Nobody likes cold calling.

It’s tough. Especially when it comes to insurance.

For the caller, it can feel boring and repetitive—maybe even demoralizing. And for the person being called, it often feels like a total nuisance.

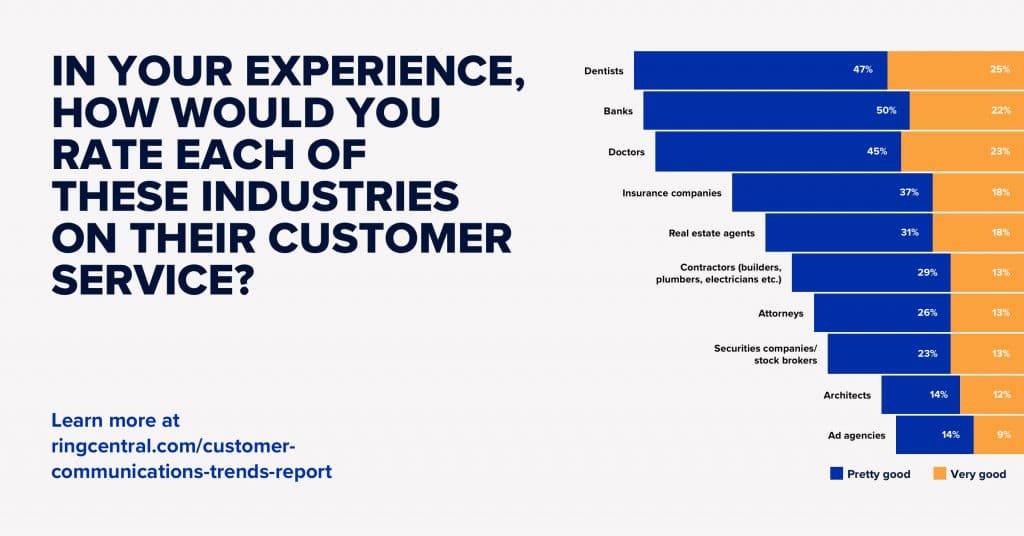

But it doesn’t have to be that way. By focusing on the prospect and how you can help them, you can turn cold calling into a win-win situation for both parties. The good news for insurance companies is that consumers actually think they provide pretty good customer service in comparison to other major industries—55% of respondents surveyed in the Customer Communications Review said that insurance companies offer “pretty good” to “very good” customer service:

In this post, we’ll cover:

- 10 tips for selling insurance over the phone

- 4 common mistakes that might get you known as “the sleazy cold caller”

- How to write an insurance cold calling script

- 7 cold calling scripts for any insurance type or situation

Let’s dive in.

Up your prospecting game and close more deals with conversational intelligence. ☎️

10 tips for selling insurance over the phone

From using the right script to the right tools, here are the top 10 things you can do right now to close more deals over the phone.

1. Use the right tools to make your cold calling life easier

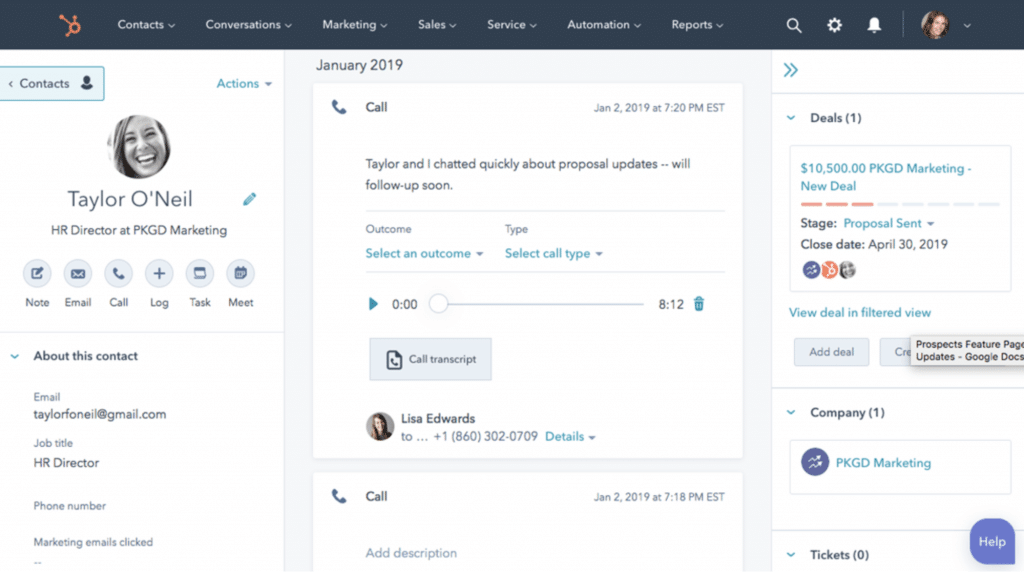

You don’t necessarily need to have to be using the best insurance app out there (but it helps)—most businesses will use a CRM (customer relationship management) system to keep track of their sales leads. A few of the most popular ones are Salesforce, Zoho, and HubSpot:

A CRM is really helpful to track your calls, but you’ll get even more bang for your buck with phone system or communication tool integrations. And if your team is distributed across different time zones and cities, this will be even more useful.

See how True Blue Insurance’s almost-fully remote team boosted revenue by 15% by doing one simple thing.

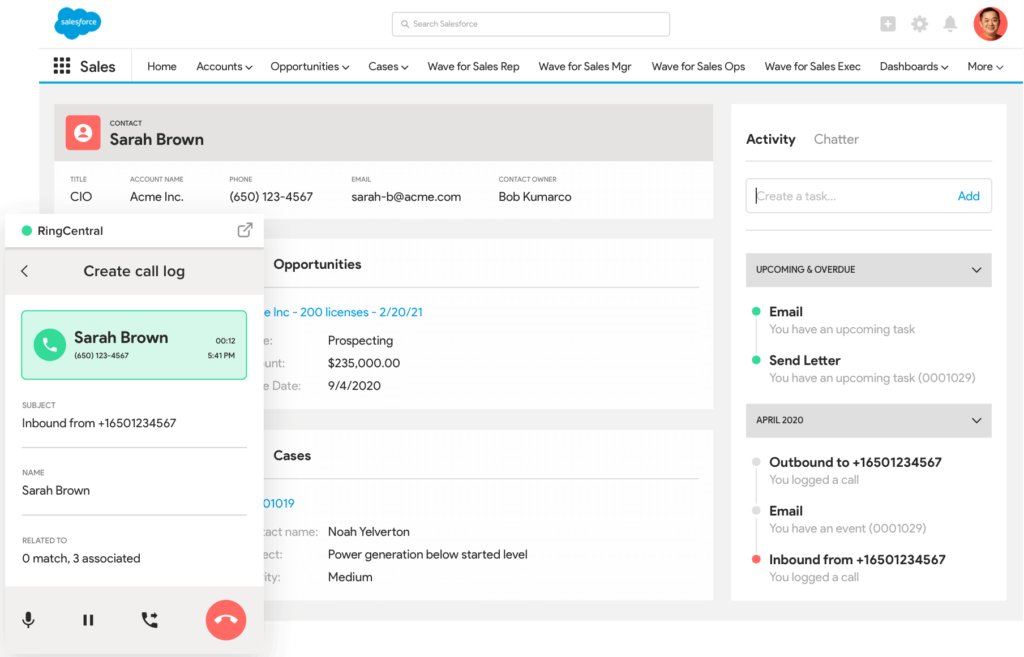

For example, you could see your call recordings directly in your CRM when you integrate with a communications platform like RingCentral, which lets you make phone calls, video calls, and more from a single app:

You can even make it look like you’re calling from your business phone number while using your personal phone, which should help increase your pick up rates:

2. Don’t forget to follow up

More often than not, it takes more than one call for someone to buy your insurance plan. That’s why you should always follow up.

The prospect probably won’t be ready to make a final decision on a cold call. Give them another call, or let them know that you’ll follow up via email.

If you’re often working while on the go or away from your desk, it’d probably be helpful to have a business calling app on your phone as well. This way, you can flip a call from your computer to your phone if you need to step away. With the RingCentral app, for instance, you do it with just one click:

Or, if you have a high-priority or more old-school client who wants to have face-to-face conversations, you can use your VoIP phone to easily switch from a voice-only phone call to a video call:

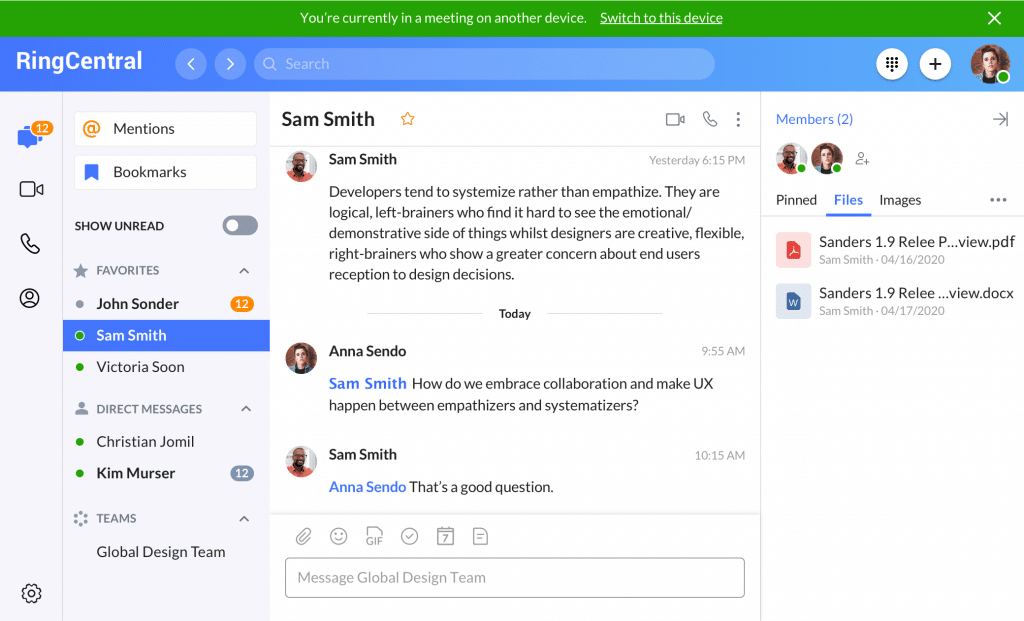

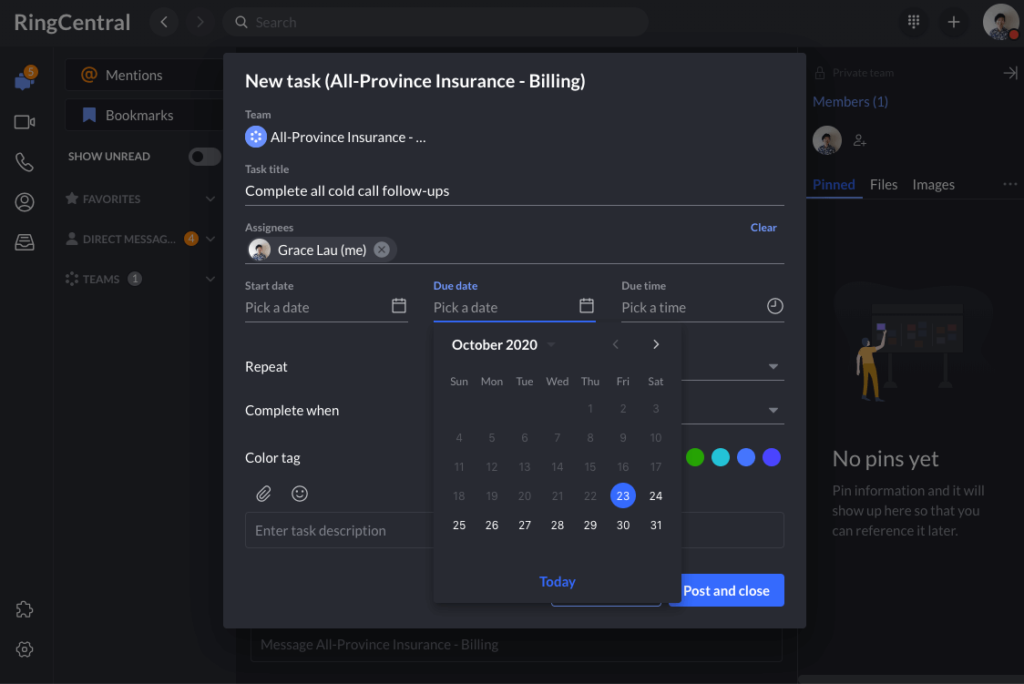

Plus, the RingCentral app has built-in messaging… with a handy task feature too! This lets you create reminders to follow up and other tasks for yourself (and your team), right in the same app you use to make phone calls and virtual calls:

🕹️ Get a hands-on look at how top-performing insurance agents are using RingCentral by booking a product tour:

💰 You can also use this calculator to see roughly how much your business could save by using RingCentral to support your team’s communication with each other—and clients.

3. Know what you have to offer

This is all about preparation.

Make sure you’re fully confident with your insurance agency’s offer. What kind of value are you offering?

You also need to be comfortable with where and how your offer can be adjusted to suit a prospect’s unique situation. Some insurance plans have more wiggle room than others, and it’s important to be familiar with those details.

4. Rehearse your script

When it comes to your full script, make sure you know it well. The more familiar you are with it, the less it’ll sound like you’re reading from a script, because you’ll be able to improvise a bit while still staying on track with the script. These little improvisations will do wonders in helping you sound confident and comfortable.

The way to do this is simple: practice!

Run through your script in the same environment and same pose you’d be in during a call. For most people, this will be sitting up tall at your desk. It’ll even help to be in your work clothes when you’re practicing.

5. But be flexible

You know your script by heart—great! Now you can be more flexible with it.

Conversations with prospects won’t always go according to script. You can learn a lot about them and what their concerns are in just a few minutes—and then you may need to adjust your offer to meet their needs.

Sometimes the conversation will even go off the topic of insurance. Maybe the prospect had a tough day or something else is on their mind and it just comes out. Be prepared to listen and go off script if that’s what the conversation needs.

Just remember to keep your goal in mind and gently steer the conversation back to it.

6. Do a little digging beforehand

The great thing about cold calling in this day and age is that you almost never go in truly blind.

Most people have social media profiles with at least some public-facing information. Sneak a peek to learn more about your prospects before giving them a call.

Start with LinkedIn to learn about their current job, what company they’re at, and what their education history looks like. This information is generally public and not that personal, so it’s okay to use it to make your pitch more specific.

You can also hop on to Facebook, Instagram, and Twitter to learn more about what your prospect’s interests are. These will come in handy for you to build trust over common interests or for you to tailor your offer to suit their needs and lifestyle.

Just tread carefully with these and allow the commonalities to come up naturally. You don’t want to let on that you’ve fully researched your prospect beforehand. It could make you come off as manipulative or even creepy.

7. Ask questions—then actually listen

Asking open-ended questions will keep your prospect on the phone longer, while also helping the exchange feel more like a conversation rather than a sales pitch.

Listen carefully so you can understand where they are coming from and what they’re looking for. With that information, you’ll be able to adjust your pitch to better suit their needs.

8. Communicate on their level

The last thing you want to do when cold calling is to put your prospect off by using insurance industry jargon they may not understand. If you have a good scripting or cold calling software, use it to log different scripts so you always have something to refer to.

Use day-to-day terms and keep it personable, but still professional.

9. Track. Every. Single. Call.

Cold calling can feel like thankless work, so it helps to know you’re actually getting somewhere with it. That’s where tracking your calls comes in.

It’s important to measure your successes. Tracking things like your close rate and your follow-up rates will give you a good idea of where you’re doing well and where improvements can be made.

10. It’s all about the delivery

When you’re cold calling, you don’t have the benefits of all the things that come with in-person interactions like facial expressions, body language, and visual cues.

All you have is your voice, so it’s important it has the right tone. You want to be confident, but still friendly.

Keep the conversation light and casual. Maybe even throw in a joke. Getting your prospect to laugh will help warm things up.

Now that you know what the best practices are in the world of insurance cold calling, let’s talk about what not to do.

4 common mistakes that might get you known as “the sleazy cold caller”

People are already wary of cold callers as it is, so you want to make sure you leave them with a positive experience. Yes, it’s possible.

Let’s go through a few of the most common cold calling mistakes that can leave prospects with a bad impression and hurt your chances of a successful call.

1. Calling at a bad time

We’ve all heard stories of annoying cold callers interrupting a family dinner. Don’t be that person.

Research has shown that the best time for cold calling is between 8 and 9 am in the morning and 4 and 5 pm in the evening1.

You might be making fewer calls by sticking to these hours, but your calls will likely be more effective.

2. Turning on your sales voice

Everyone who’s had to make a sales call is probably a bit guilty of this.

Think about your last call. Did you sound like your usual self?

If you can’t remember, record your next sales call and have a listen. Do you sound the way you do when talking to friends and family?

People often slip into a “sales voice” where their voice goes up in pitch and speeds up. Because this is pretty recognizable when it happens, prospects immediately notice it and get turned off. Who wants to be stuck on a call where they’re being sold to?

3. Pitching your insurance plan on every call

When you’re cold calling, it’s your first time speaking to a prospect. You don’t know much about them, so how do you know if they’d really be a good fit for your offer?

So, don’t fire off your sales pitch on every call before even asking the prospect any questions.

If you just blindly pitch your offer to every prospect regardless of what their needs are, you’ll just end up wasting your time—and theirs.

4. Focusing on your offer and not on the prospect

It’s so easy to get caught up in your offer and your cold calling script that you forget the call is about your prospect. Focus on them. Ask them thoughtful questions about what they and their family or business need.

By learning about your prospect and their frustrations, you’ll be in a better position to frame your offer in a way that they’re receptive to.

Okay. We’ve talked a lot about insurance cold calling scripts, so let’s start writing one.

How to write an insurance cold calling script

The basic structure of any cold calling script consists of three parts: an introduction, qualifying questions, and the close.

The introduction

It’s always polite to introduce yourself to help put the prospect a bit more at ease. The key here is to let them know that there could be something in it for them as well if they listen to what you have to say.

Qualifying questions

This is where you ask the prospect questions to learn more about them and what their main pain points are. Make sure these aren’t just yes/no questions—ask open-ended questions so they can provide as much information as possible.

Once you know what the prospect’s main challenges are, you’re in a better position to create your pitch around their individual needs.

The close

You don’t always have to close a sale on your first call, and you might not even want to depending on what strategy works best for you. The “close” here can be a more manageable goal, like getting a second conversation set-up.

It’s important to set up next steps here at the very least, so let them know when and how you’ll be following up.

And don’t forget to thank them for their time.

Put those three elements together and you’ll have a strong base script you can tweak for any insurance cold call.

Let’s look at some examples.

6 cold calling scripts for any insurance type or situation

The majority of insurance cold calling scripts have a very similar base. The variations come from the specific type of insurance, any specials on the offer, and the prospect’s current situation.

Let’s look at six examples that mix and match those variables.

1. The elevator pitch

An elevator pitch is a quick rundown of what you have to offer. It’s very condensed and should only take about 30 seconds to get through.

The elevator pitch can be used for all types of insurance. It really comes in handy when you’re short on time—or when you can sense your prospect has limited attention to give you.

Regardless of what kind of insurance you’re selling, you’re going to need to address a pain point your prospect has. They might be spending too much on insurance or have gaps in their coverage. Figure out what their main pain point is and make sure you do a good job of solving the problem.

You can also throw in the benefits of your company’s insurance policy, and what differentiates you from competitors. Maybe you have more affordable plans or faster processing times.

Throw it all together and you’ll have something like:

“Our life insurance plans have saved families just like yours in the community about 15-20% off their annual insurance costs. Is this something you’d be interested in learning more about?”

Keep it simple and short.

When you’re using this insurance script in a cold call, take a bit of extra time to introduce yourself and your company before you jump into the pitch.

2. Life insurance with a free quote offer

Life insurance isn’t exactly the most pleasant topic, but it’s something people do need to think about. It helps to throw in a free quote so the prospect feels like they have nothing to lose.

“Hi there. Is this (prospect’s name)?”

“This is (your name) from (your insurance company).”

Make sure to always ask how the prospect is doing. By listening to them and conversing a little bit, you’ll build rapport. This will help the prospect be more open to what you have to say.

“The reason I’m calling is to let you know that our firm has agents in the area offering free life insurance quotes. No obligations, of course. It’s just so you can see what options there are. Would this be of any interest to you?”

Wait for a response. While a resounding “Yes!” would be ideal, it’s common for prospects to have hesitations:

“I understand you might be hesitant. But from what I’ve seen for families with (describe the prospect’s specific family circumstances that qualify them for insurance), it’s always handy to have a bit of extra help when it comes to life insurance planning. It’ll go a long way.

Are you sure you don’t want to have a quick chat about it with one of my colleagues?”

Pause and allow the prospect to respond.

This might be when they throw some objections your way. Listen to their concerns and let them know you understand.

Address their objections and move them onto the next phase of the call:

“I just need to ask a few questions to make sure the program is a good fit for you, and it’ll save you time when you’re talking to one of our agents later.”

This is where you can collect any information you may need to see if they’ll qualify for the program. Once you have those details, close the call:

“Great! Thank you (prospect’s name). Now the only thing left to do is set up an appointment for one of our specialists to get in touch. When would work best for you?”

Let’s try another one.

3. Commercial insurance when the prospect already has a plan

“Hi, am I speaking with (prospect’s name)?”

“Great, my name is (your name) and I”m calling from (your insurance agency). How have you been?”

Let them respond.

“That’s great, (prospect’s name). The reason I’m calling today is to chat about workplace insurance for your business. Would you be open to having a conversation about your current cover?”

It’s common for prospects to provide objections here about how they’re happy with their current plan.

“I completely understand, (prospect’s name). How would you feel about a total insurance policy review and audit? We’ll be able to tell you where you’re currently covered if anything goes wrong, and what we can offer in the same price range. We’d be happy to offer you a competitive quote on your business insurance, even for when it renews. Is that something you’d be open to?”

If they seem even a little bit interested, move to the next steps and book a follow-up appointment.

“Perfect. The review process will only take about 15 minutes or so. When would be a good time to get in touch to go through this together?”

Confirm the appointment and thank them for their time.

4. Auto insurance when the prospect is in a hurry

“Hi there. Is this (prospect’s name)?”

“This is (your name) from (your insurance company).”

Sometimes at this point, a prospect might interrupt you to say they’re in the middle of something or are in a hurry.

“I understand. The reason I’m calling is to let you know that we’re expanding our coverage to your area and are offering pretty competitive quotes that could save you money. Do you have a quick 30 seconds to hear about our service?”

If they agree, make sure you really do stick to 30 seconds.

“Thanks, (prospect’s name). With the new rates we’re offering the area, we’ve saved customers about $325 per year on auto insurance. We have hundreds of five-star reviews on Google you can look at to see what others have to say. I know you’re in a hurry, but if I could have your email address, I could send you more details. Would you be open to that?”

Your prospect may be more interested now, but they’re still in a rush. Offering to move things over to email lets you keep them as a prospect without taking up any more of their immediate time.

Grab their contact information and make sure you do follow up via email within the next day or two.

5. Mortgage protection when the prospect already has coverage

When it comes to mortgage protection, there’s a good chance your prospects may already have a policy in place. But that doesn’t mean you’re out of luck.

“Hi, can I please speak with (prospect’s name)?”

“Hi, (prospect’s name). I’m (your name) from (your insurance company). I’m calling because I saw you’ve recently purchased a property. Congratulations! I was interested to know if you’ve taken out mortgage protection insurance?”

Wait for them to confirm.

“That’s great that you were so prepared. Can I ask how long your mortgage is? Just so I can see what type of insurance policy would benefit you the most.”

Wait for their answer.

“Great. Well, it’s always good to see what else is out there, especially when you’re a new home owner. I know paying a mortgage is your main priority right now. I’m happy to look over your current policy to see if there’s any way I can help save you money. Is that something you’d be open to?”

6. Income protection insurance when the prospect doesn’t think they need coverage

Some insurance plans, like those for auto insurance or life insurance, can be easier to sell because people know they need coverage in those areas. Income protection insurance, on the other hand, can be more of a challenge because people may not think they need it or even know what it is.

“Hi. Is this (prospect’s name)? Hi, there. My name is (your name) and I’m calling from (your insurance agency). How’re you today?”

Wait for their response.

“That’s great. The reason I’m calling today is to talk about how you can protect yourself and your family if something happened that stopped you from working. We all know how unpredictable life can be, and sometimes an unexpected injury or illness can keep you from working for weeks. Maybe even months.

Income protection insurance can make sure you’re still able to receive your income during these teams, letting you and your family focus on your recovery. Is an insurance like this something you’d be open to learning more about?”

Wait for their response. It’s likely they’ll tell you they’re not interested or that they’ve never thought about it before.

“I understand, (prospect’s name). It’s not something that comes up often so I can see how you haven’t had a chance to think much about it. Our consultation calls only take a few minutes and we’ll walk you through all your options and rates. There’s absolutely no commitment for you to sign up. Does that sound like something you’d be interested in?”

If they agree to a consultation, book them in for an appointment in the next few days.

7. Health insurance when age is a factor

Health insurance plans can be very different if you’re a young person compared to a senior citizen. You want to make sure you address a prospect’s stage in life during a cold call to make your offer more specific to them.

All it takes is one line in your introduction.

“Hi, (prospect’s name). My name is (your name) and I’m calling from (your insurance agency). As someone in your mid-20s, I know having the right health insurance at the right price is probably a priority for you. I’d like to review your current health coverage and see where we can help you out with more affordable options that might provide extra benefits. Is that something you’d be open to?”

If your prospects are mainly senior citizens, you just need to tweak your introduction a little bit.

“Hi, (prospect’s name). My name is (your name) and I’m calling from (your insurance agency). I’m calling because I specialize in helping people over the age of 55 find affordable health insurance options. Is that something you’d be interested in?”

All you need is one solid cold calling script base for insurance

As you can see from the examples, the skeleton of each script is similar. Once you have a cold calling script that works well for you, you’re pretty much set. Just adapt it to sell other kinds of insurance and different situations.

The more you practice, the more you’ll develop a style and conversational flow. Remember to keep things friendly and to always focus on your prospect and what their needs are.

Happy cold calling!

1blog.hubspot.com/sales/the-best-time-to-cold-call-more-data-driven-sales-secrets-infographic

Originally published Mar 14, 2020, updated Sep 26, 2024