Video conferencing is a powerful medium for connecting.

And as we’re learning from remote work’s growing popularity due to factors like the COVID-19 pandemic, video conferencing is a great and powerful way to interact on a personal level, but from afar.

This video technology has allowed more employees to work from home and doctors to “see” more clients and prescribe medication in a fraction of the time—and across great distances.

And similar to this rise that we’re seeing in telehealth and telecommuting, there’s also a growing appetite for financial firms to provide similar types of services for many of the same reasons—particularly in times of financial crisis.

As we’re forced to face our financial health, consumers are looking at new ways of using technology to learn about issues, respond quickly, and communicate with financial advisors no matter where they are. And video conferencing is a big piece of that.

In this post, we’ll look at:

- 4 major benefits of using video conferencing

- The differences between serving high-net-worth clients and your everyday clients in finance

- 4 steps to setting up your business for video conferencing with high-net-worth clients

Intrigued? Let’s go deeper…

👀 Do you work in financial services? Learn how Essential Federal Credit Union is improving efficiencies, response times, and customer satisfaction.

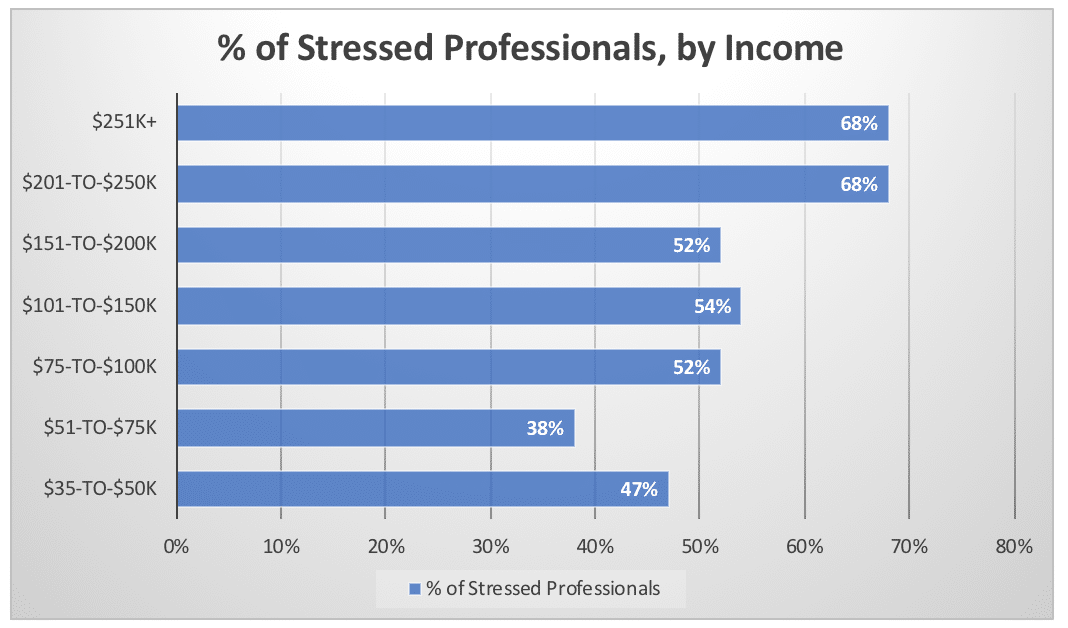

More money, more problems

According to a 2018 LinkedIn study of US professionals, the Notorious B.I.G., Puff Daddy, and Ma$e had it right. The more money you make, the more stressed out you’re likely to be:

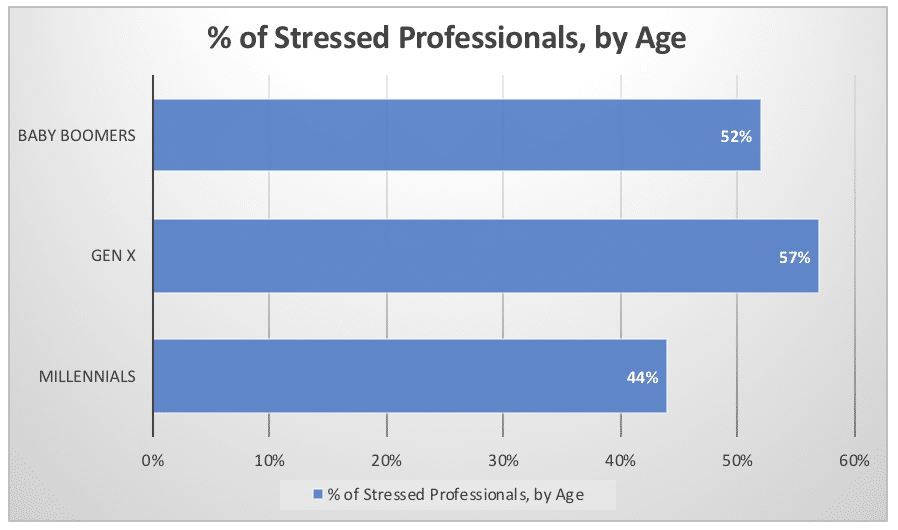

And across these income brackets, Gen X’ers ranked as the most stressed population. In the wealthy set, their stress is complicated by added dimensions: more investments, properties, and other assets to manage. Add to this the strains of thinking about retirement, handling care for aging parents, and ensuring their wealth is secure for their kids and grandkids… and you can see why wealthy forty-somethings are in need of a one-stop-shop for financial services.

Not only do they need to be able to trust the person who serves them, but they also need to be able to reach that person at a moment’s notice. Compared to boomers, their investments may be more aggressive or prone to movements, and they need to be able to get financial support quickly and across great distances.

And this is where video conferencing comes back in.

According to research from PWC’s report, “Why wealth management can’t afford to miss the digital wave,” high-net-worth individuals (HWNI’s) under 45 are disproportionately interested in using new technology to interact with their financial advisors:

Can you see why?

If you were young and wealthy, you’d probably want to keep closer tabs on how your money is working for you too, right? You’d want to be able to get in touch with a financial advisor quickly and easily—even if you’re halfway across the world from each other—because everything else in your life is at your fingertips. Why not financial management, too?

4 major benefits of using video conferencing

So, what does this mean for you as a firm? Basically, it means there’s a big opportunity ahead of you—if you can make the jump. Video conferencing isn’t only a trend in tech and health. It’s also a tool for helping you compete more effectively for more high-net-worth clients.

If you can offer more high-demand technologies to your clients, you’ll not only be helping your more average clients, you’ll also make your firm far more appealing to these wealthy folks under 50.

If you can adapt to this new normal, you’ll have a distinct advantage over those who are slow to adjust. If you can’t meet the needs of your client as well as the firm next to you, they’ll be quick to make the switch.

This is especially true for millennial wealthy individuals, who are more comfortable than older generations with moving any part of their business around. They might drop a wealth manager for not responding quickly to requests or offering enough digital services to meet their standards.

But there is an opportunity in all of this.

There are many benefits of using video conferencing for high-net-worth clients, so let’s explore a few of them.

Shopping for a video conferencing tool? (Or just curious about what to look for?) Grab the free checklist to help you choose the right one for your team or business.

1. You reach a wider range of clients.

Instead of drawing only clients from your limited local geography, you can now bring in clients from anywhere.

You’re no longer limited by your location or the location of your clients. This means you can offer services to these young and wealthy folks wherever they are.

2. You can connect with your clients in more places and times.

With the ease of meeting virtually, you can help minimize the anxiety of your clients.

You can easily set up recurring or ad hoc meetings to talk about their portfolio and even incorporate third-party stakeholders, family members, or other service providers like lawyers or accountants that your clients may want to keep in the loop.

3. You can increase trust by adding a face to your voice.

While phone calls to discuss your finances can work to some degree, humans are visual creatures, and ultimately, we want to see and be able to talk to someone face-to-face. Video can help you increase trust both through letting your clients see your face more often, but also by being able to provide them more value in your calls by physically presenting client information.

4. You can retain more clients for the long haul.

Reports indicate that under-50 wealthy are more likely to switch financial providers, but after crossing that threshold, the likelihood of switching drops significantly. That means that if you can draw more of the young wealthy before they cross that 50-year threshold, you’re more likely to keep them for life.

At the end of the day, these folks simply want results and convenience. They want responsiveness. You already have the expertise, you just need to be there when they need you to answer questions.

This will make you irreplaceable to your clients.

What are the differences between serving high-net-worth clients and your everyday clients in finance?

At this point, you may be wondering, “What’s the difference between video conferencing with wealthy clients and the other folks I serve?”

The truth is, video conferencing is helpful for many clients, even your everyday clients. But the real benefit to you is that it also more closely meets the needs of high-net-worth individuals.

For the under-50 wealthy, it checks the boxes in a powerful way. While more everyday clients are moving more towards automated solutions to handle their finances, that doesn’t mean they don’t want the human touch at all. The greater the wealth, the greater the value that is placed on 1:1 customized or “concierge” financial services.

Many of the wealthy (and especially if they’re young and wealthy) have more specific needs. They want more of a custom-fit and might be:

- More cautious due to the 2008 financial crisis. They were old enough to remember and feel its effects and tend to take a more hands-on approach to their finances. They also might be less interested in risk-taking in investing.

- More tech-savvy. They want to connect with their financial advisor as easily as they can FaceTime their mother.

- More studied on finance. With gobs of content available on finance, more of the wealthy are self-educating and using their financial advisors to help them with their financial literacy.

- Eager for higher-touch relationships. They want a coach, a counselor for their finances, not just somebody who checks in every six months.

- More skeptical. They’ve seen challenging times for the economy, and trust is an even bigger factor.

- More likely to monitor their finances on the go. If they’re on the road or abroad, they won’t want their geography coming between them and tracking their finances.

- Sensitive to fees. They don’t want to pay fees and give up more of their wealth than they absolutely need to.

Video conferencing can help you provide more 1:1 help for these types of clients.

For example:

- You can provide more reassurance by connecting with them more frequently, becoming a trusted advisor by acting as more of a financial mentor to help them allocate their wealth.

- You can use the tools of convenience that they’re already using. If they’re already having video calls in other areas of their life, they’ll appreciate the convenience of being able to do it with you.

- It’s an opportunity for you to become more than just a voice on the other end of the line. If a picture is worth a thousand words, how much more is a video worth? That’s the fundamental value add of video: it’s the closest thing to being physically present with them, without being there. With video conferencing, you can serve these clients from anywhere.

- Using video conferencing can even help you reduce your overhead. You can serve more clients without having to invest a massive amount of resources.

So at this point, you’re probably wondering how to get started with video conferencing. Here’s how to do it.

4 steps to setting up your business for video conferencing with high-net-worth clients

1. Sign up.

- There are tons of video conferencing platforms for businesses out there—for example, RingCentral Video lets you join video calls from your browser without needing to download anything. Check out this clip of how it looks:

2. Integrate with your calendar system.

- Once you’ve signed up for your video conferencing software, find the right integration for your calendar so that you can book video meetings right into your calendar. (Google Calendar or Outlook)

3. Schedule recurring or ad hoc meetings via emails with your clients based on their schedule.

- Your newly integrated calendar will allow you to automatically send an invite to your client with all the info they need to attend the virtual meeting.

4. Launch the meeting at the scheduled time.

- Remember to show your face and share your screen to instill trust and showcase your expertise.

- Share your screen and walk through your client’s reports and portfolio performance.

🕹️ Get a hands-on look at how RingCentral works by booking a product tour:

Start video conferencing with your high-net-worth clients

As you can see, there’s incredible potential to attract and retain more high-value clients.

With more and more people working remotely and looking to minimize their commute times, it’s time to start making video conferencing a central part of your firm’s strategy.

Check out a video conferencing platform and get started today!

1 “Top 3 trends that will influence Wealth Management in 2020.” finextra.com/blogposting/18264/top-3-trends-that-will-influence-wealth-management-in-2020

Originally published May 14, 2020, updated Jul 25, 2024