Highlights:

- Insurers are not immune to the effects of the Great Resignation, and 56 percent of insurers are looking to add staff this year.

- To attract and retain employees, insurers must focus on improving the employee experience at every stage.

- A cloud-based communications platform is a great tool for building a better employee experience.

🖥️ 💸 📱👩🏼💻 Can you name the top 5 trends shaping the digital future of insurance? Grab our eBook to get up to speed.

The Great Resignation is underway. Americans are leaving their jobs in droves largely due to low wages and inadequate working conditions. In 2021, an average of more than 3.95 million workers quit their jobs each month, the highest average on record.

A recent Gartner survey revealed that 91 percent of HR leaders are increasingly concerned about employee turnover1 in the coming months. It’s no wonder, considering how expensive employee turnover can be. Even prior to the Great Resignation, Gallup estimated that voluntary employee turnover costs US businesses as much as $1 trillion per year.

What does the Great Resignation mean for insurers, and what can be done to weather this storm?

Insurance companies are understaffed and trying to expand

A Jacobson Group/Aon study conducted in 2021’s third quarter suggests several insurance professionals are rethinking their positions with present employers and exploring their options. Recruiting, especially at experienced levels, is likely to be extremely challenging in the near future.

According to the study, 56 percent of insurance companies plan to increase their staff in the next 12 months, with the top two reasons stated as understaffed areas and business expansion. If insurers are successful in increasing their staff, the industry as a whole can expect to see a 1.81 percent increase in employment in the next 12 months.

Understaffing is particularly problematic currently, considering the significant rise in claims in recent years. According to the Insurance Information Institute, natural disasters and cyberattacks have increased tenfold over the last few years. 980 events occurred in 2020 alone, resulting in insurance losses of more than $80 billion. Cyberattack ransoms have also jumped by more than 170%, meaning claims professionals are sorely needed.

Staffing needs vary according to the size of the company. Here’s a quick breakdown of the talent needs according to company size.

- Large insurers: technology, sales/marketing, underwriting

- Medium-sized insurers: technology, analytics

- Small insurers: technology, claims

The most difficult jobs to fill are likely to be in technology, analytics, and actuarial roles.

What insurers can do to attract and retain employees

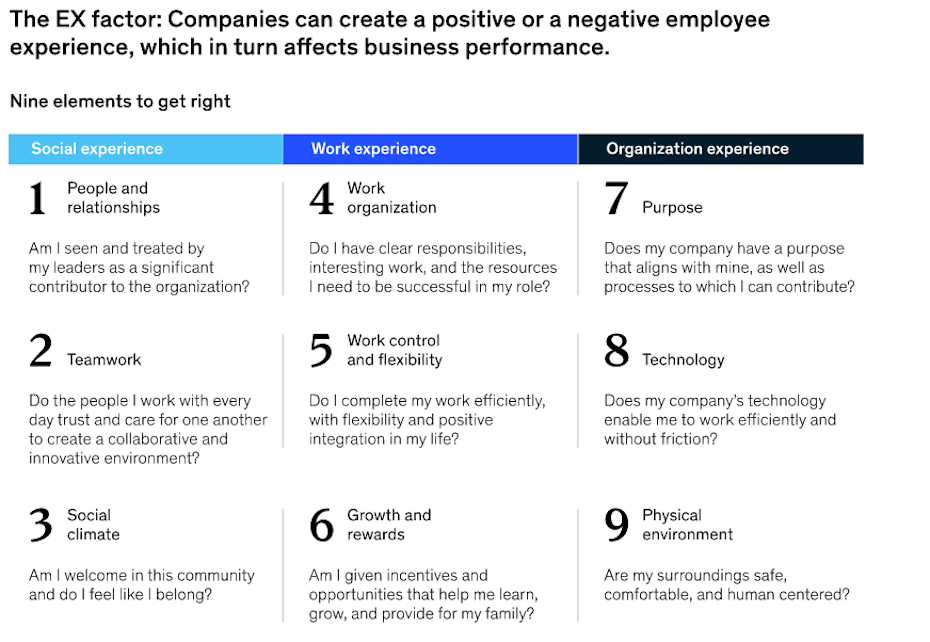

Recent McKinsey research regarding what employees really think about work and what they prioritize in their working environment provides some interesting food for thought for insurers. McKinsey analysts found that employees leaving companies are exhausted and overwhelmed, questioning what work means, and thinking through their options. In this environment, employee experience becomes a real priority for insurers looking to retain their experienced talent.

What do employees want? McKinsey notes: “Workers are hungry for trust, social cohesion, and purpose. They want to feel that their contributions are recognized and that their team is truly collaborative. They desire clear responsibilities and opportunities to learn and grow. They expect their personal sense of purpose to align with that of their organization. And they want an appropriate physical and digital environment that gives them the flexibility to achieve that elusive work-life balance.”

Source: McKinsey

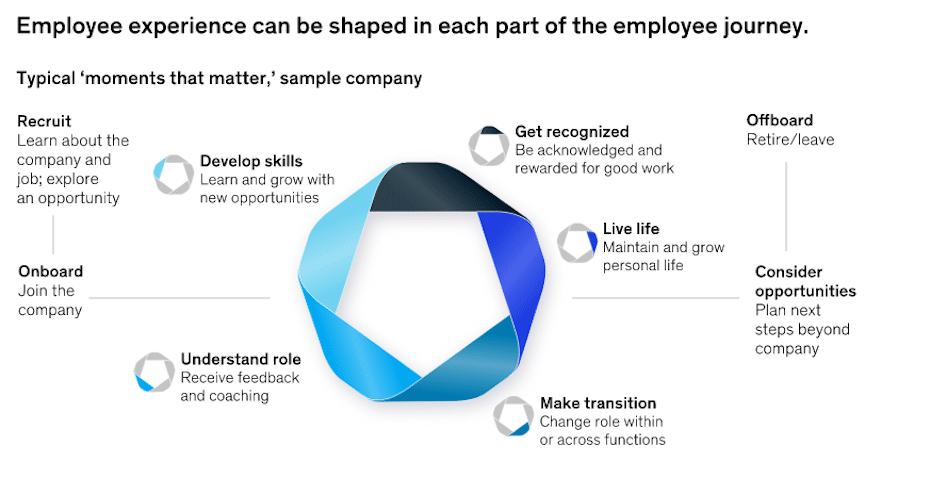

To provide better employee experiences, insurers should consider how to optimize every stage of the employee journey, from recruitment to exit interviews, paying special attention to what McKinsey calls “moments that matter.”

Source: McKinsey

How the right communications platform can help

There are several steps insurers can take to ensure additional employees will step aboard and current staff members will stick around. One of the simplest and most impactful changes an insurance organization can make is to employ a robust, cloud-based communications platform to keep employees connected and collaborative. Here are just a few of the benefits of leveraging an all-in-one, cloud-based communications platform:

Provides tools employees need to connect easily and effectively

No matter where they are, employees should be able to communicate with each other. Whether it’s by SMS messaging, video conferencing, or phone, a unified communications platform offers all communication tools through a central point that allows staff to remain in touch regardless of location.

With cloud-based communications, employees do not have to be in the same office to engage. As long as they have the necessary apps and tools available to them outside the office, they can complete tasks and stay connected.

Offers increased flexibility for better work-life balance

Following the COVID pandemic, several offices are implementing either fully remote work environments or hybrid models that involve both in-house and remote scheduling. Employees have gotten used to these flexible work atmospheres and sometimes prefer them to the traditional routine of getting up and spending eight hours in a cubicle. These remote and hybrid environments allow staff members to balance work and life better, and a cloud-based communications platform can help.

An employee experiencing an emergency in an office can communicate with a person who’s attending their child’s baseball game. The latter individual can balance their life and work schedule as necessary to remain on top of tasks and ensure things are completed within set periods. A valid communications platform should connect both individuals with the simple press of a button that can:

- Initiate a call

- Send a chat invite

- Start a video conference

Helps management stay in touch with the needs of employees with anytime, anywhere access

Cloud-based communications platforms enable managers to quickly set up and run video conferences with employees, either in a group setting or individually. Having “face-to-face” interactions, even virtually, improves employee experience. Interacting regularly in this way enables managers to quickly spot employee concerns and address any issues before they lead to employee attrition.

Builds a collaborative, inclusive culture

Similarly, by providing ways for your team members to chat with each other and with you, cloud-based communications platforms help insurers build a culture of collaboration and inclusiveness. At-your-fingertips communication channels make collaborating with others as simple as a mouse click.

Where to go from here

RingCentral is a leading cloud-based communications platform that provides insurers with the tools necessary for staff members to consistently remain connected. Whether they’re in the office or working from home, RingCentral helps insurers attract and retain employees by:

- Offering anywhere, anytime connectivity

- Providing state-of-the-art communication and collaboration tools

- Enabling a connected, inclusive workforce

To see RingCentral for Financial Services in action, request a demo today.

1 Gartner Press Release, “Gartner Survey Reveals 91% of HR Leaders Are Concerned About Employee Turnover in the Immediate Future,” September 30, 2021.

Originally published Mar 15, 2022, updated Mar 16, 2022