For new small business owners, preparing a budget can be overwhelming. Unknown values make financial planning tricky, and business budgeting can seem like a time-consuming, technical, and restrictive process. In fact, some 50% of small businesses chose to avoid doing a documented budget in 2020, considering it unnecessary.

Despite this, businesses without a budget miss valuable opportunities to make financial decisions that will have the most impact on their ongoing profitability. A budget tells you if your business is heading in your intended direction, and whether you’re on track to accomplish your annual financial goals. It doesn’t have to be a wholly inflexible structure. Instead, it can allow you to allocate resources to your business’s greatest benefit and preserve your cash flow.

Fundamentally, a budget will show you how much money you have and how to spend it sustainably. In this guide, we’ll cover the key aspects of small business budgeting:

- What a budget is

- Why you need a budget

- Common types of budgets

- How to use a budget

- Tips on how to budget most effectively

💰 Need a budget template right now? We’ve done the work for you.

What is a budget?

A business budget is a forecast of your cash sources and expenditures. Like a financial statement, it typically covers a 12-month period.

For yearly budgets, you can compare your anticipated income and spending with your actual business performance over the past year. You can then use these findings to make informed decisions for next year’s budget, such as potential business expenses and future revenue.

Use your business budget to assist in preparing for short and long-term financial obstacles. Make sure to set money aside for unexpected costs and possible liabilities.

There are different types of budgets, and for new businesses and startups (without accounting departments), it’s important to know the difference. Let’s take a look at the various types and how you might integrate them into your business plan:

Why do you need a budget?

A budget allows your business to perceive and prepare for unexpected expenses before they arise and therefore alter your plans to prevent them from having a substantial financial impact.

Should you require a business loan, it can also convince potential investors that you are well versed in your business’s operations and ready to anticipate future needs.

Every company should prepare a budget before investing money in assets, hiring staff, or purchasing property. To meet your business goals, it’s essential to evaluate how much sales revenue is necessary to support running your organization. In short, a budget is a valuable tool for managing your income, expenses, and planning.

It’s of particular use for the following:

- Determining the revenue required for labor and raw materials

- Predicting expected profit

- Estimating revenues needed to support day-to-day operations

- Totaling startup costs

Budgeting will help your small business to cut money spent on unnecessary expenses. For example, where you are paying for multiple subscription services where one would do.

Speaking of cutting costs…

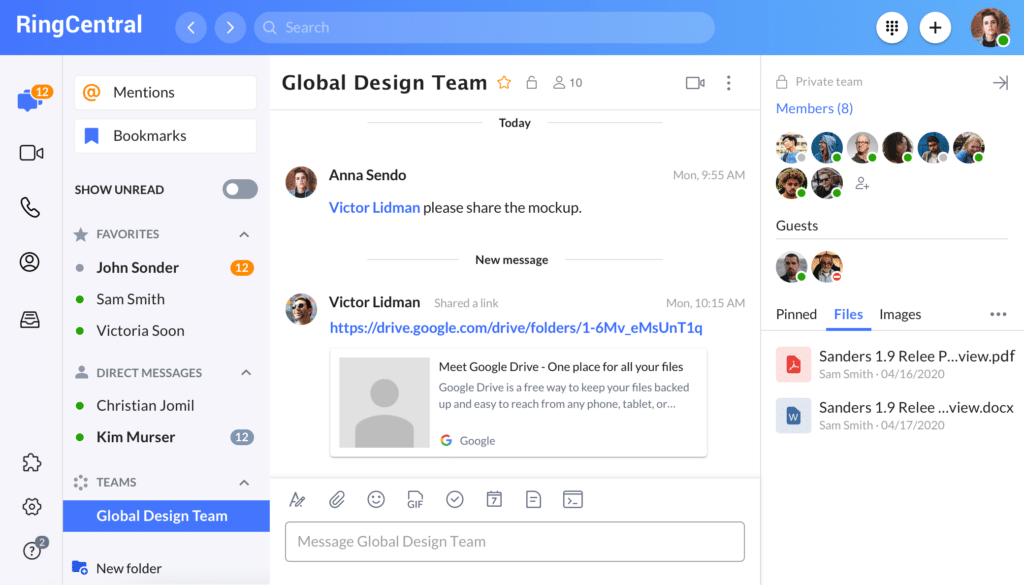

If a budget determines that costs need to be cut in communications, consider an app that provides an all-in-one service with multiple integrations. With phone calls, video calling, messaging, and integrated services like file sharing and task management, versatile software can make for a positive balance sheet. Here’s how it looks in RingCentral, an all-in-one cloud communications app for teams of all sizes:

(Psst: there’s even a totally free version for team messaging and video calls! No catch, no strings.)

Common types of budgets

1. Master budget

As the name suggests, a master budget combines all of the smaller budgets within your business and creates one overall forecast of expenses and returns. It provides your small business with a broad overview of its financial position and can be used to plan for future business needs and resource allocation to meet sales targets.

Typically, you can compile a small business master budget using an Excel spreadsheet, but it’s often more efficient to use account software. Consider a universal template across budgets to make compiling them into one balance sheet more seamless.

2. Operating budget

An operating budget is essentially a profit and loss report. It shows expenses for a set upcoming period, usually the next year. The nature of this type of budget means it’s updated throughout the year as part of an ongoing process, either monthly or quarterly. Most frequently, it includes fixed costs, variable costs, capital costs, and operating expenses like office supplies, Wi-Fi, etc.

3. Program budget

Program budgets are prepared with a particular project or business venture in mind. It’s therefore a suitable form of bookkeeping for small businesses that focus on one project at a time. The program budget allocates funds while monitoring the project performance and therefore accounts for any variable costs and variable expenses that may arise.

Is a program budget right for you? Here are some advantages and disadvantages of program budgeting:

| Advantages | Disadvantages |

| Determines the priority of projects and provides a good roadmap for future expenses. | Requires a lot of information and time to determine the financial resources and raw materials required for specific projects. |

| Helps identify areas for cost reduction. | Can lead to budgeting for dual expenses when costs overlap between the program budget and wider business budgeting. |

| Provides more accountability for your organization. Budgeting for one project at a time means better performance management and therefore improved financial health. | If the budget is inaccurate, it can increase costs. |

| Identifies where areas might require increased funding and where pricing can be adjusted in response. | Supplies no contingency for unexpected projects that may arise and take precedence over the budgeted initiative. |

4. Cash budget

A cash flow budget helps business owners determine how much liquid cash is available and whether it’s being used productively. Without consistently available money to buy inventory, pay bills, and handle payroll, a business won’t last long.

Realistic cash flow projections will show you where money is coming from, the amount of money to expect, and when to expect it.

5. Labor budget

A labor budget plans for staffing and new hire costs.. It means you can plan payroll for your employees and gauge what the labor expenses will have on your profit margin.

Small business budgeting may forgo labor cost planning if they have small teams. However, as small businesses grow, planning for labor expenses becomes a fundamental accounting practice. Here are the pros and cons of a labor budget:

| Advantages | Disadvantages |

| Predicting labor costs is more stable than material costs. | It can be difficult to adjust the budget between skilled and unskilled staff and differences in rates of pay. |

| Data for predicting wages is easily available. | Can give inaccurate estimates when workers are paid for overtime. |

| Make sure you always have sufficient finances to pay your staff and keep your business running productively. | No distinction is made between fixed and variable expenses. |

One great way to reduce your labor costs is to outsource some of your staff. With RingCentral, employees can work from anywhere. Their modern cloud-based phone system works for both desktop and mobile, and across all devices. Wherever your staff are based, all they need is an internet connection to communicate effectively.

6. Static budget

This type of budget estimates fixed costs over a business year. It remains unchanged, even with fluctuating sales volumes.Therefore, the budget it produces can differ substantially from actual results.

A static budget is most suited to organizations that have a set fund or money allocated for a particular purpose. For example, nonprofits and government organizations will likely use static budgeting.

How to use a budget

The best budgets are simple and flexible. They will indicate where your company needs more revenue than it currently earns and will adjust to changing circumstances.

Once you have set up your budget, it’s important to record expenses and income totals at regular intervals. Should you reach a spending limit in a particular area, you will have to re-allocate money, re-evaluate the costs of goods sold, or put a cap on spending until the next financial year.

The three main elements to consider when planning a budget are as follows:

- Sales revenue: This is the amount that you hope to make from the sale of your goods or services. It’s important to estimate future sales with as much accuracy as possible, basing figures on past sales (for example, from last year). This should be the first line of your budget and where you can calculate achievable sales ambitions.

- Total costs: Total costs are made up of fixed, variable, and semi-variable costs. Here, you must identify where costs might change (and by how much) and which will remain the same. Make sure to account for inflation in your estimates.

- Profit:Profit should always be high enough to make a return on your investments. A growing profit means a growing business. Make sure to account for emergency funds and put aside money for unexpected costs. Targeted profits should aim for a fair return on your labor and therefore should include your own reimbursement. Simply put, profit equals sales minus total cost.

If you hope to maximize your profit potential, it’s important to regularly assess the performance of your sales team and analyze performance. Platforms like RingCentral can assist with this by creating live reports and logging sales scripts.

Top budgeting tips

1. Stay disciplined

For your small business to succeed, it’s important to stay focused on your biggest goals. Always track your business costs and keep personal expenses separate. The more accurate and well-organized your records, the easier it will be to produce an accurate forecast.

2. Get good advice

It’s always worth consulting an expert when you feel you may be out of your depth. In budgeting, especially, guidance can provide your business with greater security. Hiring an accountant can also free up your time to focus on those jobs where you might provide more value.

Handing over some of the workload doesn’t have to mean losing control. Using an all-in-one business communications solution will mean you can connect with your advisors from anywhere.

RingCentral integrates with hundreds of work tools like Microsoft, Quickbooks, even Salesforce. Check it out:

That means you can stay in the loop whenever your account manager makes amendments to your budget. You can also use their screen sharing feature to go through early budget drafts together.

3. Be realistic and flexible

A budget is a living document—it needs to be able to adjust to changes quickly. Consider which areas of your budget are most likely to need future edits and compensate for uncertainty by overestimating your expenses. Client-driven projects often incur unexpected costs. Staying flexible with your estimates means you are prepared for the unexpected and have a financial safety net.

4. Communication is key

In the era of social media, it’s essential that new small businesses budget for marketing. Where you may be tempted to spend funds in other areas, marketing in 2021 should be considered an essential business expense. A budget that accounts for online advertising is one that invests in its business’s future.

Have a look at these dos and don’ts for spending your money on marketing:

| Dos | Don’ts |

| Build a marketing plan based on your customers and their purchase habits. | Don’t spend money before gathering accurate information. |

| Always negotiate for the best rate from advertisers and influencers. | Don’t feel confined by the previous year’s budget. As your business grows, you’ll need to adjust the funds you assign to digital marketing. |

| Balance your marketing budget with other business expenses. | Don’t overestimate the potential success of a market campaign and over-buy supplies. |

Highlights:

- Produce a budget to prepare for predicted income, expenses, and unexpected costs.

- Focus your budget on sales revenue, total costs, and profits.

- Consult an expert when you feel out of your depth.

- Cut unnecessary expenses by picking all-in-one apps that combine processes in one platform

Small business budgeting: An ongoing process

Remember—budgeting is an ongoing process that requires dedication and constant monitoring. Taking the time to budget effectively will give your business the best financial insights with which to make positive business decisions. It will help your profits grow and allow you to scale your company accordingly. Overestimate expenses to prepare for unexpected costs, help your business run smoothly, and stay on track to achieve your targets.

Budgeting is an indispensable tool for transforming your business goals into reality. It builds confidence in your organization and boosts employees towards financial goals.

Pick a type of budget, a budget template, and consider the above tips to begin planning your budget today!

Originally published Sep 16, 2021, updated Jun 19, 2024