need to make adjustments to improve business performance.

5 tips to reduce your business’ operating expenses

Expenses are an unavoidable part of doing business—you need to keep the lights on, after all. So why focus on reducing operating expenses?

Well, an increase in operating expenses cuts into your profits while reducing operating expenses allows your business to make more money.

As a business (and especially if you’re a small business), when you’re looking to improve the bottom line, operating expenses are the first place to turn. That’s because they frequently are less fixed than, say, production costs.

Plus, while a reduction in production costs might also be able to help your bottom line, it could be at the expense of quality. And while you may be able to increase your prices to make more money, you may also jeopardize sales at a higher price point.

Therefore, operating expenses are generally where you’ll look when it’s time to save some money in your small business. Luckily, since operating expenses cover so many business areas, there are a lot of ways to experiment and try to reduce them.

We’ve assembled some of our favorites below:

1. Consider remote work options

One major operating cost for small businesses is the cost of a workspace—rent, utilities, and maintenance are a major line item for businesses that choose to operate out of a physical location.

For some companies, like clinics and shops, it may not be possible to work remotely, but if you’re paying for an office space, you may consider remote work to save on your bottom line.

And, with remote work tools like team messaging and video calling, there’s no reason why your business can’t stay just as connected as it would be in an office.

For example, RingCentral’s desktop and mobile app gives you messaging, video conferencing, and a phone system—all in one app:

Just be sure to work intentionally to support a company culture of collaboration and communication, even when your team isn’t in the same physical space

2. Reduce travel costs

There are some jobs that absolutely need to be done on location, and then there are meetings that don’t necessarily need to happen in person. Examine your company’s travel expenses and consider whether you can cut back on in-person meetings and sales calls to reduce travel costs.

Whether or not your team works remotely, video calling is still a great option for connecting with leads, holding important meetings, and, yes, even closing deals.

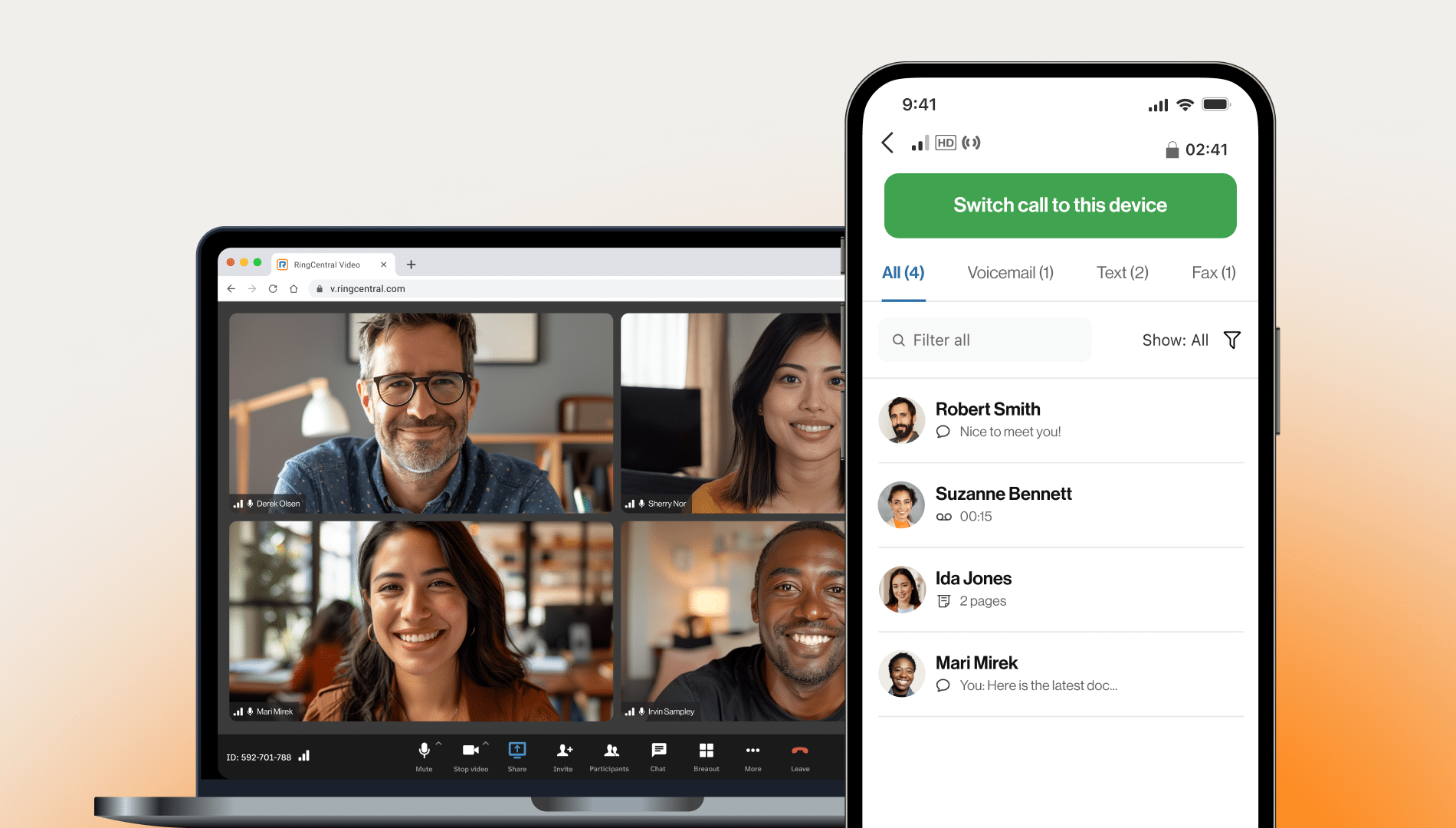

If you haven’t tried video-conferencing software for business lately, you might be surprised by the quality. With HD video calling, great quality audio, and screen sharing with annotation features, a good platform can help your business project a professional image while hosting meetings virtually.

Again, RingCentral’s app gives you the ability to do all that in your video-conferencing calls:

3. Add up your subscription costs

Recurring costs are one of the easiest ways that money slips away from many businesses without anyone noticing.

Examine your bills and look at all of those subscriptions that automatically charge you every month or every year. Then start examining your team’s usage of each of your subscriptions. You might be surprised by how little you’re actually using some of the subscriptions you’re paying for.

One good rule of thumb, especially as a growing business, is to choose software solutions that do more than one thing well.

For example, as opposed to having one tool for video conferencing, another for file sharing, and another for calling, find one platform that can do them all.

Tools like the RingCentral RingEX can handle all of that (and more), plus it even comes with features like the ability to switch from a phone call to a video call with just the tap of a button:

Plus, when you have too many software options for your team to work with, it’s unlikely that they’ll actually all get used to the fullest extent.

How much time do you need to spend on training team members on different apps? How much time and mental effort is your team wasting when they have to switch between different platforms and windows all day long?

Choose versatile software so you can waste less time training your team, avoid subscription creep, and spend less on SaaS products .

🕹️ Get a hands-on look at how RingCentral can streamline the number of tools you’re paying for by booking a product tour:

💰 You can also use this calculator to see roughly how much your business could save by using RingCentral to support your team’s communication with each other—and clients.

4. Shop around and pay on time

Examine your operating expenses and ask yourself—do you think you’re getting a good deal?

By shopping around for things like technology, insurance costs, and even building maintenance, you can end up saving a lot. Don’t be afraid to get quotes from competitors of the vendors you’re using now, just to be sure you’re paying a fair price.

You might also ask vendors you work with often if they can offer a discount for invoices paid early or upfront in full.

Keep an eye out for special promotions that will price match for your company—it never hurts to ask!

5. Outsource

As a small business, hiring any employee represents a significant operating expense. If the cost of payroll is a major percentage of your operating expenses and you’re trying to avoid costly new hires, consider outsourcing or hiring freelancers.

By working on a per-project basis with an expert in the field, you can get the high-quality work you expect for a rate that’s much more budget-friendly than an annual salary.

Plus, you’ll have the opportunity to work with someone who’s specialized in exactly what you need them to do—whether it’s marketing or accounting—rather than hiring a generalist to work full time.

Of course, once you start to have freelancers working nearly full time for you or have to hire multiple freelancers to do the same thing, it may be time to consider a full-time hire.

But for tasks that are highly seasonal, like filing your taxes, or you just don’t require a full-time employee for your company right now, outsourcing can be a great option for reducing operating expenses.

With an operating expense formula you can take your first step toward reducing OpEx

By knowing exactly what operating expenses for your business are, it will be easier to find creative ways to reduce expenses, but keep product quality high and prices fair—making more money overall.

One way might be to consolidate your software spending with a holistic unified communications solution like RingCentral RingEX. By bringing all your communication channels together, your monthly subscription spending could come right down.

Sign up now to unlock our free demo.

Operating expense formula FAQs

What is an operating expense formula used for?

An operating expense formula is used to calculate your business’ operating expense ratio. Operating expenses include everything you have to pay for as part of your business that isn’t directly related to goods and services.

Examples of costs that you must take into account when using the operating expenses formula are the cost of office furniture and your staff’s salaries.

What costs should I not include when using the formula for operating expenses?

When using the operating expense formula, it’s important to remember not to include costs such as lawsuit settlements, bank fees, restructuring costs, and depreciation, which don’t count among your day-to-day costs. You should also omit costs directly related to producing goods or services.

Originally published Jul 15, 2024, updated Jul 19, 2024