We all know that customer: the one who you know by name because of just how often they’ve complained.

No matter how excellent the service you provide, they find a fault and demand to “talk to your manager.” With the rise of social media, you’ll probably see them posting in ALL CAPS about how simply AWFUL their time was, too.

Despite your irritation, it’s worth considering this: these customers can be the best things to happen to your business.

While it’s great to have customers raving about your products or services, nothing helps your business grow better like constructive, negative customer feedback. (Keyword: constructive.)

Even Microsoft founder Bill Gates agrees. He famously said, “Your most unhappy customers are your greatest source of learning.”

🔍 Access Metrigy’s free report to learn more about the 2022 state of customer experience technology.

Unfortunately, 96% of unhappy customers don’t complain about their bad customer experience. A majority of them will simply abandon a brand forever, increasing customer churn after one negative experience:

It turns out that the noisy complainers are actually blessings in disguise. When a customer demands to talk to a manager, they’re actually taking the time to tell you what’s wrong. They care. You should offer them free coffee, sit them down, grab a pen, and get them to fill out a customer satisfaction survey.

And since most customers aren’t forthcoming with their feedback—it’s up to you to proactively follow up and seek that customer feedback by creating online surveys.

The best way to do it? Just ask.

Make asking easier by using a tool like RingCentral’s Feedback Management application. It can help you provide customers with surveys via their preferred channel—as well as gather valuable insights you can use right away.

In this post, we’ll cover the following things:

- Why customer surveys (CSATs) are important

- 4 types of customer surveys

- 3 examples of good customer surveys

- 6 steps to create an effective customer satisfaction survey for your brand

🔑 What’s the key to building a customer-centric team? Grab our eBook to find out.

Why are customer surveys so important?

You don’t always know what your customers are thinking over the course of their customer journey—unless, of course, you have telepathic powers like Professor Charles Xavier (X-Men) or Eleven (Stranger Things).

Customer surveys can be your superpower that allow you to read customers’ minds. Surveys give your business an opportunity to understand what keeps them up all night, what gets them out of bed, how they rate their overall experience with you, and how they perceive your brand.

Customers are your biggest—and most direct—source of valuable metrics; metrics you can put to good use to increase your ratio of loyal customers and decrease churn.

There’s a reason why businesses put “How am I driving?” stickers behind their company vehicles or hire mystery shoppers to assess their level of satisfaction in store. These forms of customer surveys are designed to stress-test the quality of their product/services.

Brands employ these tactics to plug the holes before poor retention rates and churn can sink their ships. Customer satisfaction surveys are yet another tactic and the guiding lights that can help your business align your goals with the customer journey.

Oh, and don’t forget your employees! Happy, engaged employees are the key to a good customer experience, so don’t forget to run employee engagement surveys from time to time. Surveys can also be a useful way of gauging new recruits’ onboarding experiences.

Good survey questions also help you gauge your customers’ satisfaction and happiness in relation to your brand—a reason why RingCentral Surveys is a popular feature in RingCentral Contact Center™.

Customer surveys are like performance appraisals, but for your business. For instance, if a significant number of customers complain about the quality of your customer service, it’s a sign that some of your teammates aren’t offering customers the positive experience they deserve. It’s a wake-up call for you to fix things before they become bigger problems.

The debate is no longer whether you should conduct customer surveys. Instead, the more relevant question is how you should do it.

In the sections below, we’ll show you how to make customer surveys an integral part of your customer experience so that it’s quick, effortless, and contextual.

4 types of customer surveys

Before we dive into the types of customer surveys, it’s important to understand that not all surveys are created equal.

For instance, you can’t expect customers to enthusiastically answer your questionnaires if they come in the form of an automated robocall or a mailed 10-page questionnaire.

You’d likely get a low response rate to these surveys because such methods don’t take your customers’ convenience into account. Surveying customers is part science and part art—and you’ve got to make sure you do it right to get the results you want.

Phones and direct mail used to be popular channels for brands to conduct general-purpose customer surveys. Today, they’ve fallen out of fashion because these channels demand time and manual effort, and lack context. Nowadays, most surveys take place online.

The best surveys are the ones that follow up customer feedback in the moment while a customer’s memory of a brand interaction is still fresh in their minds.

Let’s look at a few types of customer surveys you can try:

1. Purchase intent survey

You can use purchase intent surveys to not just understand your customers needs and customer journey but also generate leads.

You must have seen a zillion brands embedding lead forms on their websites or pop-ups for new customers to sign up. Why not extend that idea to create an intent discovery survey? This way, you can glean critical information from customers on their service experiences, what they’re looking for, and why. It also helps you to encourage your customers to start using your services.

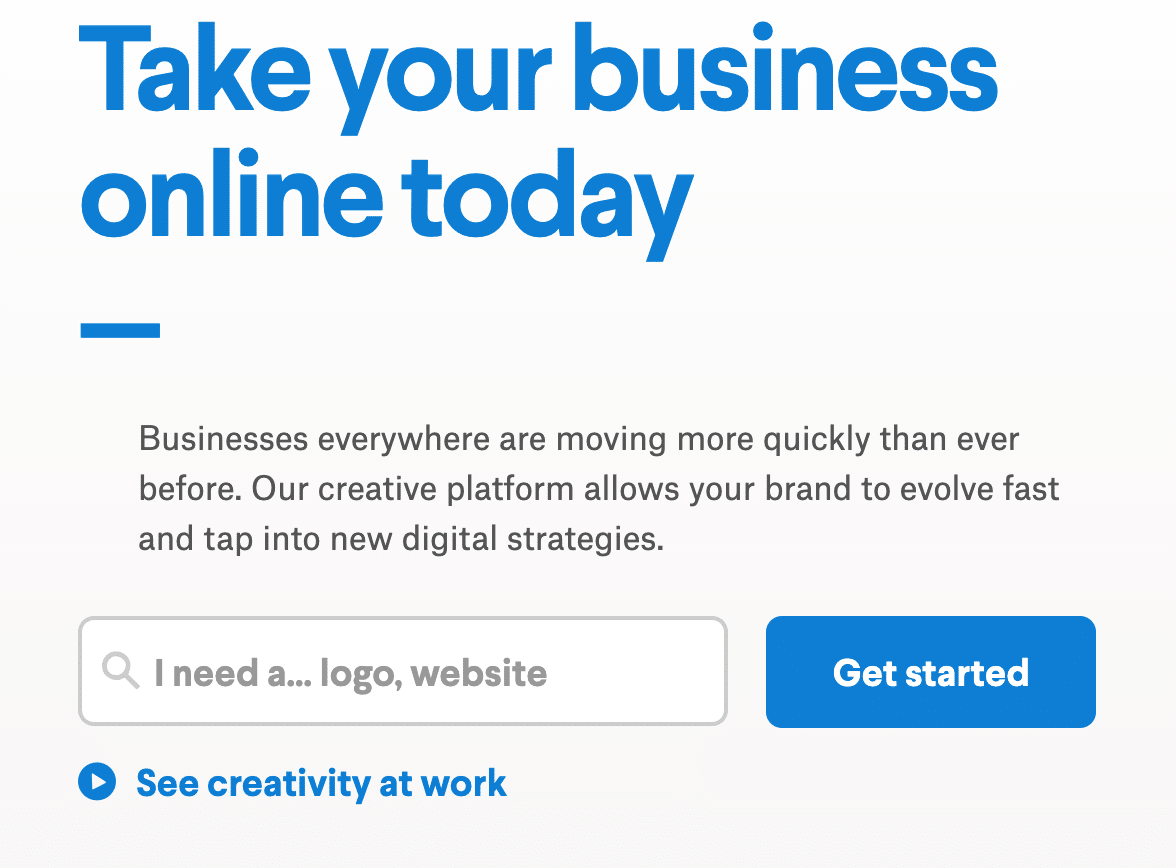

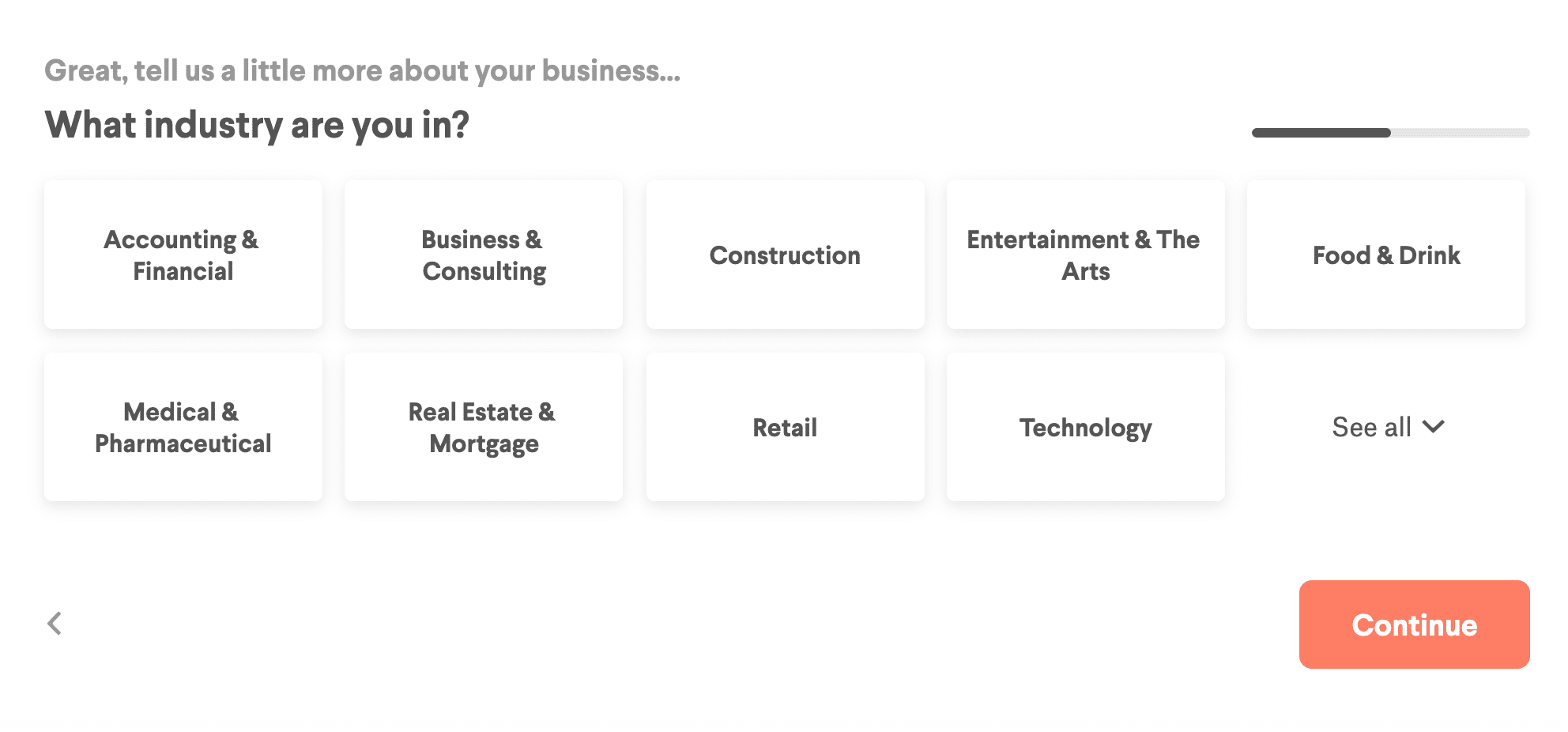

99designs—an online platform that connects freelance designers and clients—does this really well.

If you’re a new customer to 99designs, their website doesn’t ask you to sign up with them right away. Instead, they ask you a series of questions:

Depending on the answer you give, you’re taken through a flow:

Which gives 99designs information about you that helps them determine whether you’d be a good potential customer:

You get the drill.

The interactive design brief encourages respondents to unwittingly start a project on 99designs (since they’ve already spent two minutes talking about their requirements).

It also helps the support team behind 99designs understand their target audience better and improve their future product/service.

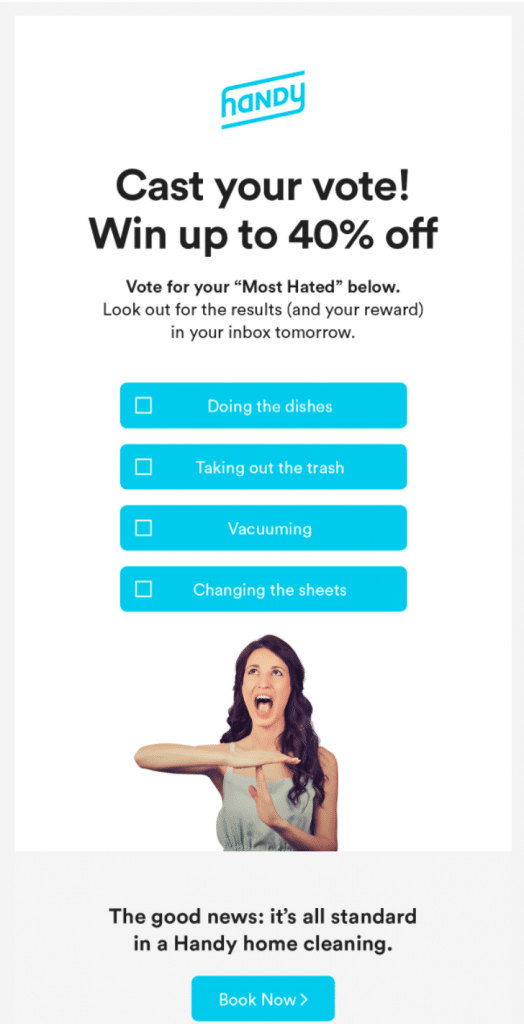

Here’s another example from Handy—the largest online at-home services provider:

It’s a smart marketing campaign using multiple choice questions disguised as a survey email. The “40% discount” serves as an attractive incentive for customers to fill out online surveys.

2. Customer satisfaction surveys

The most popular surveys in the business world are probably customer satisfaction (CSAT) and Net Promoter Score (NPS) surveys. Businesses all over the world use CSAT and NPS to assess the level of customer happiness and satisfaction score in relation to a brand experience.

They’re such a hit that a lot of businesses actually benchmark the CSAT and NPS survey results as metrics to measure their teams’ performance. (If you’re not sure where to start, we’ve got a guide about how to choose the right customer satisfaction survey questions.)

Here’s an example of how Netflix runs a CSAT survey:

Both CSAT and NPS are typically customer support teams’ first choice to gauge customer happiness about an offer or a post-purchase experience. While CSAT helps you understand a customer’s needs, likes, and dislikes, NPS helps you identify your most satisfied customers, detractors, and even your passive existing customers.

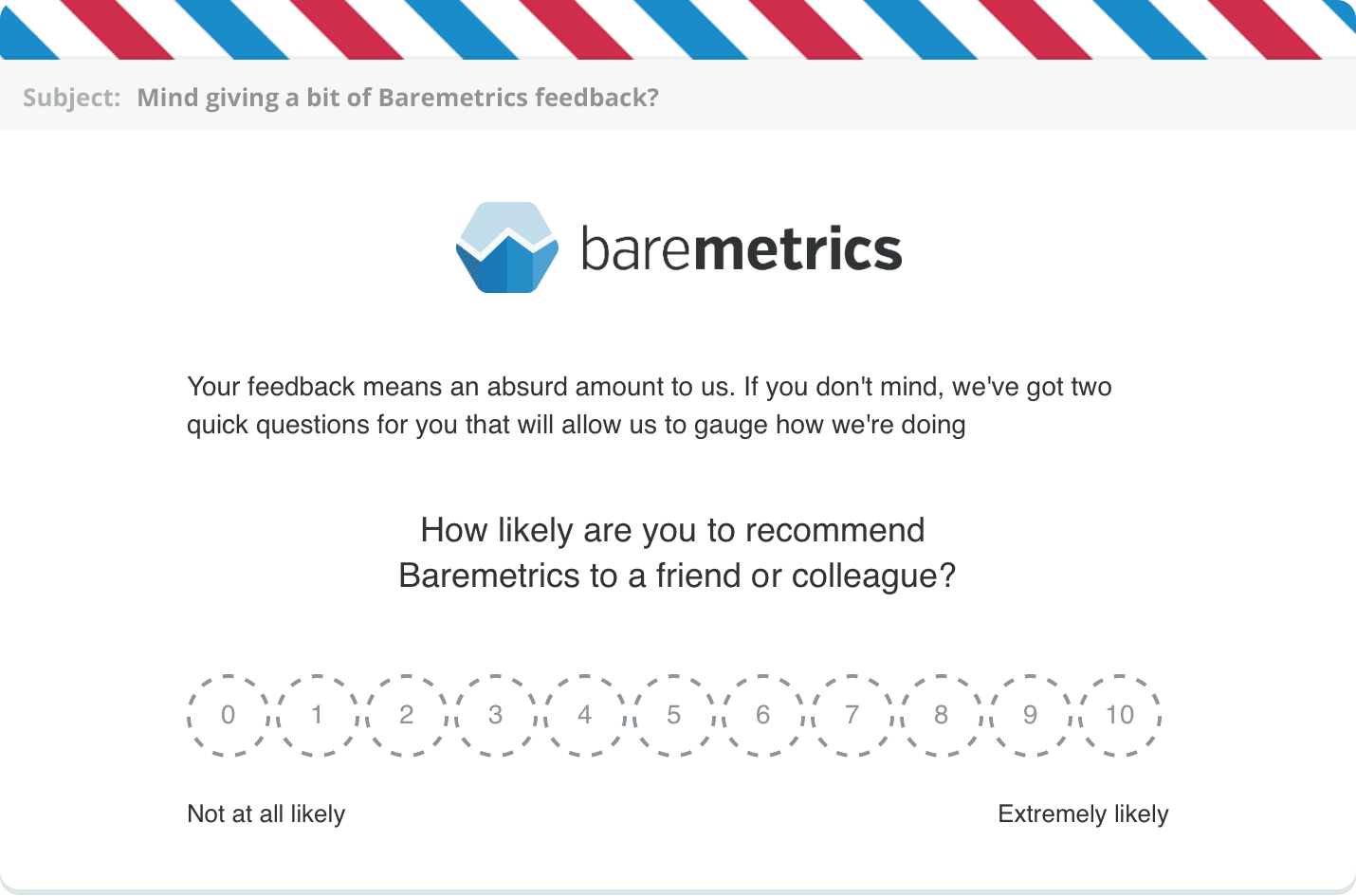

Here’s an example of how Baremetrics—a forecasting and analytics tool for SaaS companies—uses NPS to understand how their customers feel about their brand:

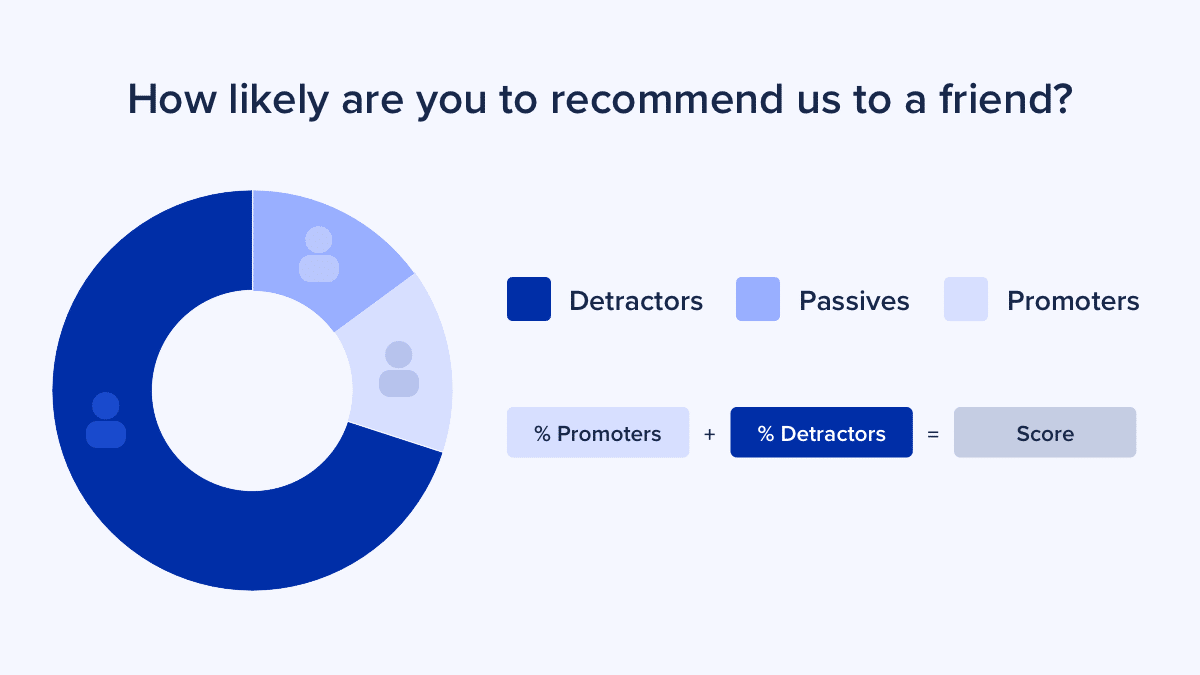

There’s a formula to calculate the NPS, which is the number that you get after you subtract the total percentage of your detractors from your promoters, like this:

For example, if 47% of the customers you surveyed vote a score of 9 or 10 while 24% give you 6 or less, your NPS is 23 (47-24).

The 20% of the customers that vote 7 or 8 are neutral, and this percentage of customers doesn’t contribute significantly to the survey’s results. But this also means there’s work to be done to turn them into your brand promoters.

While understanding your NPS in binary terms (“good” vs “bad”) is possible, it’s also highly contextual to the industry your brand belongs to. For instance, an auto dealer has a good NPS if they score 39 or above (on a scale of 0–100) and bad if they score 20 or lower. For internet service providers (ISPs), “good” is 19+ while “bad” is -16 or below.

3. Customer effort survey

Beyond CSAT and NPS, there’s another type of customer survey that helps you measure the level of effort a customer has to put in to engage with your brand: the customer effort score (CES).

You can create a CES survey either by using a numerical scale or by describing the level of customer effort in words, like this:

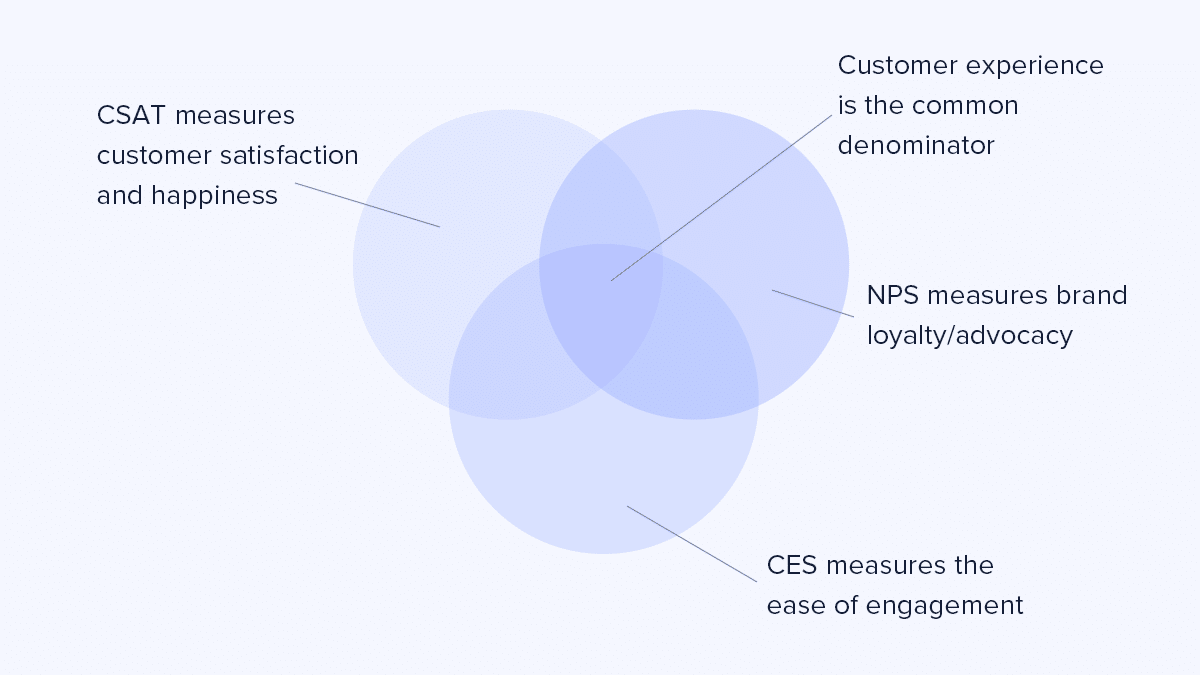

If we were to draw a Venn diagram for CSAT, NPS, and CES, they would all overlap at the customer experience—while each having its own nuanced approach to measuring different aspects of customer expectations:

CSAT, NPS, and CES all complement each other. But don’t overwhelm your customers by sending all of them at once. Use one survey at a time to get a gradual understanding of the customer experience.

Another thing to note: NPS and CES are single-metric surveys that don’t give you the full picture of your customers’ experience. It’s best to follow up an NPS or CES survey with a more qualitative or in-depth survey to understand a situation better, especially if the responses were negative.

Alternatively, you can also include open-ended questions along with a CES survey, for example, asking customers why they give the service interactions a certain rating at a specific score.

Engage Voice is a RingCentral program that can help agents collect valuable customer insights. As well as providing customers with an on-brand experience, it’s a great opportunity for them to carry out quick, personalized customer surveys.

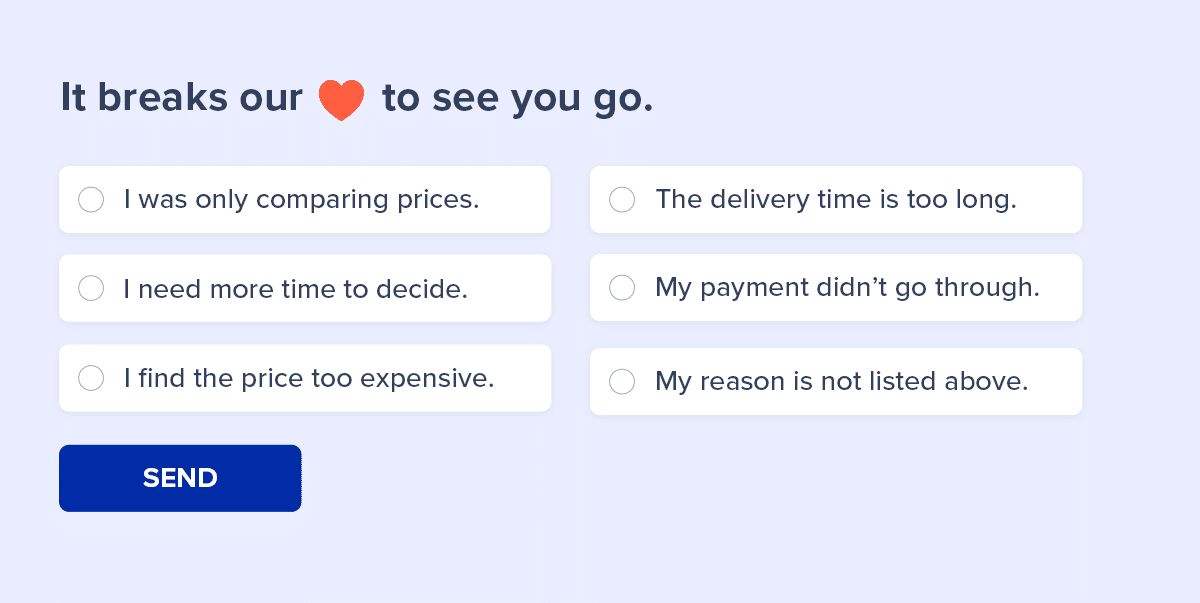

4. Exit surveys

Brands usually use exit follow-up surveys when customers abandon their products or services, either during a purchase journey or after buying a product:

An exit customer survey is a great way to identify the biggest culprits if you have a low customer retention rate and to help future-proof your customer experience.

For instance, if many customers select “price” as a reason for not completing their purchases, you might start rethinking your pricing plans or email a discount later on to lure them back.

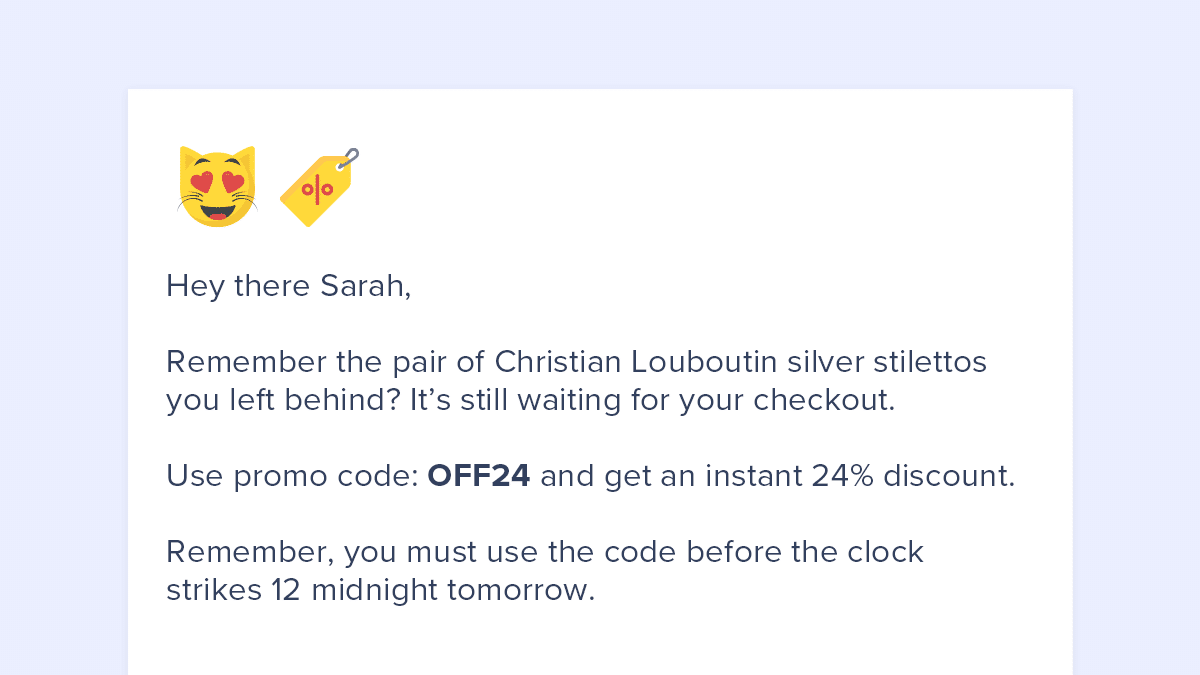

Here’s an example:

And then the email that this triggers:

Here, we can see that this survey uses automation to trigger a contextual email campaign to customers who chose “price” in the exit survey as a reason to abandon their purchase.

If your potential customers don’t immediately come back to finish their purchase, that’s still fine. You can use an exit survey to capture their email addresses and launch targeted ads or email marketing campaigns to earn their trust back.

3 businesses that made the most of their customer surveys

Here are examples from three brands that harnessed the power of customer surveys.

1. The Affinity Group International

The Affinity Group International (TAGI) is an Atlanta-based retail merchandising consulting firm that helps ecommerce platforms maximize their profits.

A few years ago, TAGI realized that their traditional ways of cold calling customers were out of whack. Not only did it get very few qualified leads, but it also took a long time for the TAGI team to manage bookings that came with a wide range of requirements (ranging from vague requests about building a brand strategy to not very well thought out answers to TAGI’s questions).

So, they replaced their outbound sales pitch calls with a simple survey form on their website. You can check out TAGI’s survey page here.

A sample of the TAGI survey

DeAnna McIntosh, TAGI’s Chief Global Strategist and the brains behind this survey, says that embedding the survey form on their website automated their sales outreach and gave TAGI’s teams solid talking points to start a conversation with the clients.

The idea worked, and within a few months, the TAGI team was able to cut the time it took for them to convert a lead into a client by a whopping 40%.

2. Eventbrite

Eventbrite’s co-founder and CEO Julia Hartz says surveying customers was a major driving force behind Eventbrite’s growth and success. That says a lot about the power of customer feedback.

According to Hartz, asking customers for feedback and applying the advice to the company’s website helped Eventbrite successfully transform from a simple ticketing app to a full-service event organizing platform.

When Hartz and her other co-founders started Eventbrite, they began organizing meetups and conferences to help tech bloggers exchange ideas. They were very sure of one thing from the very beginning: they wanted to build the platform along with their earliest loyal customers.

So Hartz and co. “maniacally” surveyed their users to assess their satisfaction scores, and, based on the feedback they received, grew Eventbrite into a platform that served communities other than just the techies.

During their early days, Hartz and her co-founders encouraged users to directly call them on their phones to share their service experience. Now, they have robust processes to gather customer feedback. They use customer survey tools and have a dedicated data insights team and people whose sole job is to talk to customers.

RingCentral’s Feedback Management app can be used to provide detailed customer feedback and gain a clearer understanding of where you stand compared to your competitors.

3. Bureau Veritas

Bureau Veritas is Latin for “office of truth,” and that’s what it has sought out to do since its establishment in 1828. The Paris-based marine survey and rating company provides testing, inspecting, and certification to marine vessels across the globe.

A few years back, Bureau Veritas ran a sample NPS survey to understand how customers viewed their overall satisfaction. The survey response wasn’t huge, but it yielded valuable insights. So they sought out to scale the survey—this time, to include 10,000 customers worldwide.

Bureau Veritas used a customer satisfaction survey template

They used a survey software platform called SurveyMonkey to design a user-friendly survey campaign. And just like they expected, the easy design of the survey form (using a customer satisfaction survey template) increased their response by a jaw-dropping 800%:

How to create a customer survey in 6 steps

Here’s a step-by-step breakdown of how to create a customer survey for your business.

1. Identify why you want to survey customers

A survey without a goal is like thunder without rain; it doesn’t serve any purpose except for creating noise. For a survey to make an impact on your business, you’ll have to understand why you want to do it.

Here are a few examples to find a “why” for a survey:

- The number of customer detractors on social media has doubled in the last quarter.

- Customers are leaving you in droves.

- There’s a sudden spike in your organic website traffic since last month.

- You want to beta test a new product feature with a limited set of loyal customers.

Asking the right questions not only helps you figure out a good motive to do it, it also makes your survey directly relevant to a business problem (or an opportunity).

2. Have a reasonable assumption

Once you have a clear rationale to conduct a customer survey, you want to come up with a hypothesis you want to test. Let’s look at three of the above scenarios as examples:

- The number of customer complaints has doubled in the last quarter.

- Hypothesis: Customer complaints have gone up since you downsized your customer support bandwidth.

- Customers are leaving in droves.

- Hypothesis #1: Customers are moving away since one of your competitors launched an aggressive brand switch campaign.

- Hypothesis #2: It’s a temporary drop in subscriptions due to COVID-19’s impact on businesses.

- You want to beta test a product feature with a limited section of your customer base.

- Hypothesis #1: They’ll like it because it’ll help them become more productive.

- Hypothesis #2: They might not want to pay extra for an additional feature.

These assumptions can help you come up with the right kind of questions to ask your survey customers. But keep in mind, the survey results might lead you to an entirely different conclusion compared to your original assumptions.

3. Ask the right questions

Asking the right question is the key to finding the right answer.

Align your survey questions with the goals that you’re trying to achieve. Don’t put in questions just for the sake of doing it because the unnecessary questions can lead your respondents to lose focus.

For example, if you’re an automobile insurance company and you’re conducting a survey on the driving habits of suburban families, stick to relevant questions in that direction instead of asking not-very-smart questions like this one:

4. Identify the right sample size

You don’t necessarily have to plan a nation-wide-level census to gather customer feedback. However, you can’t talk to just a handful of customers and call it thorough research.

It’s important to pick the right sample size for your survey based on your survey’s goals. For instance, if you want to know whether customers have had a positive experience about a new feature you’re about to roll out, keep your survey within a lean community of power users.

But if you want to gauge your customers’ buying and repurchase behaviors during the holiday season, it might be better to widen your sample base to include a few hundred people.

5. Check out survey examples to determine the right channel and format

You’ve heard this one before: the medium is the message.

In this case, if you have great social media interactions with your customers on Twitter, you can effectively survey your audience via a Twitter poll that involves multiple choice questions instead of a drawn-out survey in a separate platform that demands time and effort.

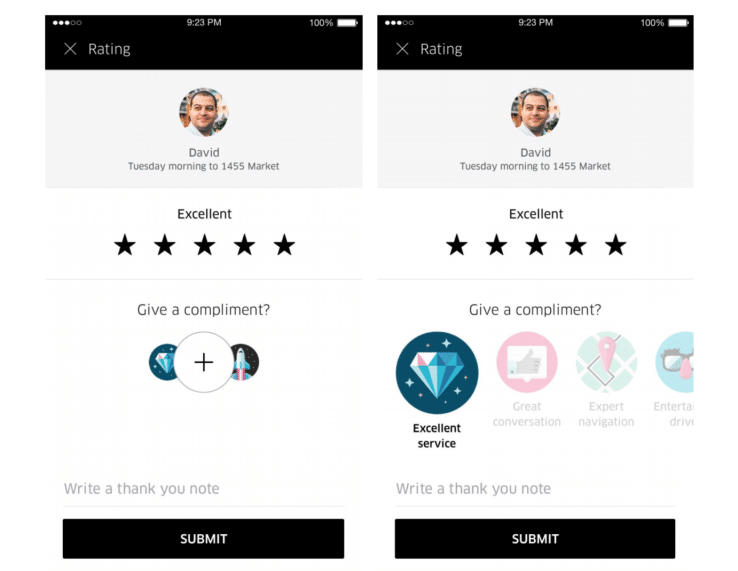

Take Uber, for instance. They use their customers’ in-app experience to get instant feedback, which reduces the friction in the process:

Many other brands place emoji reactions or upvote and downvote buttons at the end of their blog pages for their readers to gather an in-the-moment, contextual rating scale.

If you want to measure customer satisfaction more accurately, it makes sense to give your customer support team the ownership of surveying your customers on the heels of a service interaction.

6. Offer incentives

Feedback forms aren’t always popular with customers. If you’ve hated filling out a customer survey, it might’ve been because the survey’s design interface reminded you of your college’s mid-term tests or the questionnaire itself was longer than War and Peace.

Most people turn down customer surveys because they don’t have a reason to do them.

Good news: you can bribe almost any number of customers to participate in your surveys if you offer an attractive reward.

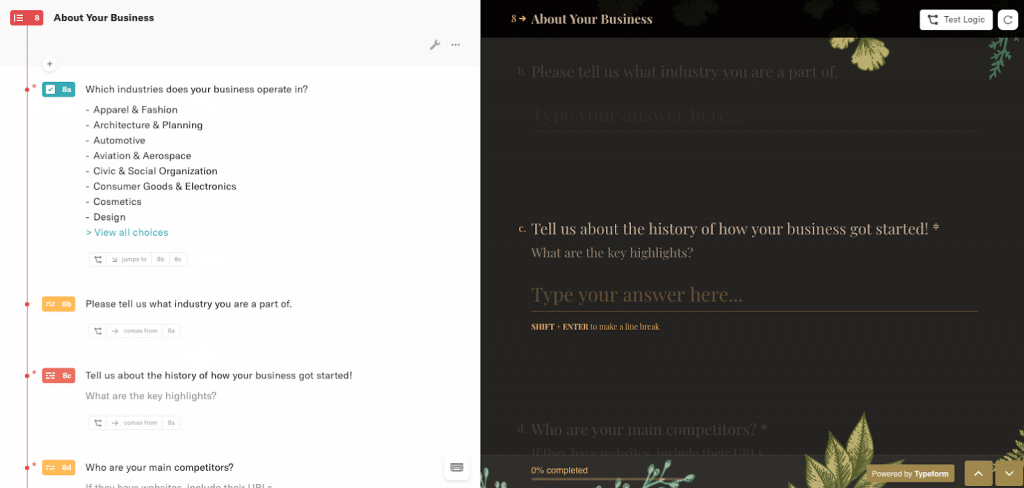

Sometimes, the incentives can be in the form of tangible rewards like a discount code or a free eBook. Other times, the ease and fun of filling out the survey can itself serve as an incentive for people to give their feedback:

A Typeform survey. Isn’t it pretty?

How will you leverage the power of customer surveys?

Ken Blanchard once said, “Feedback is the breakfast of champions.”

You realize how true that statement is when you look at how customer-centric many successful companies are (like Netflix and Eventbrite). These businesses use survey responses as guiding lights that direct their focus to their customers’ needs and increase their number of satisfied customers.

Find and create opportunities to talk to customers as much as you can. Getting an understanding of what your customers expect when it comes to service experience is a goldmine of wisdom that no amount of business books or management principles can replace.

RingCentral’s contact center solutions are designed to make you become customer-centric. Offering skill-based routing and agent management, you’ll be able to answer customer queries right the first time, every time. Happy customers are often more likely to answer a few quick questions at the end of a call, so take advantage of this and gather some feedback.

1vox.com/2020/2/5/21079162/karen-name-insult-meme-manager?modpost

2superoffice.com/blog/reduce-customer-churn

3experiencematters.blog/category/temkin-group-research

4mastersofscale.com/us/en/blog/wp-content/uploads/2019/01/mos-episode-transcript_-julia-hartz.pdf

Originally published Mar 09, 2021, updated Nov 03, 2023