Running an accounting firm is a big challenge, even at the best of times. As with any other small business, there are seemingly endless demands on your time and energy, and there never seem to be enough hours in the day to get everything done.

From prospecting for new clients to cash flow and time tracking, there’s no shortage of things to keep tabs on. This is why it’s so important to find tools that can help take low-value tasks off your plate. Specifically, by helping you automate or streamline workflows.

Today, there are a whole range of apps designed to do just that. Want to be accessible to clients and stay in touch with your team while you’re out and about during the day? There’s an app for that.

Need a sophisticated call forwarding setup so that you never miss a client call? There’s an app for that too.

Some people still have an outdated image of accounting as simple bookkeeping. This might have been the case at one time, but today—as any client who’s worked with a tech-friendly accounting firm will tell you—accountants are far from just bookkeepers.

From accounting software to cloud accounting solutions, to management software, to data entry, and even project management tools, it’s never been easier for accountants to communicate with their clients while on the go.

But first, you have to choose the right apps for how you and your clients prefer to work. In this guide, we’ll provide more insight into these apps and what they can do for your accountancy firm—and your clients:

Let’s get started.

🔍 Find out why RingCentral is the best app for your accounting firm. Get the rundown with our free accounting brief.

The 5 best apps for accountants

So, if you’ve been in the accounting game for a while, you might already have a few favorites when it comes to accounting apps. And if your business is growing, you’ll need a service provider that can not only keep up with you, but also take your accounting business to the next level.

Bottom line: If you choose the right tools, it could give you a big competitive advantage over your less nimble and flexible rivals (and we’re guessing there’s a lot of those in the accounting world). Here we’ll take a look at several of the best apps that will help you build better long-term client relationships—and boost your bottom line.

Apps for your firm

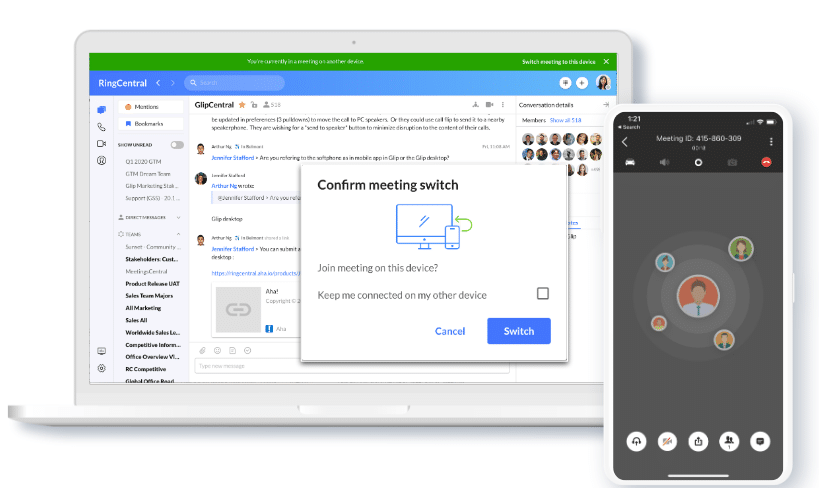

1. RingCentral—an all-in-one communication platform for keeping in touch with clients and prospects

Let’s face it. Clients’ expectations are constantly changing, and accounting firms that fail to keep pace with this risk falling behind their more adaptable competitors. RingCentral gives you a one-stop shop for secure business communications, bringing together video conferencing, messaging, cloud-based phone calls and more—all in one easy-to-use app.

But what makes this a really practical tool for accountants is that it works across every type of device (iOS, Android, Mac, and PC) and has thoughtful features like:

- Voicemail — This isn’t just your average phone voicemail. With RingCentral, you can have visual voicemail (for when it’s more convenient to read your voicemails instead of listen to them) and even get your voicemails automatically sent to your inbox.

- Call forwarding — Route incoming calls to any (or all!) of your devices, any department, and any location—ringing them sequentially or simultaneously. You’ll never miss a call again.

- Auto-attendant — No receptionist? No problem. The auto-attendant acts as a virtual receptionist service, greeting your callers and routing them directly to other people on your team.

- And more…

Learn how Mowery & Schoenfeld, LLC, a Chicago-based accounting firm, became one of the best places to work—and provides an amazing client experience no matter where their team is.

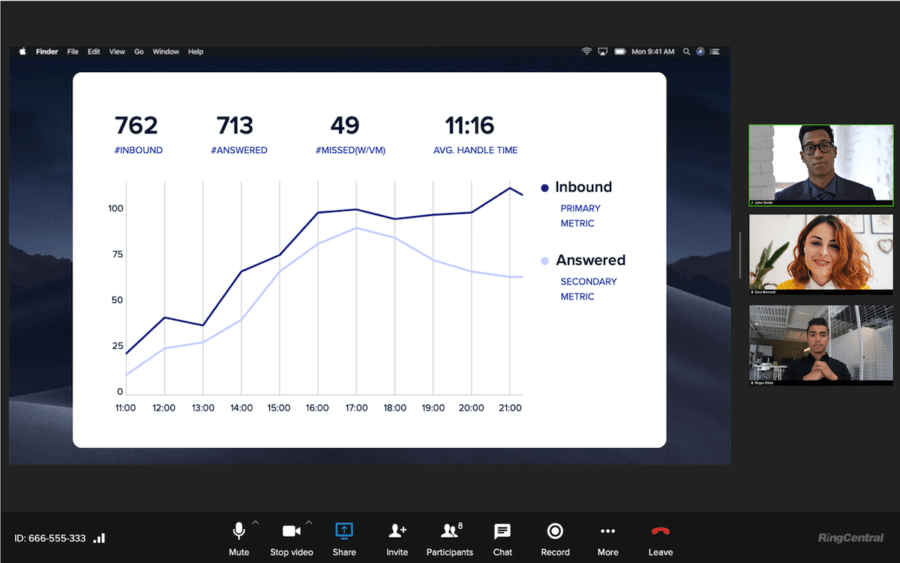

Remote working is becoming increasingly commonplace, and a lot of office-based roles are now being carried out from places outside the office. This means, of course, that ensuring reliable communication is even more important. RingCentral is helping accountants continue to provide an excellent standard of service to their clients with personal video calls from anywhere. This is a great way of providing a reassuring, personal touch.

Tools like RingCentral are designed to not only integrate with common apps that accountants typically use, but also create a better client experience by making sure you stay accessible to them when they have pressing questions about which receipts they need for their tax return and what they can and can’t claim and… you know what we’re talking about.

RingCentral has other useful features like screen sharing—maybe you’re on a call with a client and need to show them something on your screen:

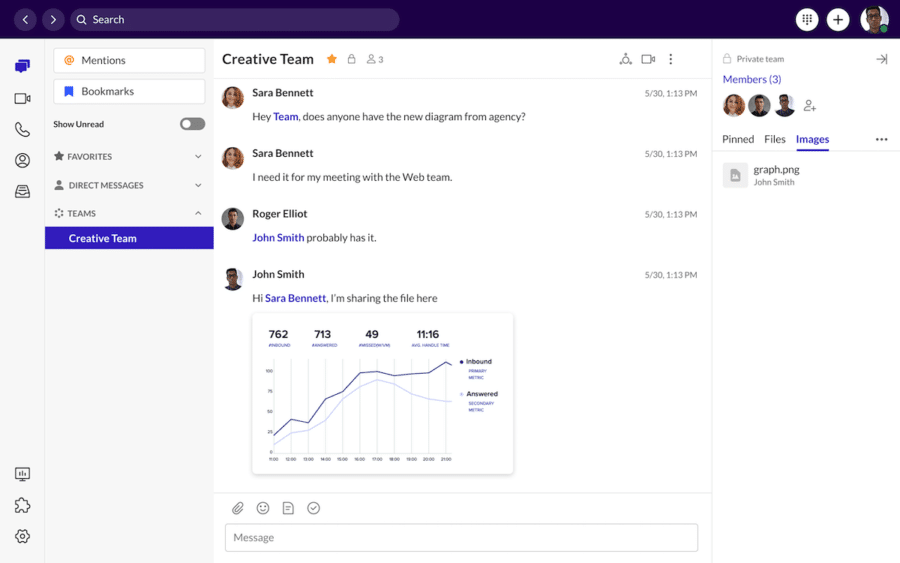

Or maybe you want to share some files with your client…

RingCentral is a PCMag’s Editors’ Choice Award winner because of its reliable service and easy-to-use app (among other reasons)!

🕹️ Get a hands-on look at how fast-growing accounting firms use RingCentral. Book your product tour today!

💰 You can also use this calculator to see roughly how much your business could save by using RingCentral to support your team’s communication with each other—and clients.

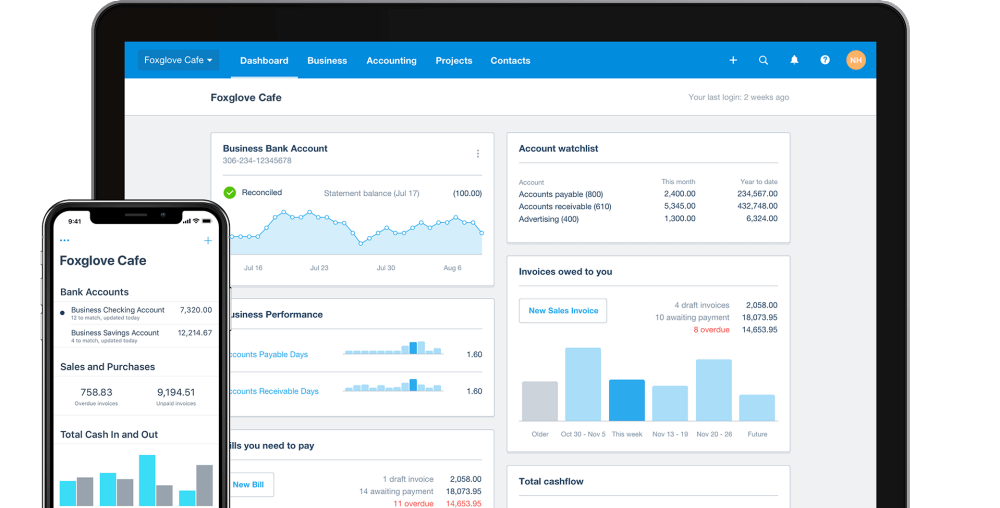

2. Xero app—comprehensive and user-friendly

Xero is one of the most popular accounting solutions available. Given the range of features it offers, it’s not hard to work out why. The Xero app offers a one-stop solution for a whole host of different accounting functions, including invoices, claims, receipts, and income reports. Its add-on marketplace also means it’s easy to add more functions in real time as and when you (and your clients) need to.

There are other advantages as well. These include Xero’s user-friendly interface, which is easy even for relative novices to navigate. You can also add unlimited users. This differentiates Xero from some other apps that require you to pay before you can add more users over and above a certain limit.

As a cloud accounting tool, it puts everything together in a shared database, which makes it easy for accountants and their clients. Its flexibility and add-ons, meanwhile, make it especially convenient for startups and small business owners.

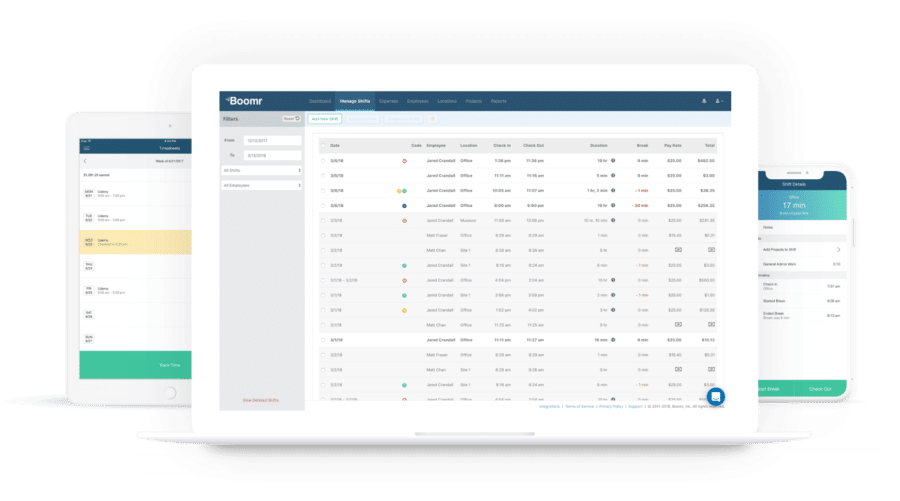

3. Boomr: simple time tracking for CPA firms and clients

Time tracking, as we’ve already noted, can be a huge challenge both for accountants and clients. Boomr takes much of the hassle out of it by integrating your chosen accounting software with timesheet management.

Accountants can also join Boomr’s Trusted Advisor Program. That not only gives your accounting firm a free lifetime Boomr account but also offers other benefits including wholesale pricing for clients.

What’s more, Boomr can offer potentially substantial savings for your clients—something they’re sure to thank you for. This is because it helps to strip away unnecessary administrative overheads and timesheet padding, effectively doing away with a lot of wasteful expenditure and giving clients a truer overview of time tracking for budgeting. All serving to make invoicing easier and more accurate.

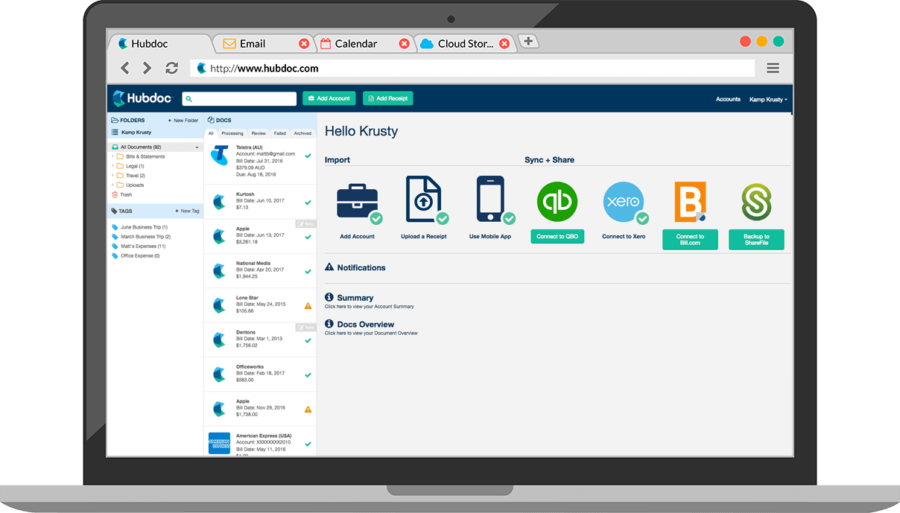

4. Hubdoc: secure access to clients’ bank accounts

If you’re running accounts for large numbers of clients, Hubdoc is a practical solution both for you and for them. It’s an app that allows you secure access to clients’ bank accounts, saving them the trouble of having to send you send their statements or granting you read-only access.

Now, all they have to do is log in to their online banking account and set up a HubDoc connection so that you can check in on it for yourself, entirely securely.

The app downloads bank statements automatically and can also extract PayPal CSV files on your behalf. That’s one less job for you to worry about, leaving you more time to do other things. In addition, HubDoc takes care of invoices, credit card receipts, and bills, and you can sync these documents with other apps including Xero and Intuit QuickBooks.

5. Becker’s CPA Exam Review: perfect for CPA study

Preparing for a certified public accountant (CPA) exam is a serious undertaking. Clearing this hurdle is a prerequisite in order to become a US-certified public accountant and setting up an accounting practice. It consists of four sections, each lasting four hours. These are auditing and attestation, financial accounting and reporting, business environment and concepts, and regulation. Clearly, then, passing this exam requires serious hard work and studying.

Fortunately, there’s an app for that. Becker’s CPA Exam Review is a perfect choice for CPA study. It offers up to 275 hours of audio and video lectures, unlimited practice tests, three simulated exams for each section of the CPA exam, over 400 task-based simulations, and more than 7,000 multiple-choice questions. It also comes with an interactive study planner to help would-be certified public accountants keep track of their studies.

The 3 best apps for your clients

1. RingCentral: desktop and mobile app for clients to reach you at all times

Yes, it’s RingCentral again, and we’re not just saying that because it’s our solution! We’ve already talked about the accounting application your firm can put RingCentral to. At heart, though, our software and apps are about communication, and that includes the client experience too.

For example, you and your clients can talk to each other on the app via both computers and mobile devices. Need to step away from your desk? Just hit the Switch button to flip the meeting to your phone without interrupting the conversation:

With RingCentral’s impressive functionality, your clients can reach you whenever they need, and wherever they are.

Not only that, you can even switch your call with a client from a phone call to a video call—just in case you want to have a face-to-face conversation:

Whether they’re using a Microsoft desktop or an Android or iOS mobile device, you’re only a couple of clicks or taps away.

That means they can either talk to you or just send a quick message to resolve any questions, with minimum fuss.

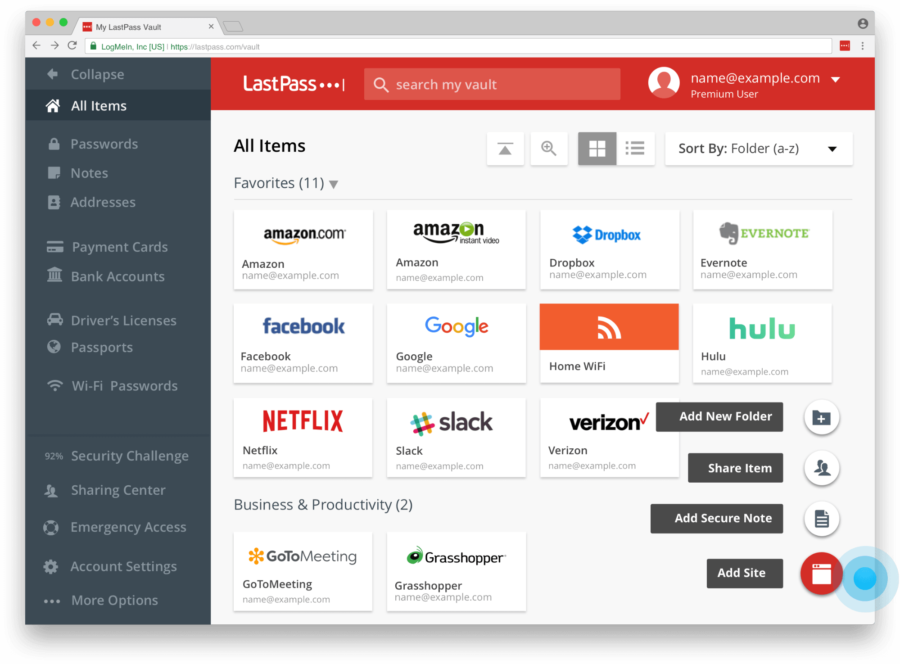

2. LastPass: lets CPA firms share passwords with clients

Sharing passwords with clients can be tricky for you and a little unnerving for them. Often clients hesitate (understandably enough) before handing out passwords for fear that their security might be breached. One app that simplifies matters for accounting firms and clients simultaneously is LastPass. It allows for simple password sharing with clients and is perfect for managing passwords across all your team members.

LastPass offers an Administrator Plan, which comes equipped with an array of detailed controls so that you can manage the passwords and logins of everybody else on your team. As you’ll already understand, it can be a major security vulnerability when employees write passwords down on Post-It notes or store them willy-nilly on their computer. With LastPass, you can create a master password and let the app do the rest.

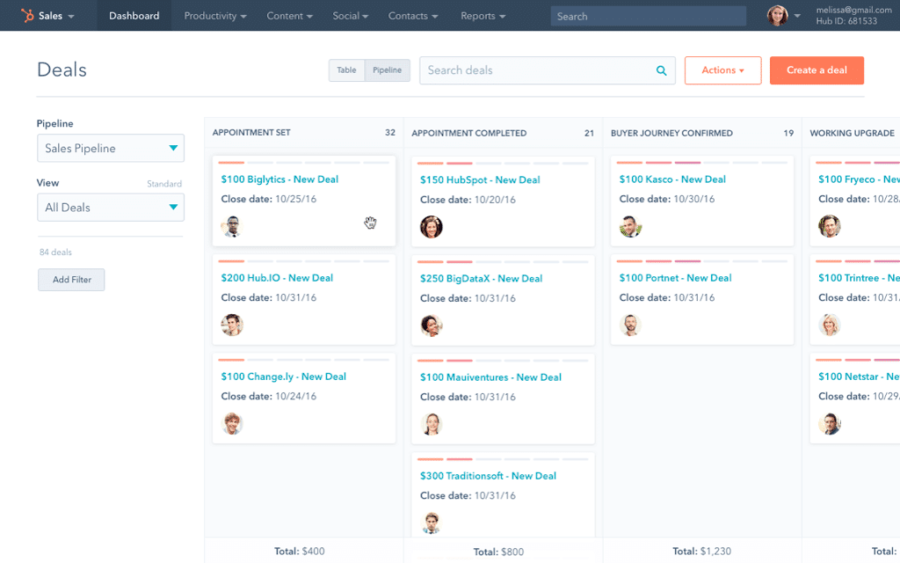

3. HubSpot CRM: a convenient CRM tool

Customer resource management (CRM) can at first seem quite forbidding for a lot of small firms. The prospect of getting to understand it seems to intimidate many of them. So much so that they often don’t bother with it at all. With HubSpot CRM, however, it’s quite simple and, best of all, it doesn’t come with the prohibitive pricing that many CRM solutions do—it’s totally free to use.

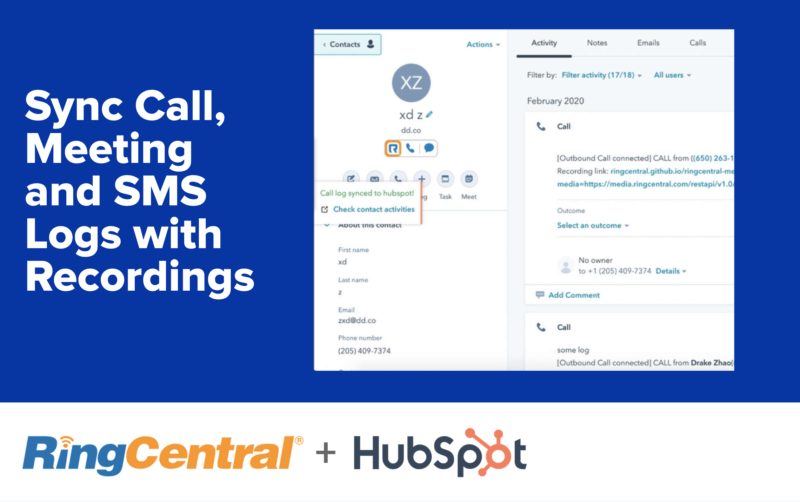

Better still, HubSpot offers easy integration with RingCentral. You can make and sync RingCentral calls through HubSpot. It’s simple: once you connect RingCentral with HubSpot, all you have to do is select the former as your call provider. This enables you to listen to voicemail, send and receive SMS messages, access your RingCentral Company Directory to call colleagues, and directly schedule RingCentral meetings.

Accounting technology that can transform small business

There’s much to consider as we look to the future for small business. The rise of remote work, in particular, is bringing about major changes for small, medium, and large-scale enterprises alike. Along with the pre-existing trend towards automation, this adds up to nothing short of a revolution in business practices.

Without question, running a small business is tough. There are all sorts of things you have to juggle—from customer engagement to staff training, and, of course, budgeting and accounting. Choosing the appropriate technologies is therefore something that every business must take seriously.

The question here, then, is which criteria you need to take into account when choosing the right accounting tools for your small business. It’s important to think carefully about this so you know exactly what you’re looking for. Here are some key criteria you should consider:

- Your overall budget. How much can you afford to spend on accounting software?

- Add-ons. What additional features will your company need as it expands and your business needs evolve?

- Cloud accounting. Can you access your accounts from wherever you happen to be? More and more of us are doing business on the move.

- Your own accounting skills. How knowledgeable are you when it comes to handling finances?

- The specific requirements of your business. You must choose software that’s suited for your business and its individual needs.

When choosing accounting software, thorough research is always vitally important. You’ll soon see what a transformative impact this can have on your business’s bottom line—which is, after all, the most important thing.

How to choose the right accounting software

There are many different accounting solutions on the market, not to mention other more general tools like Dropbox or Evernote that can also prove invaluable. In this concise guide we’ve only been able to introduce you to a few possible solutions. But that should have been enough to demonstrate what accounting software can do to benefit your business. All of which leaves you with more free time to do what really matters—taking your company to the next level, winning over new clients and customers, and boosting your profits.

Again, before you choose any accounting software, make sure you’ve properly weighed up the relevant pros and cons. Ensure that the plan and pricing structure is right for your business and that it offers the kind of functions that’ll make it worth the money you pay for it.

The worst thing you could do is rush out, pay for software, and then find it’s of little practical use to you. Thorough research can save you valuable money and your business will reap the rewards.

Originally published Dec 16, 2020, updated Jun 18, 2024