When bankers and insurance agents had to meet with clients and prospective clients, it used to be that they would meet in their office. Clients would walk in or make an appointment to come in, and they’d have a conversation in person about, well, money.

Now, with remote work on the rise, things are changing.

Morgan Stanley, probably one of the biggest investment companies in the world, has a wealth management app for its clients, which lets them check their portfolios and even video chat with advisors from their phones.

A few continents away, ICICI Bank in India launched video banking, giving its clients 24/7 access to reps through video conferencing.

From mortgage brokers to insurance companies to wealth management firms, more and more financial businesses are adapting to our growing comfort with video conferencing.

And sure, it’s convenient for clients—but if you work in finance, it’s good for you too.

In this post, we’ll look at five benefits of using video conferencing for finance.

Shopping for a video conferencing tool? (Or just curious about what to look for?) Grab the free checklist to help you choose the right one for your team or business.

1. It’s better than a phone call

Having a video call requires you to have a phone. And internet too, of course, but that’s it. You don’t need a fancy camera or any other gear to have a quick face-to-face conversation with someone.

And when you’re having a serious conversation about finances, it’s best to have that added visual communication. (Hey, there’s a reason we’re used to walking into the bank to handle our finances instead of just doing everything over the phone.)

For example, with RingCentral Video, all you have to do is send your client a link to your video call, and they can join from any device they want.

Being able to see your mortgage client’s face during the pre-approval process gives you so much more nuance and context into how they’re feeling about their finances right now, whether or not they think they’d be able to support that mortgage… all useful things to know if you’re deciding whether or not they’d be a good fit for a loan.

2. Gain a competitive edge over your competition

Finance is one of the oldest industries around—and whether or not this is actually true, to most people, it’s probably the least open to change as well.

So, how will your average broker or bank or credit union adapt to what the new generations need?

Slowly, probably.

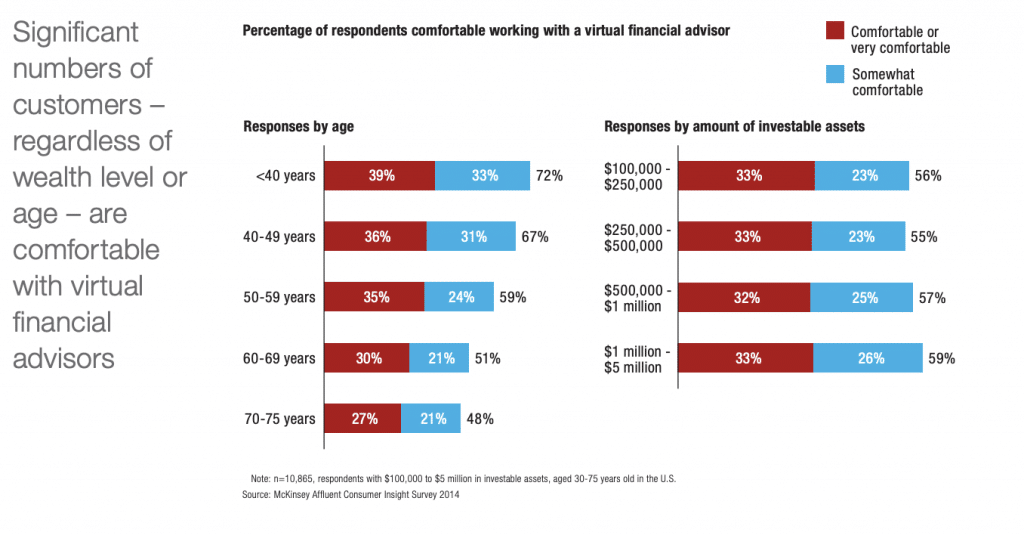

But according to McKinsey, many of your clients and prospects are actually comfortable working with a virtual financial advisor. Who will be ready to serve them?

It could be you, if you move quickly enough. If you can fill this gap and offer a way for people to do their finances online—you’ll have a head start on building stronger relationships with these new clients, getting referrals, and more.

3. It attracts a younger client base—and a younger staff

Millennials are in their 30s now. Gen Z is more than old enough to have their own bank accounts—and might even be starting to think about loans and mortgages.

Will you be able to communicate with them using the channels that they like using?

We’re not saying you need to have a TikTok page. We’re not even saying you need to have an Instagram page for your business.

But you do need to have the right people and the right skillset to attract this audience. And to do that, you need to first attract a team with those skills. Namely, they should be comfortable with using tech—like video conferencing and social media. (Starting a video call isn’t that hard either.)

The interesting thing is, according to Deloitte, millennials still value face-to-face meetings for advice—in their survey, 82% of millennials said that they wanted more personal meetings with their financial advisors, not less. So, how can you provide that face-to-face interaction in a world where convenience reigns supreme?

Video conferencing, of course.

And there are other benefits to incorporating video conferencing into your day-to-day work too—it can get your team more comfortable with trying different technologies, and the more tech-savvy your team is, the more likely they’ll be able to come up with creative solutions for serving clients or even innovative products.

It’s a trickle-down effect. If you want your business to be fluid and adaptable to changes in the financial space (and they’re happening more quickly now compared to before), be open to incorporating new tools so that your team has the opportunity to try new things and adapt.

4. It saves you money

If you have clients or branches in other cities or towns, or even countries, it’s not always feasible to travel to meet with people.

And unless you’re a new grad, traveling for work can get old (and exhausting, and expensive), real fast.

With a video conferencing tool, you can schedule meetings quickly—no more traveling—just by sending out a link to the video call.

Whether you’re training new hires or meeting with clients or having a team brainstorm meeting, you can save on flights and hotels for everyone by having video conference calls instead.

In a year, you could save thousands (or even tens or hundreds of thousands) of dollars. The real kicker? Most video conferencing tools are super budget-friendly and charge you on a relatively cheap monthly subscription basis—they’d probably pay for themselves within months or even weeks.

5. It saves you time too—lots of it

Video conferencing actually saves you time in a few ways.

First, the obvious one: it saves you lots of travel time. Instead of having to fly or drive to meet clients in remote areas or have meetings with teams in other branches, you can just get on a video call with them.

Yep, RingCentral Video lets you have video conference calls on computers too.

Secondly, video conferencing can help you make decisions faster too—especially when multiple people are involved. If it’s a big discussion with investors and partners, and everyone needs to refer to files and documents and videos, then having a good video conferencing app is essential.

A good video conferencing app will let you and your team have the video call while screen sharing and looking at docs on the screen if you need to. Some even let you have team messaging and calls going at the same time:

Ready to start using video conferencing for finance?

Finance is probably the industry with the biggest opportunity to set your business apart from the competition.

And using a video conferencing app, like RingCentral Video, isn’t that hard—or expensive—either. (Actually, it comes included with RingCentral Office’s Standard, Premium, and Ultimate plans.)

Start taking a look at your client base and how they prefer to communicate with you. Would they be open to video calls? Check out a few video conferencing apps, and see how you can start evolving your communication options!

🕹️ Get a hands-on look at how RingCentral works by booking a product tour:

💰 You can also use this calculator to see roughly how much your business could save by using RingCentral to support your team’s communications with clients, customers, and each other.

Originally published Apr 07, 2020, updated Apr 18, 2021