Highlights:

- The global health pandemic of 2020 caused many to defer healthcare, and overall costs of deferred healthcare are projected to rise in 2022.

- Delays in routine screenings and diagnostic testing may have significant impacts on payer costs.

- Continued uncertainty regarding COVID variants, government regulations, and unemployment are all factors that may impact payer costs as well.

🧑⚕️⚕️👨🏻💻 Did you know that collaboration-enabled care is a top priority among healthcare leaders? Grab our Collaboration-enabled care research report to get the whole story.

Although healthcare providers saw record numbers of patients and payers processed record numbers of claims in the wake of 2020’s global health pandemic, many individuals chose to defer healthcare during the same time period. There were many reasons for deferment, including:

- Loss of employment (and employer-sponsored insurance benefits)

- Avoidance of healthcare facilities for treatment due to COVID concerns

- Inability to access care due to overcrowding in healthcare facilities

Regardless of the reason for it, deferred healthcare is expected to cost payers a significant sum in 2022 and beyond.

PwC’s Health Industries Research and Insights analysts recently performed a deep-dive analysis into projected costs for healthcare in 2022. Here are some of the major findings from that analysis, along with accompanying charts and graphs.

Medical cost trends

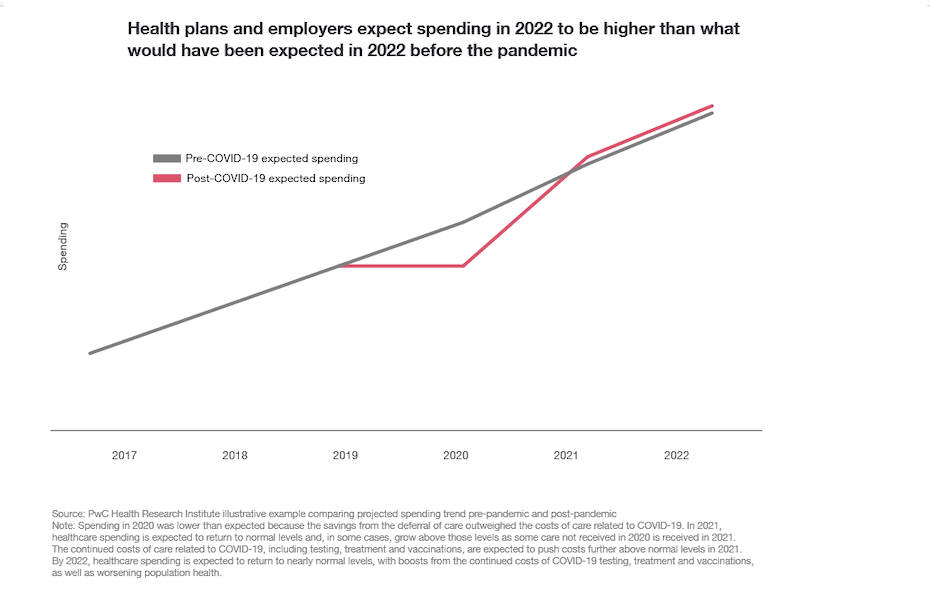

PwC determined that overall costs for care in 2022 will be higher than what would have been expected for 2022 prior to the pandemic.

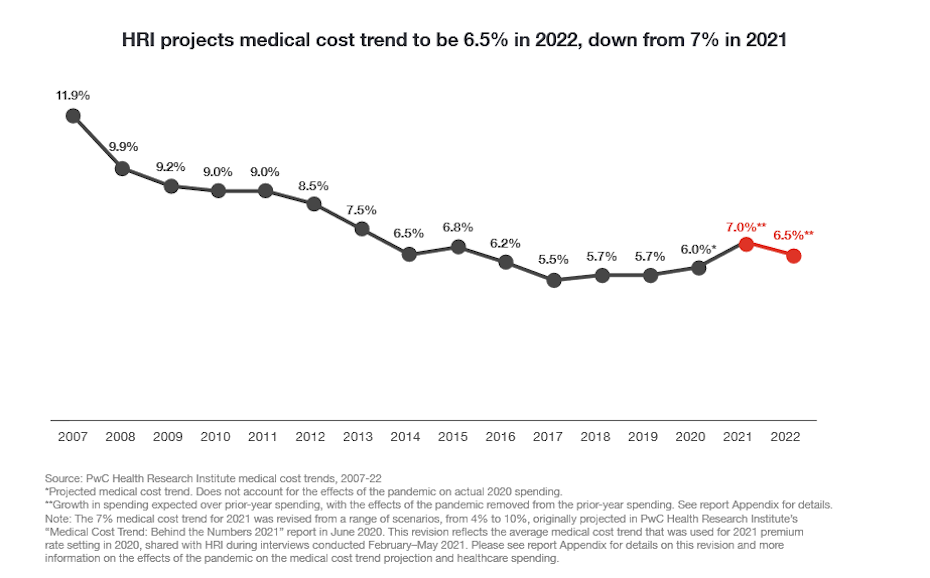

The following chart shows the medical cost trend from 2007 through projected costs for 2022. Each percentage represents the year-over-year increase in medical costs. There was a clear trend of gradually diminished cost-rate increases through 2017. Then, cost increases remained relatively steady through 2020.

Following the onset of the pandemic, 2021 saw a spike from a 6 percent cost increase in 2020 to a 7 percent increase in 2021. The increase is projected to reduce a bit to 6.5 percent in 2022, which is still higher than the pre-COVID level increases.

Projecting healthcare costs for 2022

The Congressional Research Service reported that the United States spent $3.6 trillion on healthcare in 2018, ahead of COVID-19. Payers spent one-third of that total, or $1.195 trillion.

Applying the cost rate increase percentages identified in the chart above, payers would spend around $1.526 trillion in 2022. The total cost for healthcare in the United States projects to around $4.577 trillion.

Breakdown of deferred care and cost implications for 2022

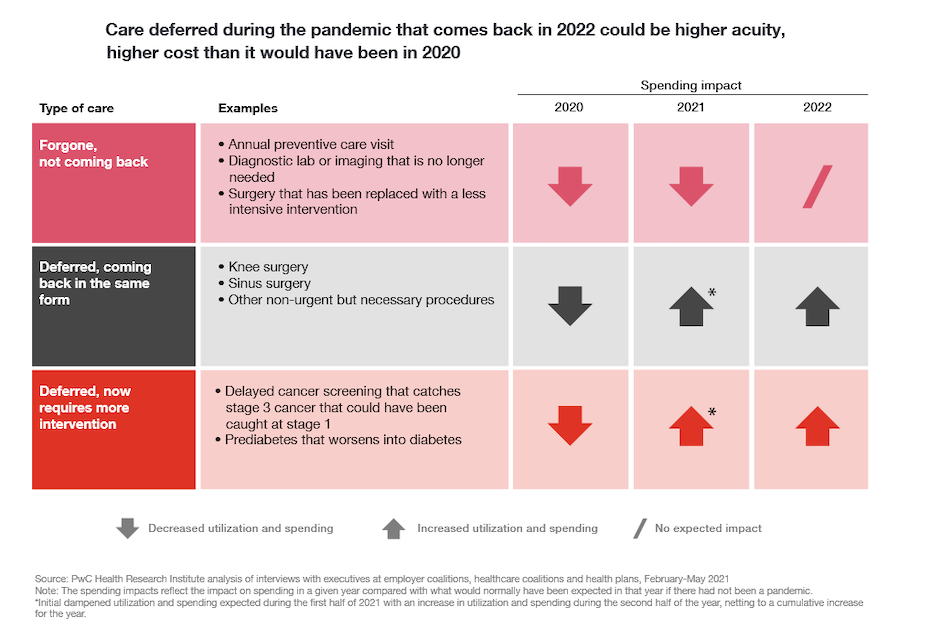

The following table illustrates the potential spending impact of various types of deferred care. Specifically, it shows whether the costs for certain care and procedures will increase or decrease in 2022, relative to what that same care would have cost in 2020 or 2021.

In some cases, care that was deferred is no longer needed. This situation might occur if the ailment resolved itself. Care and procedures that were deferred may also get replaced with less intensive care in 2022. These examples are reflected in the first row of the table where it shows “no expected impact” to costs in 2022. Knee surgeries, sinus surgeries, and other necessary (deferred) procedures are expected to cost more in 2022 when the same procedure is utilized.

One of the most cost-intensive parts of deferred care is intervention due to delayed detection of health conditions. These circumstances result from delays in routine screenings, such as mammograms and colonoscopies. Without early detection, more advanced and costly intervention is typically required.

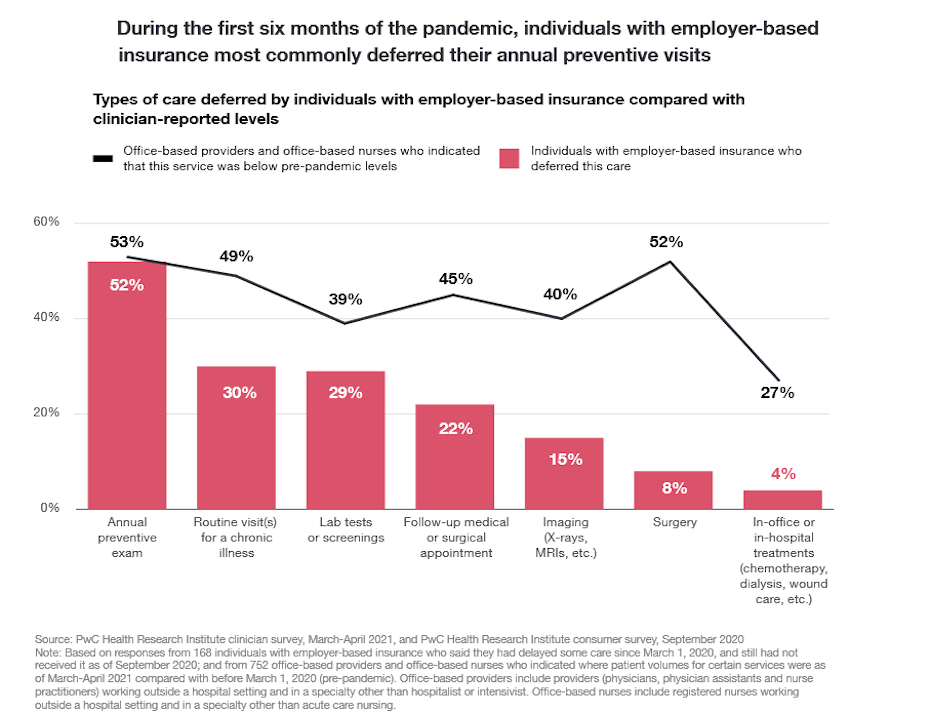

The following chart shows the most common types of deferred medical care during the first six months of the pandemic, showing that routine preventive exams were the most likely care to be deferred during that period.

Costs per visit location

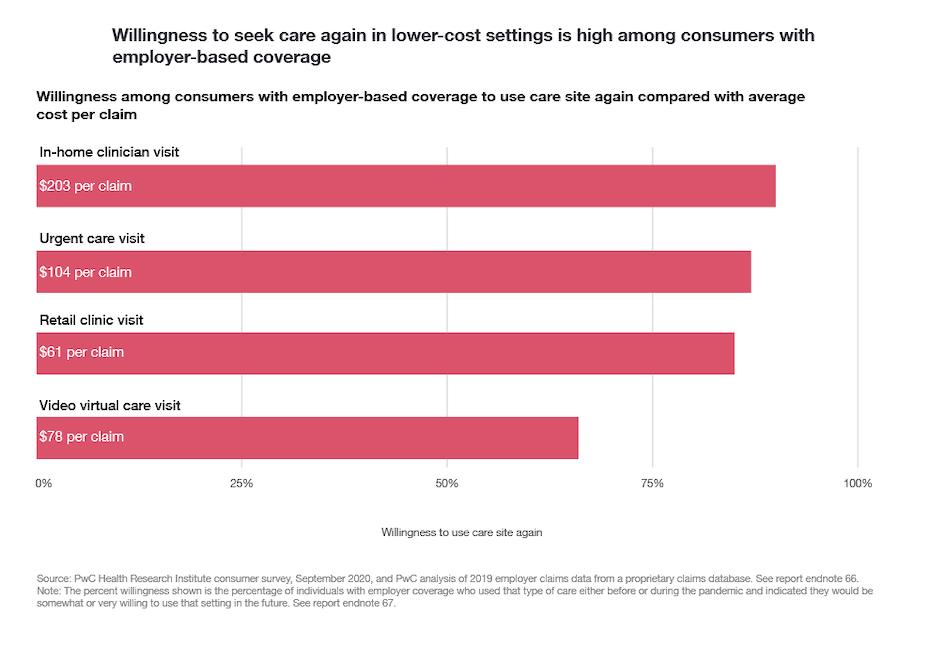

The following chart shows data from a September 2020 PwC Health Research Institute consumer survey. In it, consumers on employer-based health plans were asked about their willingness to seek care in various locations. Overall, people showed a willingness to return to appointment settings that have a lower cost structure.

The chart also shows costs per claim for each type of visit. In-home clinician visits are the most expensive, with a per-claim amount of $203. Urgent care visits are $104. Regular retail clinic visits offer the lowest per-claim amount of $61, followed by video virtual care at $78 per claim.

Video virtual care was prominent during COVID, but it costs $17 more per visit than standard clinic visits. Thus, a high rate of patients willing to return to in-person clinics is a positive sign as it relates to the overall average claim per cost. Preventative care through virtual or retail clinic visits also eases the burden of more expensive urgent care for conditions left untreated.

Accounting for uncertainty

Just as it has been difficult to predict the ebbs and flows of the pandemic, accurately projecting payer costs in 2022 is challenging. There are several factors that contribute to the uncertainty, including:

- Unknown impact of communication outreach: It is difficult to know how successfully providers and payers will attract patients for deferred screenings and care.

- Relationships between providers and payers: In a dynamic and volatile marketplace, some payers may opt to pull out of certain markets, networks, and exchanges.

- COVID fluctuation: Finding a definitive end to the pandemic is unlikely. Rates continue to lower and then spike as new variants come into play, and seasonal changes impact the spread of viruses.

- Legislative action: Lawmakers took a lot of action during the pandemic to mitigate challenges for individuals and essential industries such as healthcare. It is possible to see programs that impact payer costs added, restarted, or ended in 2022.

- Unemployment levels: Economic conditions and unemployment are also in flux heading into 2022. If employers remain cautious, higher levels of unemployment mean fewer people participating in employer-sponsored health plans.

Impact of longer delays

Providers and payers know that continued deferment of healthcare only exacerbates the industry challenges and costs moving forward. If COVID persists at high levels in 2022, payers continue to foot the bill for related costs. The challenges with undetected conditions amplify the burden as well, and the backlog for care expands.

Avoiding further deferment of care is important for both payers and providers and explains why the industry is becoming more proactive at communicating the need for screenings with consumers.

Optional cost considerations

A lot of payers opted to support consumers plagued by health and economic burdens during the pandemic. Support included waivers of certain out-of-pocket obligations, and other fees normally paid by the insured party. Some payers even sent premium rebate checks to covered persons since money normally spent on elective care was not being used.

If payers continue to support consumers in these ways, costs may rise. However, if the support is tied to continued deferment, the implications to overall payer spending are less significant. The choices payers make on these items hinge somewhat on the evolution of COVID and decisions on the continuation of advanced child tax credit payments by Congress.

RingCentral: Healthcare communications to control costs

There are limits to what healthcare payers can do to control costs for 2022. However, combined efforts of providers and payers to motivate people to make appointments are beneficial. Targeting the right people who need routine screenings can help mitigate costs for 2022 and in the years to come.

Providers and payers can take measures to reduce costs, optimize healthcare communications, and deliver a great customer experience. RingCentral is a leading provider of cloud-based communications platforms that contribute to all of these objectives. Cloud communications systems are transforming healthcare. Find out how.

Originally published Feb 02, 2022