Highlights

- A delay in the CFPB data-sharing rule is likely to cause disruption to bank and fintech partnerships.

- More restrictive policies on data sharing with consumers and fintech are likely.

- Safe, unified communications solutions will be more important than ever.

👀 👀 Did you know that digital transformation in financial services is well underway? Grab our infographic to get the whole story.

In line with the Dodd-Frank Act, the Consumer Financial Protection Bureau (CFPB) plans to enact a data-sharing rule that defines parameters for consumer data access in a usable electronic format. However, it appears likely that the CFPB may not implement a rule until late 2022 or some time in 2023.

Delaying the rule impacts both financial institutions and consumers. It creates a lot of uncertainty among consumers and makes it difficult for financial institutions trying to plan ahead to meet compliance standards.

The following is an overview of some of the key implications a delay of the CFPB data-sharing rule would have on financial institutions.

Data-sharing rule basics

The Dodd-Frank Act says consumers have the right to control their bank and transaction data, and it ensures access to a usable electronic record of all data. However, the specific parameters of how banks must comply are not yet in place, which creates a lot of uncertainty for banks and consumers.

The new CFPB rule is supposed to make it clear to consumers what their rights are and how they can access and manage their data. It will also give guidance to banks on how to enable consumer access. For banks, clear parameters are necessary for installing the right technology systems and putting the right protocols in place.

Implications of a data-sharing rule delay

Delays in the data-sharing ruling impact the current approach financial institutions take with data sharing. These are some of the important ways banks are impacted by a delay:

More restrictive data-sharing policies

In lieu of defined rules, banks typically take a more restrictive approach to data access. In addition to data-sharing considerations, banks are dealing with heightened regulations to protect privacy and security. Traditional financial institutions are particularly concerned with third-party fintech applications and others with whom consumers want to share information.

A lot of third-party apps request access to consumer banking data to provide holistic access to all available tools through their solutions. However, banks have concerns about the risks presented by third-party access to the security and privacy of customer data. Concerns stem from consumers possibly granting access to unscrupulous entities, or from others simply gaining access to the data without the consumer knowing.

Given these concerns, banks are likely to maintain more restrictive policies for data access until the CFPB rule establishes guidance.

Reliance on data-clearing initiatives

Many banks currently rely on private data-sharing clearing houses to validate the legitimacy of third parties. These programs offer risk evaluations of data aggregators and fintechs attempting to access consumer data. This layer of assessment helps banks determine whether such entities are safe, or pose a threat with data access.

There are limits to the assessments provided by such data clearing houses, and much of their evaluation is based on API connections between fintech and banking systems. Banks are concerned that the CFPB rule will reduce or eliminate the ability to conduct such risk assessments if consumers grant data access.

Bank-fintech partnership disruptions

Although some banks view the evolution of fintech apps as a competitive risk, others recognize the benefits to consumers and embrace fintech partnerships. A delay in the CFPB rule impacts the ability of banks to partner with fintechs given the risks of uncertainty.

Banks are leery about implementing partnerships only to have the new rule undercut some aspects of the solution. Having to shut down or revamp a collaborative solution is expensive and could damage trust between the banks and their consumers.

Given the risks, some banks are holding off on partnerships. Others are limiting the scope of the partnered solutions with fintech until the rule is in place.

Consumer annoyance

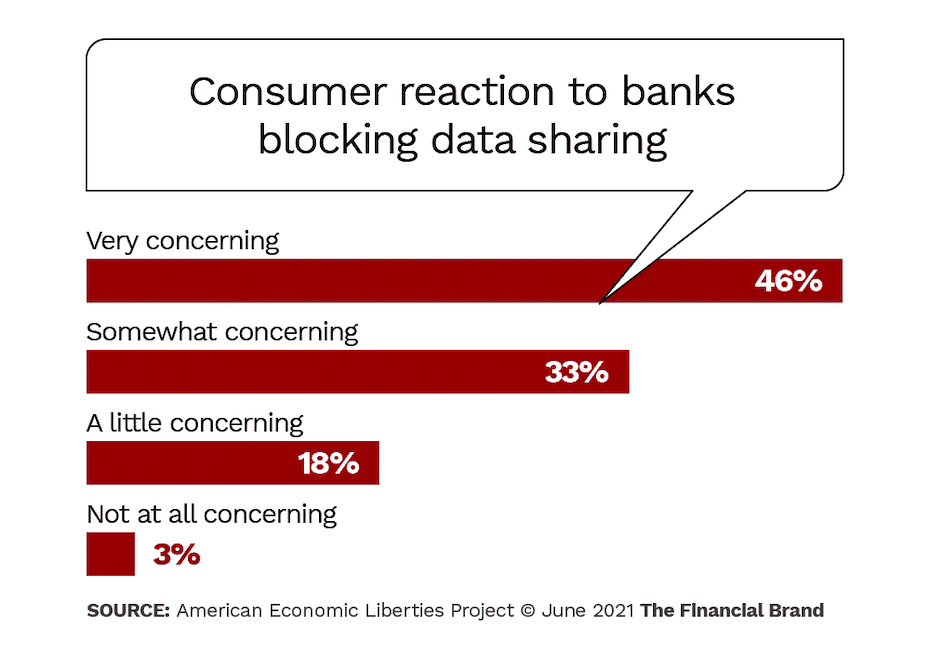

Consumers have generally embraced fintech and don’t like the idea of having data access limited in any way. Limits to third-party sharing can create frustration as well. The following chart shows the results of a recent survey by the American Economic Liberties Project. It is clear that consumers have issues with blocked data sharing, as 79 percent of those responding said they are either “very” concerned or “somewhat” concerned. Only 3 percent indicated no concern.

(Source)

The challenge for banks is to communicate effectively with consumers in the current state of uncertainty. Typical consumers aren’t aware of the impending CFPB rule and may perceive data blocks as an unnecessary restriction put in place by their bank. This perception negatively impacts relationships and may even lead to consumer defections. Banks must make it clear why they are taking certain measures for protection.

Increased importance of secured systems

Now more than ever, financial institutions need top-level security systems to protect consumer data. This security is especially important when data-sharing access is granted. Secured transmissions help safeguard hacking of consumer data when it is delivered from the bank to the consumer or third-party application.

A cloud-based unified communications system is a holistic platform that integrates advanced end-to-end security into cross-channel communication. It allows your team members to share data with customers securely and efficiently across multiple communication channels. It also ensures security while employees collaborate with each other.

RingCentral provides protection for banks

The delay of the CFPB rule on data-sharing continues to put the onus on banks to protect consumer security and privacy. Financial institutions are trying to balance fiduciary responsibilities for consumer protection with consumer expectations for data access. The lack of a clear rule and parameters means continued reliance on clearing houses and other risk assessments.

The RingCentral comprehensive, cloud-based communications solution delivers seamless, cross-channel capabilities with multi-factor authentication. It is the safest and most effective way for your bank to interact with consumers across all popular channels. See how it works!

Originally published May 10, 2022, updated Jul 26, 2024