Small businesses each have their own unique ways of operating and serving their audience. Despite these differences, most small businesses experience similar stages of growth throughout their journey. Understanding these stages can help you navigate the challenges and opportunities that come with each phase.

So, what are the five major stages of small business growth? According to the Harvard Business Review, they are:

Let’s break these down and find out where your small business lies today.

🚀 As your business takes off, find ways to stay lean and mean. Read our eBook to learn how small and medium-sized businesses can thrive in today’s dynamic environment with enhanced mobility and flexibility.

1. The existence stage: Generating customers and fulfilling their orders

If you’ve just launched your small business, congratulations! Your entrepreneurial spirit is commendable, and we wish you great success.

However, sheer determination alone won’t help you overcome the two biggest challenges of starting a new business: attracting new customers and fulfilling their orders.

Whether you’ve opened a new gym, an ice cream parlor, operate on a subscription model, or provide a unique service or product, the hardest part of the existence stage is finding that first customer and successfully delivering what they paid for.

But why is this so challenging?

If you’ve never navigated the existence stage before—which involves just beginning to service customers and start generating revenue—it’s difficult to grasp how tough it can be to win your first paying customers and fulfill their orders or contracts effectively.

The reality is, it’s incredibly challenging.

Part of the difficulty stems from the fact that, at the outset of most small business life cycles, there are typically only one or two people running everything. Often, it’s a founder or two co-founders managing all aspects of the business during the existence stage. This puts immense pressure on them, as they not only have to market and sell their offering but also handle logistics, product/service delivery, and any customer service needs that arise.

Additionally, most new small businesses don’t have a significant amount of capital to sustain them. The longer it takes to acquire those first paying customers, the more money is lost early on. In such cases, small businesses may need to take on debt, raise funds in exchange for equity, or face the possibility of failure without ever reaching the next stage of growth: survival.

2. The survival stage: Breaking even and generating cash flow

You’ll know you’ve moved beyond the existence stage when you have a consistent flow of customers and are successfully delivering your agreed-upon products or services without any problems. Soon after, you’ll begin looking at sales versus expenses a bit more carefully and start considering how to maximize the profitability of your company. After all, that’s the only way to grow your company in a healthy way.

This is also the stage when effective communication becomes critical. You have to be able to communicate with not only your own team (typically your staff, contractors, or freelancers) but also your clients or customers, and prospects.

You’ll need a business phone, sure, but that’s the bare minimum. Will you need to be able to make video calls with a contractor or clients who are located in another country? Would you prefer texting with clients instead? What about instant messaging? Depending on your industry and how your customers like to operate, you might need other communication channels beyond the phone.

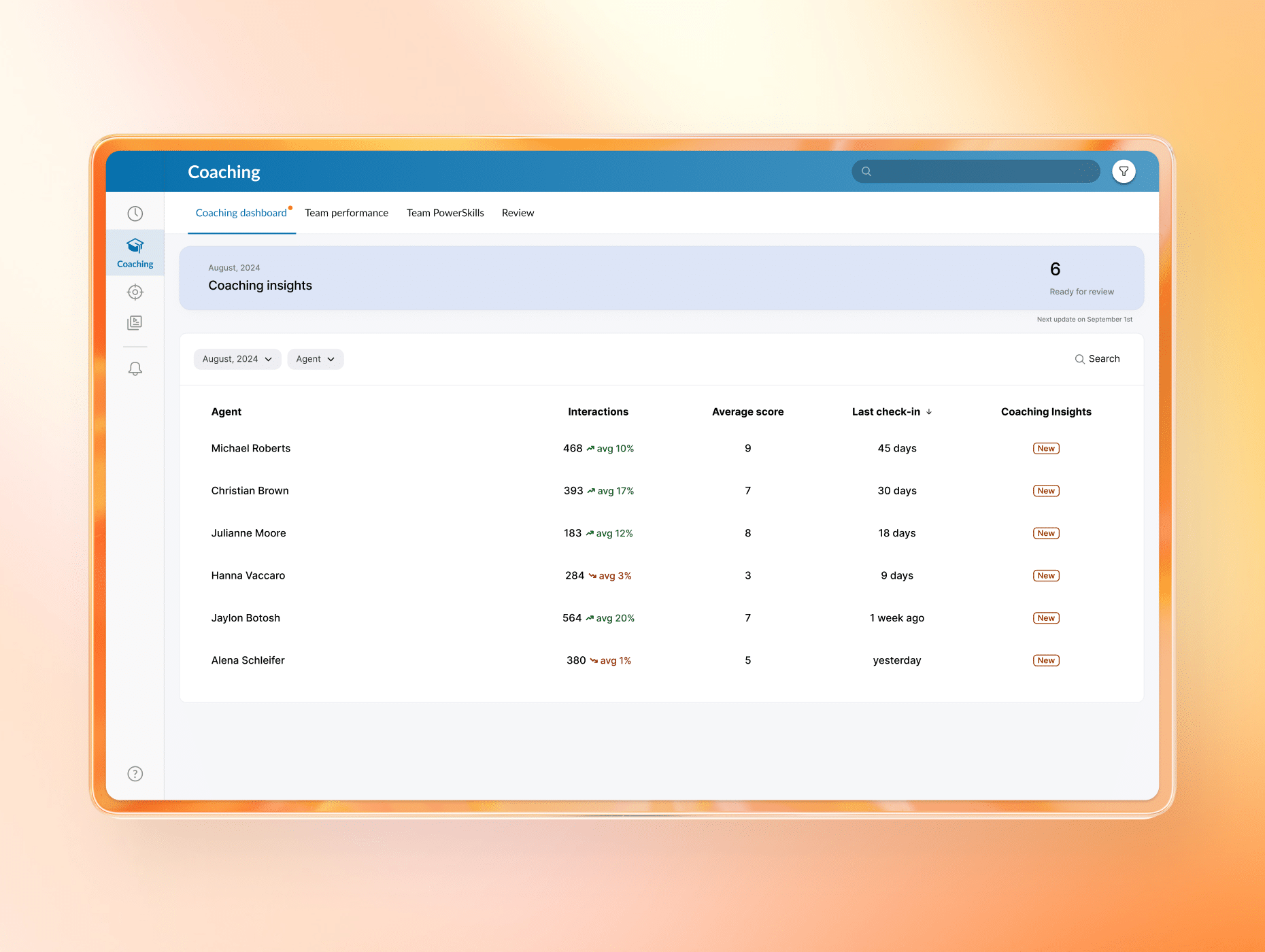

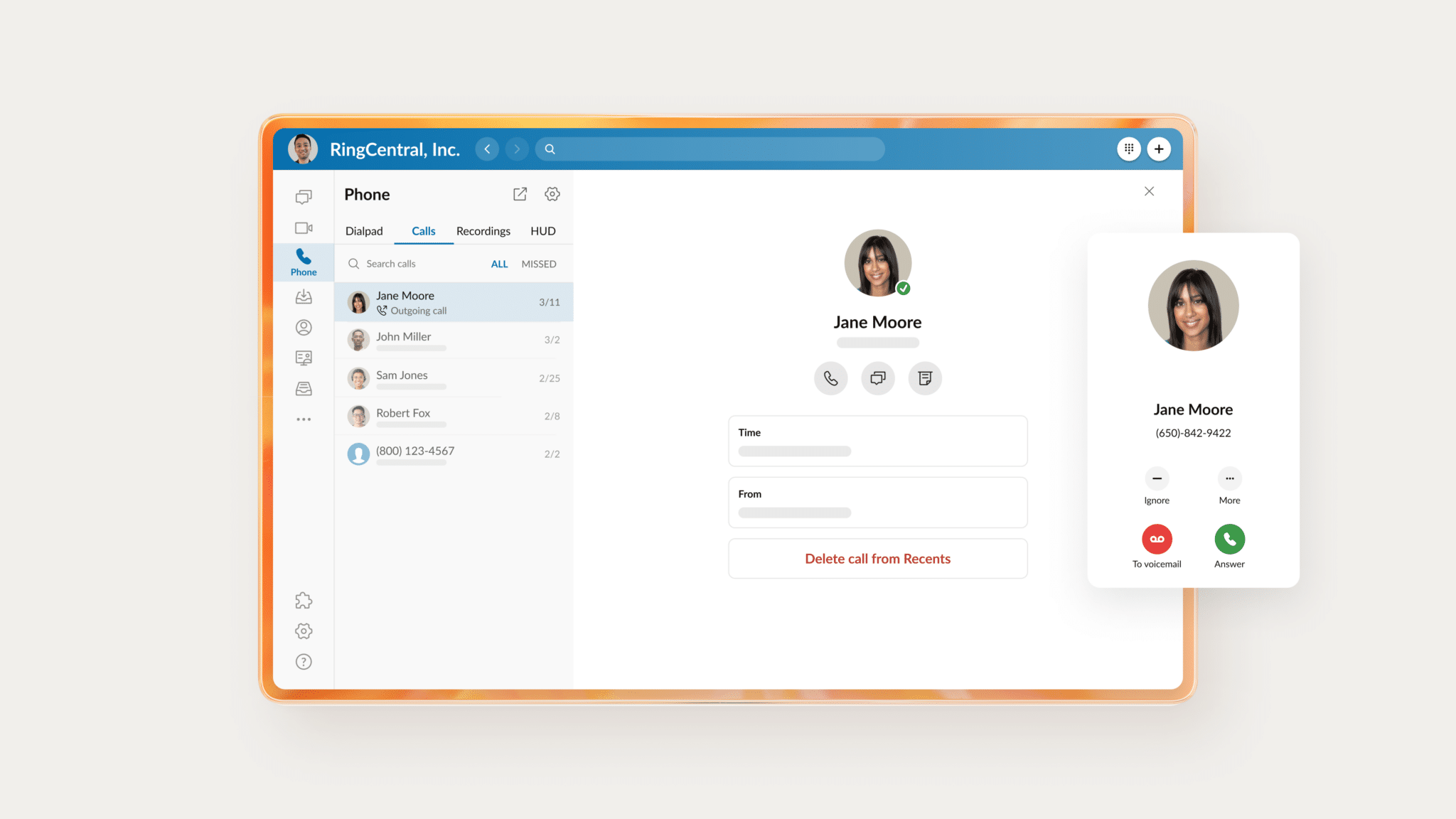

If you’re in this situation, our advice would be to look for a solution that gives you all those different channels in one app or software. This not only streamlines the number of tools you’re using (and paying for), it also makes life easier for you overall because you won’t have to manage a bunch of disparate tools. For instance, RingCentral’s desktop and mobile app gives you messaging, conference call services, and a phone service, all in the same app:

Remember, starting in this stage and going forward as you get into the success and take-off stages, this will become more and more important because, well, you’ll be communicating with drastically more people. A lack of communication is one of those “silent killers” that can really hurt a business—you won’t notice it being a problem until it’s too late.

By the time a client leaves because you’re not responsive enough, or your teammate gets frustrated because they can’t do their work, the damage will have been done.

However, one thing’s for sure: if you know how to grow your business during the survival stage, you’ll be introduced to a stage within the business life cycle that many owners never quite reach, and one that can be significantly more comfortable and lucrative for you. We’re talking about is the success stage.

3. The success stage: Continue growing or enjoy stable profitability? The choice is yours

At this stage in your company’s life cycle, you’ve established effective operating procedures and effective customer retention strategies , ensuring your profit margins remain consistently healthy.

In other words, your small business is running smoothly.

So, what’s next?

That decision largely depends on your vision for the future of your business.

In the success stage, you have two primary options: you can aim for further growth (a high-risk, high-reward path), or you can maintain stable profitability (a low-risk, lower-reward path). Pursuing further growth means reinvesting all your profits back into the company—a strategy that could propel your business to new heights or potentially lead to financial trouble.

Alternatively, maintaining stable profitability allows you to step back from some of your founding responsibilities and explore other ventures. However, this approach carries the risk that your absence could impact the company’s continued success. Of course, there’s also the option to enjoy stable profitability while remaining deeply involved in the day-to-day operations of your business.

Ultimately, the choice comes down to your personal preferences and what you envision for the future of your business.

4. The take-off stage: Growing fast and how to finance it

Let’s pretend for a moment that at the success stage, you decided to go for it.

You took all of your profits and additional company resources and invested them back into the company to take a shot at extreme growth.

And it worked!

Your small business is now in the take-off stage, which occurs when you experience rapid growth in a short period of time. This stage is equal parts fun and frightening, as massive growth requires massive amounts of cash to continue paying overhead (e.g., employees, rent, vendors, etc).

At this stage, it becomes vitally important for you to begin developing a pitch deck and connecting with investors—because if you don’t start raising money fast, you’re on the accelerated path—to bankruptcy.

Last but not least, to round out our stages of business growth, we have something called “resource maturity.”

5. The resource maturity stage: Taking control and remaining entrepreneurial

As the name suggests, the resource maturity stage marks a period where your business achieves significant financial freedom and market control. At this point, you’ll have established predictable plans and practices that consistently yield reliable outcomes. It’s now crucial for you and your team to effectively manage your cash flow while refining strategic plans, business models, messaging, and growth initiatives to sustain the success you’ve achieved thus far.

However, it’s essential not to lose sight of the entrepreneurial spirit that fueled your growth. During the resource maturity stage, there is a risk of adopting business practices and policies that stifle innovation, limit collaboration, and erode company culture. As small businesses evolve into medium and large enterprises, founders often forget the principles that originally drove their success, potentially leading to stagnation and decline.

Therefore, striking a balance between structured processes and the dynamic, entrepreneurial mindset is vital for continued success in this final stage of the small business lifecycle.

Small business growth: Invest in scalable tools

We hope this guide has provided valuable insights into your business’s journey—past, present, and future. One key takeaway from our experience supporting small businesses through these stages is this:

As you prepare to enter new phases of growth, ensure you are equipped with tools that will serve your needs both now and in the future. Prioritize scalability when selecting new technology, as this can help you avoid significant growing pains down the line. Carefully evaluate the features available at each price point so you understand the capabilities you’ll have at your disposal when it’s time to upgrade. Wishing you continued success and growth!

Originally published Nov 04, 2021, updated Sep 26, 2024