Cloud migration in financial services has been a major topic of conversation over the last several years, as companies have rapidly shifted from on-premise to cloud-based digital solutions. According to LogicMonitor’s Cloud 2025 survey, 74% of global IT decision-makers believe that 95% of all workloads will be in the cloud by 2025.1

Cloud communications systems, in particular, garner attention in financial services as firms strive to optimize innovation and productivity with a hybrid workforce and increasing customer expectations.

Today, we’ll cover:

- Why are financial institutions moving to the cloud?

- 5 benefits of cloud migration for financial services

Why are financial institutions moving to the cloud?

“At a time of economic uncertainty, banks and credit unions have to split their attention between innovating to counter the downturn and increasing operational resilience. In many cases, this needs to occur with the headwinds of cutting back on budgets and head counts, the increasing frequency of disruptive events, the emergence of new technologies, and the increasing of customer expectations.”

Several catalysts have radically accelerated the financial services move to the cloud, as part of a broader digital transformation. The global pandemic led to a geographically dispersed workforce, with employees who needed digital connectivity. It also created a more digitally inclined customer market.

Throughout 2022, rising inflation led to interest rate hikes, which can be good for some financial institutions (banks and credit unions) and tough for others (mortgage lenders). But uncertain economic conditions combined with higher borrowing costs create more risks for businesses.

In response, financial services organizations are showing increased interest in the use of advanced technologies to optimize customer experience, improve risk management, and increase operational efficiency everywhere they can.

Even as they have reduced IT budgets, financial services organizations are investing in cloud technologies as a way to increase agility and future-proof their organizations.

5 benefits of cloud migration for financial services

Relative to on-premise tech systems, cloud solutions enable:

1. Increased productivity

“The bottom line is that a digital transformation without an all-in-one unified communications solution is incomplete and inefficient. Unified communications as a service (UCaaS) is central to optimized communication for a remote and hybrid workforce, and it also provides the foundation for engaging customers seamlessly on all popular digital communication channels.”

With UCaaS, employee productivity receives a major boost. Agents can easily shift interactions with customers from one channel to the next. It is also easy for dispersed work teams to hold planned and spontaneous meetings for collaboration.

In addition to spurring product & service innovation and employee productivity gains, in-house management requirements and IT costs remain low with UCaaS. An organization’s physical footprint can be greatly reduced due to less demand for hardware and on-premise system infrastructure.

2. Improved customer and employee experiences

Financial services has always been a competitive industry, but it has become even more so with the rise of fintech. More competition puts greater emphasis on the need for optimized customer and employee experiences. Attracting and retaining customers is critical to sustained revenue and profits, especially in a tough economic environment. Retaining talented employees is necessary to ensure an optimized customer experience.

Despite of the focus on cost controls, organizations continue to invest in transformative tech solutions, including:

- Cloud systems: Cloud systems provide real-time data, analytics, and access to communication tools that enable a seamless omnichannel customer experience and give employees key flexibility.

- Automation: To do more with less, automation of manual processes is a key component of cost efficiency and employee productivity.

- Solution integrations with APIs: APIs are the connective tissue across financial ecosystems. They allow companies to monetize data, provide valuable financial product and solution partnerships, and enable rich customer experiences across all channels.

As an industry, financial services added many tech tools from 2020-2023, including some of the best FP&A software, and this trend is going to continue in 2024. The objectives are to standardize common business processes and simplify for ease and efficiency.

3. Harnessing the power of artificial intelligence

According to a recent Accenture report, artificial intelligence (AI) will boost the profitability of global firms 38 percent by 2035.2 Financial services is among the industries noted as being most impacted by AI efficiency gains. Using the metric Gross Value Added to determine economic influence, Accenture stated that financial services will see a 4.3-percent AI-driven growth rate through 2035. This rate is third among all sectors studied, only behind information and communication at 4.7 percent and manufacturing and 4.4 percent. The growth in communication and financial services are closely linked.

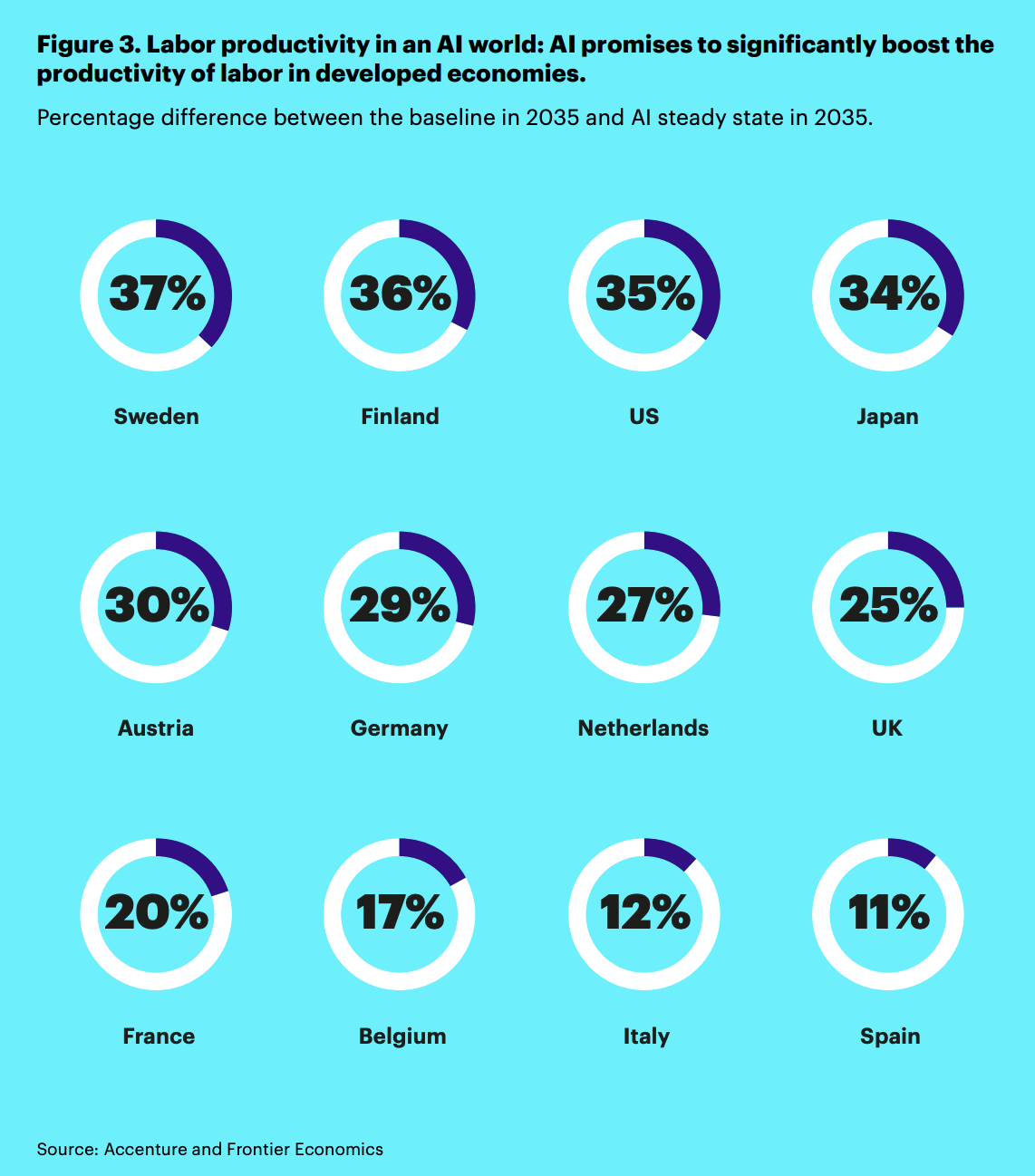

Accenture also evaluated the boost to productivity for companies that leverage artificial intelligence. By 2035, companies in the United States will experience a 35-percent higher level of productivity than those that do not. Similar rates of impact are identified across all developed countries that have the necessary technology infrastructure. These productivity boosts are not only beneficial to employers, but support the ability of workers to maximize their talents.

The role of AI is amplified, with a major push from conceptual AI toward more practical AI. Banks, insurers, and investment firms use AI to gather research, leverage deep learning, and personalize customer experiences efficiently.

4. Streamlined workflows with integrations and custom APIs

As briefly mentioned above, one of the ways digital expansion optimizes cost-efficiencies is through integration opportunities. It is more efficient to combine digital solutions into singular systems than to have each exist in a silo.

As firms consider digital solutions, access to open architecture and communication APIs is important. An open architecture gives the greatest flexibility for firms to use digital solutions in the best ways to fit their strategies and existing infrastructure. UCaaS solutions that leverage communication APIs to integrate with popular cloud tools allow firms to maximize past investments and open new pathways for innovation and growth.

For example, RingCentral integrates seamlessly with Salesforce, so your team can make, transfer, and even record calls within the Salesforce app for more streamlined customer management:

5. The competitive advantage of digital maturity

Deloitte’s Digital Banking Maturity 2022 report highlights the significant advantages digital champions enjoy when compared with other financial services organizations.3 As defined by Deloitte, digital champions are those financial services organizations that:

- Offer a wide range of functionalities relevant for customers (e.g., omnichannel communications)

- Offer a compelling user experience

- Set key digital trends

- Have leading market practices

Based on that criteria, digital champions develop functionalities that build and expand customer relationships. Communications technology plays a large role in the competitive advantage digital champion organizations have. For example, according to the Deloitte report, when compared with less digitally mature organizations, digital champions offer:

- 1.5x the functionality for channel accessibility

- 1.3x the functionality for new user guidance at onboarding

- 1.5x the functionality for customer support

- 2.5x the functionality for investment services

- 1.8x the functionality for product cross-sells

Cloud migration for financial services: Drive optimization and greater productivity for your organization

Cloud communications are vital for financial services firms seeking innovation and productivity in the midst of restricted budgets. Innovation leads to fewer manual processes, improved accuracy, and better financial decisions. In addition to its cost, flexibility and security advantages, an all-in-one cloud communications system supports the best user experience strategies.

RingCentral is designed to help financial services organizations achieve these objectives. It is a comprehensive, cloud-based communications system that enables seamless, cross-channel interactions. It integrates with many popular applications banks already use and features the most advanced security protocols. See how it works!

1https://www.logicmonitor.com/resource/cloud-2025

2https://www.accenture.com/t20170620T055506__w__/us-en/_acnmedia/Accenture/next-gen-5/insight-ai-industry-growth/pdf/Accenture-AI-Industry-Growth-Full-Report.pdf?la=en

3https://www2.deloitte.com/content/dam/Deloitte/br/Documents/financial-services/Deloitte-DBM%202022-global-report.pdf

Originally published Mar 07, 2023, updated Sep 30, 2024