Things have changed rapidly with the development of contactless payments, and there is no better time to explore this technology than now.

Contactless payments for business are becoming more and more popular each day. They are especially helpful for small business owners who want to improve sales and customer experience without breaking the bank. This tech can help them achieve their goal in a cost-efficient method.

And that’s just scratching the surface. Contactless payments offer many more benefits that are impossible to ignore. Let’s unpack everything to do with contactless payments in this guide.

What Is Contactless Payment?

Contactless payment is the ability to make purchases and complete transactions using a near-field communication (NFC) chip in your smartphone or other NFC-enabled devices. This payment process allows you to make payments using your mobile phone without removing your card from your pocket or purse.

Contactless payments are fast, convenient, and secure. They are especially useful for small purchases, such as tickets to a movie or a single item from a supermarket. They are easy to use and reliable, making them the ideal option for people who want to make quick purchases.

Before you start a business and take advantage of contactless payments, you must be familiar with the technology and the various merchant acceptance protocols. It’s also important to note that not all contactless payment methods are created equal. Also, ensure you choose the one that is most convenient for your business. More on this a little later.

4 Benefits Of Contactless Payments For Your Small Business

There are plenty of advantages to using contactless payments for business. Not only does it save customers time, but it can also reduce the risk of fraud. Here are four benefits of using contactless payments for your small business:

1. More Safe And Secure

Since contactless payments work without storing sensitive data like security codes and card numbers, customers will feel safer when completing transactions.

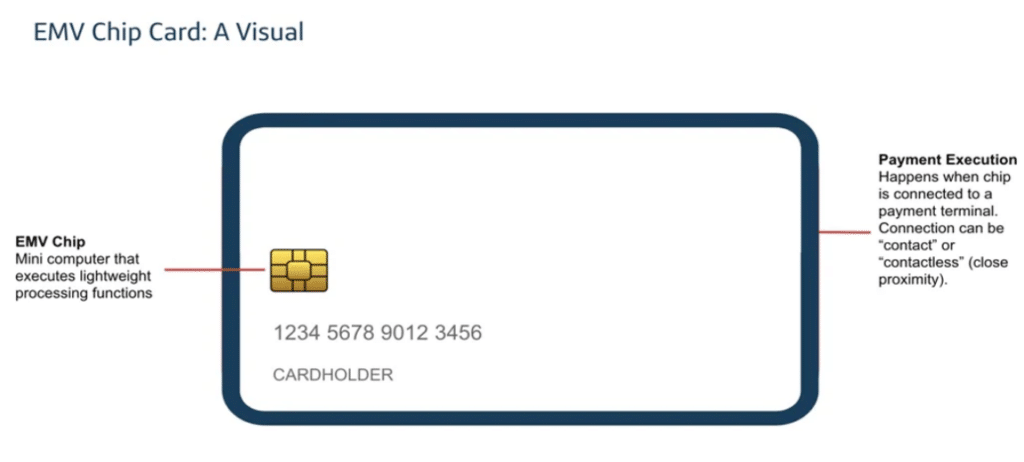

When customers complete transactions with a payment-enabled device or contactless chip card, a one-time code is generated for each transaction, just like EMV chip cards.

Unlike conventional credit cards with a magnetic stripe that requires pins to complete transactions, contactless payments offer superior encryption and security. It means customers won’t need to worry about their information falling into the wrong hands when they make payments with their contactless card or mobile wallets like Apple pay.

Contactless payment uses short-range NFC technology to prevent data theft and ensure customers and business owners have a more secure transaction experience. In addition, the speedy authorisation period makes it virtually impossible for fraudsters to steal customers’ card information without being discovered by the shop or other parties involved.

The NFC technology also makes transactions more secure since no physical contact is required between the credit card or smart device and the POS terminal.

Essentially, contactless payment is the ideal choice for businesses and customers who are particularly concerned about the safety and security of payment options.

2. Faster Than Other Forms Of Payment

Contactless payment processes are faster and make checking out more convenient. Unlike swipe or chip card transactions, customers can complete transactions within two to five seconds. The quicker transaction time results in shorter queues and will likely improve sales.

Once your business adopts a contactless payment system, customers no longer need to input their pin or swipe their cards. Transactions are done with a simple tap of the card against the terminal.

The contactless cards’ integrated NFC technology streamlines the payment procedure. Unlike magnetic stripe cards, which are annoying to use and eventually degrade with repeated usage, they are less likely to malfunction.

Since contactless payments for businesses reduce transaction time, it allows business owners to shift their focus to other aspects of the business, like monitoring inventory. The technology also helps to increase the efficiency of your business.

Adopting contactless payment technology for your small business will reduce the stress of making payments and improve the customer experience. Speaking of which…

3. Improves Customer Satisfaction

Unlike cash or credit cards, contactless payments are swift and more convenient. With contactless technology, a consumer only needs to tap their card, smartphone, or wearable device on a scanner to complete the transaction. Your consumers may pay quickly and easily by tapping without touching anything, which helps you process payments more quickly.

With contactless transactions, you’ll deliver exceptional customer satisfaction thanks to the ease of making payments. Faster, more secure transactions translate to quicker checkout times, which improves the overall checkout experience.

Your business can show it values its customers’ security and convenience by providing a contactless payment option. And when customers see how much significance is placed on meeting all their needs to ensure they get the best shopping experience, it will most likely foster greater brand loyalty.

4. Doesn’t Require Additional Cost

Business owners looking to set up contactless payment options at their location are not required to pay additional fees. You pay similar rates as you would for a typical credit card transaction and still enjoy the benefits that come with it.

With contactless payment methods now becoming more popular among consumers, failure to adopt this technology exposes you to the risk of losing existing and potential customers.

How To Adopt Contactless Payment Technology

Contactless payments are paving the way for the future of business. Adopting this new payment technology can benefit a business that wants to meet its customers’ needs.

Below we discuss how you can adopt different contactless payment technology for your small business:

1. Contactless Cards

Often referred to as tap-to-pay cards, contactless cards are debit or credit cards enabled with contactless technology. Although these cards look similar to conventional cards, they have a built-in antenna that enables wireless connection with a reader.

To use a contactless card, simply tap or hold your card close to the card reader, and your transaction is complete.

Below are some digital payment systems that will allow your business to receive payments with contactless cards.

Square

Square is one of the most widely used digital payment systems. It is renowned for its low costs, simple platform, and quick payouts.

If you are a small business owner, Square Cash is your best option when you need a fast, user-friendly method of accepting payments. It also works with almost all major credit cards and functions on Android and iPhone devices.

Square has several unique features, including an inclusive payment system, and is ideal for low-volume users. For your business to receive payments through Square, you will require a Square free credit card reader compatible with the free Square Point of Sale app. To get your contactless Square reader, you must sign up for Square and purchase the $49 reader.

Flint

Flint is a platform small businesses can use to receive credit card payments using virtual swipe technology. The technology utilises a scanner built into a smart device’s camera to quickly and easily collect the card number and expiration date.

All transactions completed through Flint are CNP (card not present) transactions. You can select one from the platform’s various monthly business options based on your demands. Other benefits of using Flint include in-app invoices and no monthly minimum.

Businesses looking to complete transactions with contactless payments can choose from Flint’s free, pro, and enterprise-level services. Its prices are comparable to those of most pay-as-you-go solutions.

2. Mobile Apps And Wallets

Mobile Apps and Wallets are applications stored on mobile devices that are currently replacing credit and debit cards. Using them is easy.

Simply activate contactless pay on your smartphone, install the necessary apps or link your accounts. If you already have the applications on your phone, then you can use your phone to pay like a contactless card.

Below are some mobile apps and wallet options for receiving payments.

Apple Pay

Apple Pay is a secure way to pay with an iPhone and other Apple devices. Nearly all card issuers and payment processors are compatible with Apple Pay. Users simply add their credit or debit cards to their mobile wallets to complete transactions.

The devices’ NFC technology enables contactless purchases when used at a retailer that supports contactless payments. Completing transactions with Apple Pay requires Touch ID, Face ID, security password, or signature for higher-cost transactions.

To set up Apple Pay for your business, you need a POS (point-of-sale) terminal that can accept contactless payments. When you set up the terminal, get in touch with the payment provider and inform them that you will accept Apple Pay.

If you already have an NFC, it implies you can accept contactless payments, and setting up Apple Pay won’t be difficult.

Google Pay

Like Apple Pay, Google Pay is a platform for digital transactions that transmits data to payment networks to complete transactions. Users can make payments by installing Google Pay on an Android device. For a business owner, Google Pay transactions are similar to credit card transactions.

Google pay offers several benefits to users, including multiple security layers, a unique code for each transaction, and secure encryption technology.

You will require a contactless payment terminal with an NFC reader for your business to use Google Pay to accept payments. To ensure your business is prepared to accept contactless payments, it is best to cooperate with POS suppliers.

3. QR Codes And Online Ordering

A QR code is a barcode that retrieves and provides information allowing customers to use their smartphones to scan QR codes and purchase anything they want from a particular webpage.

To use QR codes, simply hold your device over the code until it appears in the viewfinder and shows a notification. Click on it, and the URL linked with the code will open, allowing you to submit your order. After submitting your order, you can make payment from your device.

Here are some payment systems that will allow your business to receive payments with QR codes:

PayPal

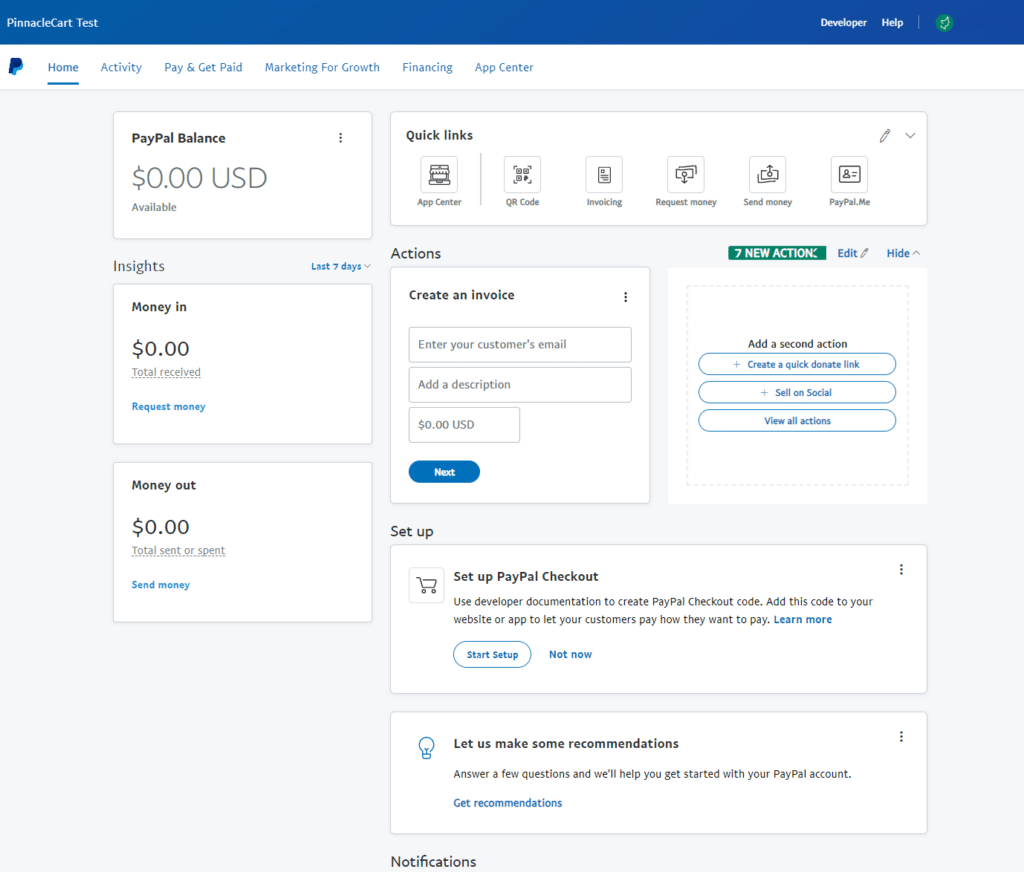

PayPal is a digital payment option that enables small businesses to accept contactless payments easily. Users need to configure the PayPal application on their Android devices before they can pay with PayPal. Once the application is set up, they can scan a QR code, input the amount, and complete the transaction.

For a business to accept PayPal contactless payments, it must have a PayPal application. Once you have the app, you can execute transactions by downloading a QR code from it. Customers must also have the PayPal app installed on their smart devices.

Stripe

Stripe is a third-party payment processor that allows businesses to complete transactions online. It lets companies use Stripe’s development tools and accept credit card payments.

Stripe is used for subscription billing, allowing many retailers and SaaS business owners to accept in-app payments. SaaS businesses can even improve customer value by making this payment method a part of their SaaS product marketing strategy.

Although Stripe includes a mobile payment option, it is designed for large enterprises. Also, to fully utilise this platform, you will require a developer.

It has several benefits, including advanced reporting tools and multi-currency support, and it is ideal for international customers.

With Stripe’s powerful APIs and software solutions, your business can accept payments from anywhere in the world.

To start accepting payments with Stripe, you just need to set up an account. Additionally, Stripe provides specialised business solutions for e-commerce, marketplaces, and other uses.

PaySimple

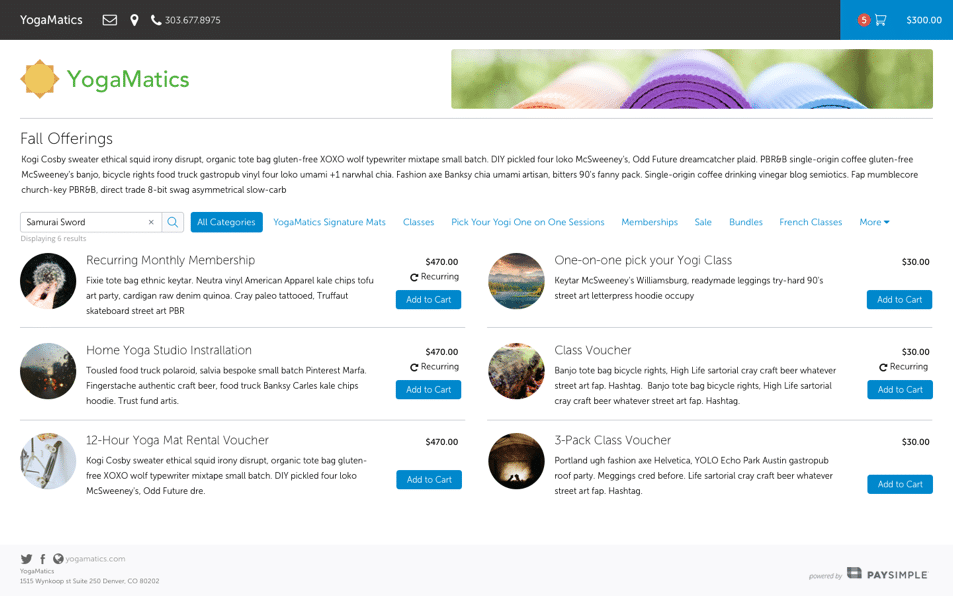

PaySimple is another payment platform that allows small businesses to complete secure payment transactions. This payment technology enables business owners to accept credit and debit card payments and send invoices to clients.

PaySimple has several pros like no setup or application fee, good for service industries, customisable payment pages, and subscription and invoice tools.

To use PaySimple to accept payment, you must first register for the platform to create an online store. Once registration is complete, you receive your merchant account and a processor. With the online store, you can promote your goods or services to customers via PaySimple.

The platform also integrates a merchant service provider with a mobile payment solution. For a service-based business like accounting firms, law firms, and freelancers, you can choose one of two advanced billing features: Enterprise or Pro.

Adopting a contactless payment method can increase the cash flow of your business and improve productivity and customer satisfaction.

In Closing

There are several contactless payment platforms available to small businesses. However, before adopting any payment method, you need to research the different options to determine which one best suits your business needs. Hopefully, this guide has given all the information you need to pick the appropriate contactless platform.

Originally published Aug 20, 2022, updated Feb 20, 2023