The insurance industry is at a pivotal moment: policyholders are demanding faster claim resolution and digital support options. At the same time, insurance companies are faced with the challenge of providing excellent customer experiences while contending with the constant threat of commoditization of the industry. How can insurance providers balance these demands? How can they adapt to a rapidly changing environment and remain competitive?

There are a number of strategies that must be undertaken to achieve and maintain a competitive advantage in the insurance industry, but one of the most cost-effective actions to take involves finding and using the right technology to move your business forward.

The digital imperative

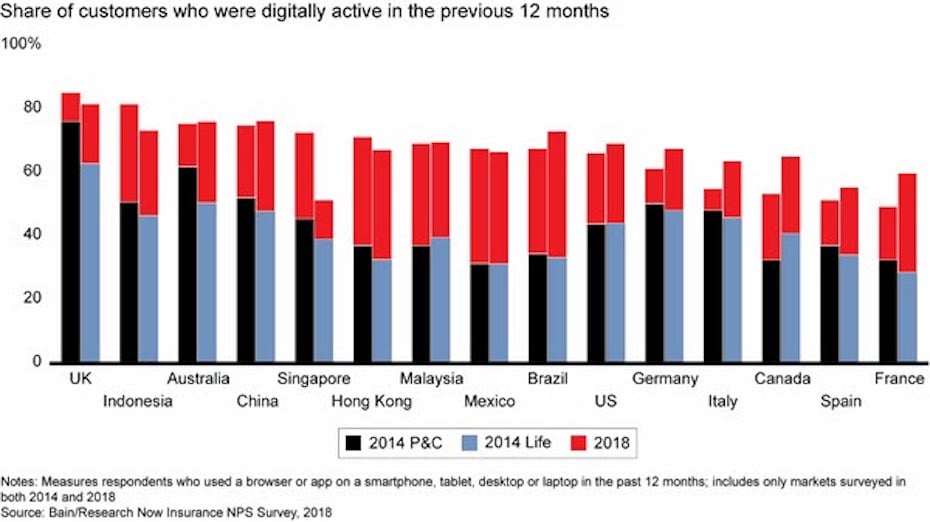

A recent Bain & Company survey of more than 174,000 insurance consumers in 18 countries serves as a reminder to the insurance industry that the time to question whether a digital transformation is a necessity is over. The answer is a resounding “yes.”

Policyholders are increasingly turning to digital channels to conduct business, and they fully expect their insurance providers to do the same. On average, between 2014 and 2018, the survey revealed, the share of digitally active customers increased by 60%. And the trend has only intensified in the wake of the global pandemic that forced more people to conduct their business online than ever before.

In the summation of its findings, the Bain report had this to say:

“In a time of disruption, the insurers that emerge as winners will be those that consistently deliver quality at competitive prices and delight their customers in each and every episode, using a variety of channels, with a growing emphasis on digital. They’ll expand and intensify their connections—and maintain their command of the customer interface—by positioning themselves at the center of an ecosystem of services that meets their policyholders’ evolving needs.

“Insurers that do the hard work of understanding and delivering the elements of value that matter most to today’s and tomorrow’s customers can put themselves on a path to sustained loyalty and lasting growth.”

One essential component of your digital transformation toolkit should be a cloud-based communications platform.

What is a cloud-based communications platform?

A cloud-based communications platform offers unified communications (telephony, instant messaging, video conferencing, and collaboration capabilities such as file sharing and the ability to edit documents) in a single, cloud-based solution.

It also offers cloud contact center functionality. For the insurance industry, this type of software is used in claims centers so that policyholders can connect with insurance providers through their preferred channels, which may include text messages, emails, voice calls, social media, chatbots, or even self-service options. Cloud-based communication platforms offer several unique benefits.

Benefit 1: Connect with policyholders on their terms

According to a CapGemini report from 2020, the vast majority of people shopping for insurance want to buy it online, and 75% of them would be willing to switch insurers if seamless policy servicing isn’t available across all channels.

A cloud-based communications platform enables policyholders to reach an insurance claims center through a variety of channels. Providing a multi-channel experience for policyholders indicates a level of care for which consumers are grateful, and it helps ensure customer retention.

Additionally, when policyholders switch from one channel to another in their interaction with your claims center, cloud contact center software tracks the interaction, so policyholders don’t need to repeat information from one channel to the next. Providing seamlessness between channels is a hallmark of superior customer experience.

Benefit 2: Cloud-based communications platforms accelerate the claims process

In an increasingly technology-centric environment, claims operations is fast becoming a differentiator for forward-thinking insurers. Deloitte’s “Future of Claims: Digital claims processing: Hitting the reset button in insurance” notes:

“At the center of this insurance reset, the new growth engine is customer retention and loyalty, both of which are largely driven by customer interactions their insurers, specifically the claims experience…The key enablers for the likely future of claims are a combination of insurance claims process transformation, adoption of new technologies, a connected partner ecosystem, and a talent model that values technical claims handling and data science skills.”

Technologies such as cloud-based communications platforms play a significant role in transforming the claims process. For instance, cutting-edge claims center communications platforms have intelligent routing features that automatically route policyholders to the claims representative most qualified to handle the claim on the first call, saving the policyholder time and accelerating the claims process considerably.

Benefit 3: Enable self-service capabilities

Today’s policyholders want self-service capabilities. A PwC study from June 2020 shows that 41% of policyholders who had difficulties with their insurer said they were likely to switch carriers who had better digital capabilities, including those that enabled self-service. Cloud contact center software gives insurance companies the option to set up chatbots and knowledgebases so their policyholders can find their own answers faster.

Self-service capabilities also play an important role for claims center operational teams. Goosehead Insurance is an excellent example. The Texas-based insurance brokerage realized that its legacy phone system wouldn’t allow for simple adjustments that could be done through self-service (such as adding a new agent to a team). RingCentral’s cloud-based communications platform gave supervisors and agents the freedom to make those adjustments themselves without involving IT, saving Goosehead time and money.

Benefit 4: Gain real-time insight into your claim center operations

Another benefit of cloud contact center software is that it provides real-time analytics into your insurance claims center operations. At a glance, you’ll see the metrics that matter most to your claims department so you can make better decisions.

With RingCentral’s cloud contact center software, Goosehead was finally able to analyze 100% of its calls, as opposed to a fraction of the calls the company was able to review previously. The insurance brokerage increased its supervisors’ capacity by 50%. Before partnering with RingCentral, supervisors could only oversee 12-15 agents, whereas they can now manage 22-25 agents. This increase in capacity has saved the company thousands of dollars in costly supervisor salaries.

Benefit 5: Manage a remote or distributed workforce more efficiently

Deloitte’s 2021 Insurance Industry Outlook highlighted one of the key challenges facing the insurance industry in the aftermath of 2020’s global pandemic, stating:

Technology was vital in helping insurers shift to remote work environments and in ensuring employees had the tools to conduct business while remaining connected with distributors and clients.

This shift to a largely remote workforce shows little sign of abating in the near future. However, cloud-based communications platforms help insurers manage claims processing teams efficiently, no matter where team members may be. Built-in collaboration tools such as integrated team messaging, video conferencing, and telephony help remote teams remain productive and provide excellent policyholder support at the same time.

Benefit 6: Peace of mind with digital security and compliance

For the insurance industry, 2020 was a difficult year in terms of cybersecurity. Insurance providers experienced the fifth-highest attack volume out of any industry by July 2020, according to McAfee. Ransomware attacks on insurers have made the news in the past year, ranging from Oman to Canada.

Then there is the matter of compliance. According to Thomson Reuters Global Cost of Compliance 2020 report, the top three challenges for risk and compliance officers in financial services firms around the world were:

- Keeping up with regulatory change

- Budget and resource allocation

- Data protection

How can a cloud-based communications platform help with these challenges? A cloud-based platform built with enterprise-level security in mind includes:

- Transport Layer Security (TLS) and Secure Real-Time Transport Protocol (SRTP) encryption between all endpoints

- Robust security measures at every level of its architecture and processes, including the physical, network, host, data, application, and business processes, as well as the enterprise level of your organization

- Threat detection and mitigation

- Secure application programming interfaces (APIs)

RingCentral: cloud-based communications works for financial services

RingCentral offers an integrated cloud-based communications platform that meets and exceeds the needs of financial services firms today. Whether you are staffing a claims call center or connecting multiple agency locations via a unified communications solution, RingCentral can help.

Our all-in-one communications platform enables you to:

- Engage with policyholders on their channel of choice

- Resolve policyholder questions on the first call with smart routing

- Scale and support multiple teams in multiple locations

- Capture and analyze important KPIs and metrics

- Provide superior customer experiences

- Remain secure and compliant with all regulatory standards

RingCentral in the real world: a tale of two insurance companies

When you partner with RingCentral, you get much more than just a streamlined communication system for your company. Just ask Insureon.

Brightway Insurance is a national property/Casualty insurance distribution company with more than $560 million in annualized written premium, making it one of the largest personal lines agencies in the US. Due to the company’s rapid growth and its commitment to world-class customer service, Brightway was contemplating how to manage its growing communications needs.

Its legacy phone system was not able to scale, and Brightway turned to RingCentral. That decision turned out to be provident because Brightway got much more than it bargained for with its new partnership. The company had been planning a massive call center build, but when Brightway deployed RingCentral, something amazing happened.

Brightway’s Enterprise Architect, Michael Baker explains:

“We assumed our challenges with handling all of the inbound policyholder calls stemmed from us not having enough staff at our call center. But when we examined the call reports from RingCentral Contact Center, we realized the issue was more about not getting callers to the right experts…

“This was a game-changer for several reasons. First, because we learned the problem wasn’t simply headcount, we didn’t need to invest in a massive new call center, which might have cost us hundreds of thousands of dollars and required hiring dozens of in-house agents. Second, because these call reports helped us pinpoint the problem as a need for more region-specific knowledge, we were able to hire just a handful of expert agents in different states and allow them to take calls from home, which RingCentral makes so easy.”

RingCentral: the right cloud-based communications platform for your insurance claim center

What efficiencies might you find with RingCentral’s state-of-the-art cloud-based communications platform? RingCentral’s cloud-based communications platform makes it easier to communicate with policyholders, manage claims center operations, and ensure collaboration between team members. Our commitment to security gives you and your policyholders peace of mind. Request a demo today to see how it works.

Originally published Feb 08, 2021, updated Jul 25, 2024