It’s tough for any small business to get off the ground. Even with a brilliant plan, sourcing funding from banks or venture capital firms can be a demoralizing task.

You may have heard of angel investment, but dismissed it as a pipe dream—the idea of wealthy investors helping struggling startups certainly sounds like a fairytale.

But the good news is that finding your very own angel may be easier than you think. There are plenty of investors actively looking to invest in new businesses, and if you can demonstrate that your idea has potential, it could be a match made in heaven.

Finding the right angel investor can give your business a push towards success. Below, we’ll guide you through some ideas for attracting angels—and show you how some of RingCentral’s tools can help you do it.

- What is an angel investor?

- Preparing for angel investment

- 4 ways to find an angel investor

- What to look for in an angel

🤝 Is your tech startup’s team collaborating as effectively as it could be? What should you look out for before you start scaling in earnest?

First off, let’s look at what exactly an angel investor is.

What is an angel investor?

Angel investors are high net-worth individuals (or groups) who offer financial backing to early-stage companies. They invest their own money in exchange for an equity stake in the business.

They are usually successful entrepreneurs or business professionals who are willing to take a chance on a new company. They often invest locally so that they can give back to their communities.

Angel investors may work as individuals or groups, while “super angels” are a cross between angel investors and venture capitalists. Those such as Brian Cohen, chairman of New York Angels, and Ron Conway, founder and co-managing partner of SV Angel in Silicon Valley, can invest larger amounts as they use other people’s money.

However, angels are not merely a source of cash. They also bring business know-how, mentoring, and contacts.

What are the 4 key components of a successful startup?

Preparing for angel investment

Before you begin searching, make sure your startup is ready for angel investment. One way to impress potential angels is to invest early in an advanced unified communications system—this will help your small startup look like a much larger company to outsiders.

It will also let investors know that you have the best tools in place for your employees to collaborate and stay connected. Plus, angels will recognize that you have the ability to scale up and securely support your customers on any channel as your startup grows.

For instance, you could use RingCentral Office®’s desktop and mobile app to get your team together via video or phone calls to decide exactly what you need from your angel. You can even use the app to message each other:

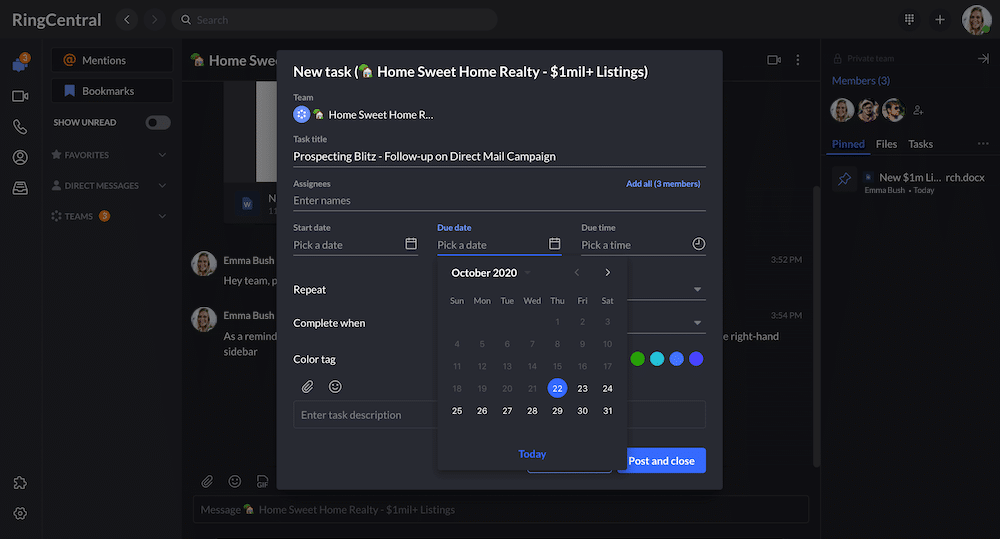

And assign tasks to each other to stay organized:

In your discussions, you can talk through topics like whether you’re seeking general guidance or a specific skill set, and cover questions like:

- How much money will you ask for?

- How much input will you expect?

- How much control are you willing to give up?

- Does the angel share your vision and goals?

Potential investors will want to perform a valuation of your company. You’ll need to demonstrate that you have what it takes to be successful—and have a sound business plan to prove it.

Angels commonly ask for financial statements and projections, market research, and a demo of your product or service. They’ll want to know that you’ve already invested your own money and tried other funding options like bank loans. Oh, and have answers to these questions ready:

- What do you plan to do with their money?

- What is unique about your business idea?

- Do you have the right team in place?

- Who are your competitors and how will you outperform them?

- What are the risks?

- Can you scale your business quickly and without disruption?

Let them know that you’ll be willing to take their advice. If you can show that you believe in your business and its potential, then hopefully the angel will, too!

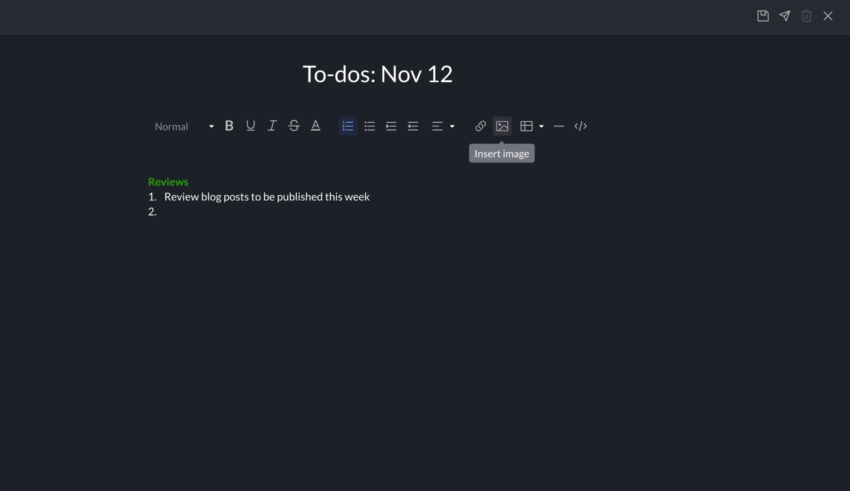

It helps to have a strong plan for finding angel investors. You could set up a dedicated team with different members carrying out stages of the search. RingCentral’s task management tools can help you organize the process with functions such as team messaging, video conferencing, and a handy notes feature:

4 ways to find an angel investor

1. Networking

Small business owners often approach friends and family first. That’s fine if you happen to be related to a millionaire, but you don’t want to fall out with loved ones over money. If you’re going down this route, make sure you have a legally binding contract, not just an informal agreement.

Even if none of your existing contacts is able to invest, you should still tell everyone you’re looking for an angel. The more people you tell, the more likely it is that somebody will know somebody. And a personal or “warm” introduction or referral can go a long way. Communications services from the likes of RingCentral can make networking a breeze.

Expand your network by attending industry events or meetups. Dedicated “angel events” help you connect with investors looking for new opportunities. Because angels often work together, one angel may be able to introduce you to others.

2. Angel investor groups

Some angel investors work as groups covering a geographical area or a specific industry, such as real estate. They meet regularly to review funding requests and invite startups to make pitches.

For example, Angel Capital Association (ACA) is a professional alliance of angel groups in North America. If you can’t find a local group, ask other entrepreneurs if they know of any.

Each angel group will have its own application process. They all receive a ton of pitches, so make sure yours stands out from the crowd—and still try to get a warm introduction if possible.

3. Internet platforms

As well as social networking tools such as LinkedIn, there are a number of online platforms that specifically connect angel investors with startups.

Examples include AngelList, FundingPost, and Angel Investor Network, while Gust aims to streamline the investment process with online tools to help entrepreneurs.

Going from macro to a more micro, 1-on-1 level, you’ll need some kind of communication tool to keep your investors (and potential investors) in the loop. Again, that’s where an app like RingCentral can help build your relationships with investors, wherever they are. Even if your angel is based locally, they may not always be able to meet in person, so you should be able to update them by video call, file sharing, and other avenues:

4. Startup incubators and accelerators

These are organizations that provide early stage startups with support and resources. They can often put you in touch with angel investors, as well as provide access to networks and mentoring from other local businesses and experienced professionals.

Some examples of startup incubators include:

- ucreate Spark (six-week, rapid early-stage incubator)

- Newchip Accelerator (offers equity-free funding)

- Episolo (affordable mentoring program)

- Antler (global early-stage VC)

5. Crowdfunding

Some angel investing takes place via equity-crowdfunding platforms. However, ACA recommends that you only work with accredited investors who meet specific guidelines from the Federal Securities and Exchange Commission:

- Individual (or joint with spouse) net worth of more than $1 million

- Individual annual income of more than $200,000

- Joint annual income of more than $300,000

Again, it pays to do the research and find out exactly who you’re bringing into your business.

What to look for in an angel

Whether you’re targeting angel networks or individual investors, make sure your angel is right for your business needs. Sure, it pays to establish a wide network of contacts, but only hone in on those who you think will be a good fit.

Angels do plenty of due diligence before investing, but it works both ways—you should vet any potential investors thoroughly too. Don’t rush into anything, no matter how much you need the money.

Pro-tip: If you end up with several angels in the frame, you could create a database of their pros and cons, which all team members can add to as the search progresses.

1. Professional expertise

Find out what your angel brings to the table in terms of professional knowledge. Do they have expertise specific to your industry? Could they fill a skills gap in your company?

Contacts and reputation are also important. Well-connected angels can help build relationships or attract other investors.

2. Previous experience

It’s a good idea to choose someone who’s worked with startups before, even if they weren’t successful—this experience should help them steer you through the pitfalls of new business development.

Contact other companies they’ve worked with, and ask them to rate the angel. How hands-on were they? How did they react to certain situations?

3. Working practices

You need to figure out how involved a potential investor wants to be and how involved you want them to be. It’s crucial that you both agree on how the arrangement will work.

The angel will require regular updates, but there should be no need for micromanagement. Some angels will prefer to communicate face-to-face, perhaps via video conferencing, while others will be happy to just receive news via an instant message.

Either way, you need someone with great communication skills—and it helps to use a versatile communications app like RingCentral to help you connect and stay on the same page.

4. Personal values

Your angel needs to share your values and goals. Investors should be excited about your startup, but unafraid to tell you when an idea’s not working.

Check out their ethics—they shouldn’t make unreasonable demands (such as asking to be named as co-founder) in exchange for funding. Above all, make sure you can get along, communicate effectively, and enjoy working together.

Angel investment is a great start for your startup

Approximately 20 percent of new businesses (that’s one in five) fail during their first two years, 45 percent during the first five years, and 65 percent in the first 10 years.

So, help from the right angel could be a vital key to staying afloat. Here are some of the main pros and cons of angel investment:

| Pros | Cons |

| The funding gives your startup a higher chance of success. | The angel will have high expectations, putting pressure on you to deliver. |

| It’s not a loan, so no repayments required—even if you fail. | There will be some strings attached. |

| Angels bring valuable experience and expertise. | You’ll have less overall control of your business. |

| Angels are willing to take a risk on a new business. | It’s a one-off investment to get you off the ground, not a source of future funds. |

If you decide that this is the right move, make sure you’re using the best tools to help the process run smoothly.

And our final plug: With everything you need for successful communication (plus seven layers of security for extra peace of mind), RingCentral is the perfect partner to see your startup through angel investment—and beyond.

Originally published Mar 02, 2021, updated Jun 18, 2024