Starting a business is no easy feat when you haven’t got much experience.

And although it’s an exciting stage, getting your business off the ground requires careful planning and consideration—especially in regards to startup costs.

If you’re in the early stages of developing a business and want more information about your startup costs and how it all works, keep reading our helpful guide. We’ll discuss how much startups costs, as well as offering you tips on how to keep those costs down.

We’ll cover:

- How much do startups (really) cost?

- How do you calculate startup costs?

- How can you reduce startup costs?

👀 What are the 4 key components of a successful startup?

How much do startups cost?

According to the US Small Business Administration, most microbusinesses (small businesses) cost around $3,000 to start. And, most home-based franchises can cost $2,000 to $5,000.

This is a good indicator of what it may cost for a business to get on its feet, but in reality, over the course of the year, startup costs may be considerably more. For example, over the course of the year, you may have to pay for software, including communication tools for your employees, and other project planning and analytics solutions.

The cost of this can add up if you don’t make smart decisions early on about the type of communication and collaboration software you use. The biggest thing to remember? Try to keep your tech stack streamlined from Day 1 and choose versatile tools that can handle many essential features on one platform. This will help you reduce the number of tools you end up having to pay for (and manage).

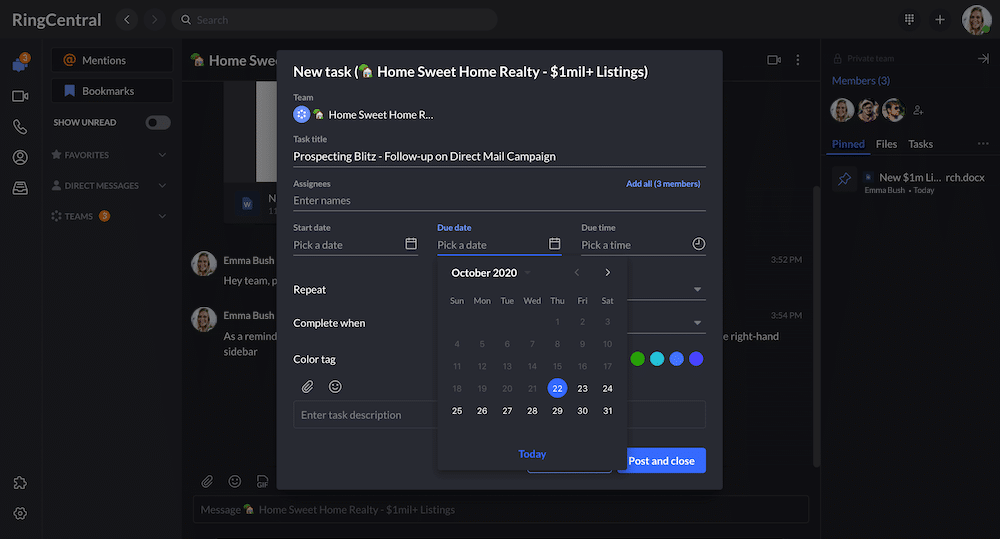

For example, RingCentral’s desktop and mobile app contains multiple communication channels all in one place. So, instead of paying for one video conferencing tool, and another messaging app, and another phone app, and so on… you can make calls, send messages, share files, assign tasks, and more, all in one app:

Of course, although every business has its own financial needs, this is a good rule of thumb when you begin.

So, what do we mean when we say “startup costs”? Business expenses can be grouped into two categories:

- Investigatory costs: When that little idea seed has planted itself into your head, you’ll want to do some investigating. In some cases, there are costs attached. Market research is the biggest investigatory cost. You need to figure out whether your idea has potential and whether there’s anything else like it on the market.

These costs cover analysis of existing products on the market. You may have to try and test for comparison or invest in software to check out the competition.

- Pre-launch costs: This is where you’ll spend a considerable amount of your startup budget. This includes creating a website, domain name costs, advertising, equipment, employees, and digital infrastructure installation like Wi-Fi and telephone systems.

Investigatory and pre-launch costs are vital for getting your company prepared for launch. While many of these may be one-time costs, you’ll also need to keep up ongoing costs that help the business tick over.

How do you calculate startup costs?

To calculate your startup costs, you’re going to need to figure out your one-time expenses and your ongoing expenses. Then, you’ll need to create a budget template to keep track of it all.

This will give you a detailed breakdown of your startup costs and recurring expenses. Here’s an idea of what one-time costs and ongoing costs you can expect in a small business:

1. One-time costs

- Website build

- Office furniture and supplies

- Equipment

- Wi-Fi installation

- Phone installation

2. Ongoing costs

- Rent (if you’re in a rented building)

- Marketing

- Utilities

- Payroll

- Legal fees

- Business insurance

- Travel

- Shipping

- Equipment servicing

- Software

Some of these costs are what we refer to as “varied” costs, as in, they can change. However, some are “fixed” costs, such as rent, which is consistent from month to month. As you can see, typically there are more ongoing costs related to business operations than one-time costs.

So, to get a good idea of how much it’s going to cost in the short term, try to plan your organizational costs for the next six months. And, where possible, try to pay for this in advance.

In these first few months, your profit margins will be slim. Having the stability of your rent paid and other expenses sorted means you’ll be able to spend less time worrying about financing and more time on growing your business.

An example of business startup costs for the year

We’ve created a very basic example of some startup budget costs for a hypothetical company. This is an example template that you should create in order to gain a better understanding of what costs you will incur in your first year.

| Item | Description | Estimated costs (per year) |

| Rent | Small office space in shared building | $12,000 |

| Website | Maintenance and hosting | $2,400 |

| Marketing | Paid social media posts, pay-per-click marketing | $4,000 |

| Payroll | Three employees with a $50k per-year salary | $150,000 |

| Accounting services | One accountant for the business | $10,000 |

| Basic office equipment | Pens, paper, ongoing supplies | $100 |

| Total (per year) | $178,500 | |

This is just a basic guide of what kind of expenses you may see when you get past the investigatory and pre-launch costs in your first tax year.

How can you reduce startup costs?

1. Streamline your apps

As a new business, you’ll need to start from scratch. That includes all your software subscriptions, and other tools and services. But, for a startup on a tight budget, this is easier said than done. Try an all-in-one solution like RingCentral.

Because it includes everything you need from messaging to video conferencing and a phone service in one app, you won’t need to pay for countless separate tools each month. Instead, you can enjoy the benefits of everything your business needs in one easily accessible place.

Not only does it include communication tools, but it also comes with a range of app integrations. So, project planning tools like Trello and email apps like Gmail are available at the click of a button, with no need to toggle between apps. Some other neat RingCentral features your startup may need include…

- Group conference calls

- Easy meeting flips between voice and video:

- Team messaging

- File sharing:

- Task management:

- Masked phone numbers (use one company number)

🕹️ Get a hands-on look at how some of the fastest-growing startups are using RingCentral by booking a product tour:

💰 You can also use this calculator to see roughly how much your startup could save by using RingCentral to support your team’s communication with each other—and clients.

2. Start online

We’ve given examples of startups that may jump straight into the thick of it, with a rented office and a few employees from the get-go. However, as a new business owner, one of the best ways to keep costs down is to start small.

Depending on your business, you may find that, actually, launching solely online is viable. The COVID pandemic has proven, beyond doubt, that online-only operations work across niches.

For example, if you’re selling scented candles and homemade gifts, you may find it’s not necessary to have an office or a storefront. In the early stages of your business, you can get by online with good branding and solid marketing.

Even if you’re setting up a digital marketing agency that regularly connects with clients, you don’t need to meet clients to begin with. Meaning, technology has come a long way even in the last 20 years. Video calling has become completely normal for many businesses.

Sure, at some point you’ll want to meet your clients face-to-face and get to know them, but to start you can get by with the right software. Take RingCentral, for instance. It offers a complete solution to communication across the globe. There’s combined video, audio, and team messaging in one app. So, you can stay in touch with clients wherever they are.

See how MHP&S, a law firm based in Tennessee, provides an awesome client experience—no matter where its attorneys are.

There are some exceptions to the rule, however. For example, a real estate agent may prefer to have a physical location to welcome clients and organize viewings in person. This type of business requires a personal touch, which may be challenging to start solely online.

3. Secure funding for your new business

If your idea is exceptionally good, you might not have to front the costs from your own bank account. Small business loans can be limiting for a business because most companies only feel comfortable lending to those with a good reputation or portfolio of other businesses.

Thankfully, there are some other funding options for small businesses to consider, such as:

- Bank loans

- Investors/lenders

- Small Business Administration (SBA) loan

- Grants

- Crowdfunding

- Credit card

These options are ideal if you’re struggling to cover upfront costs or having issues with cash flow but truly believe in your business idea. Compile a business plan and highlight why your specific business deserves funding.

What are the 4 key components of a successful startup?

Are startup costs capitalized or expensed?

You don’t just need to know what costs you may face, you must understand how to account for them. Are they capitalized or expensed? This refers to how a cost is treated on your business’s financial statements. Startups have two options when adding costing to their statement, they can either capitalize or expense it.

If you expense the cost, it’s added onto your income statement and deductible from your revenue to determine profit. But, if you capitalize (also known as amortization), this will count towards capital expenses. This means it’ll be counted as a business asset, and your income statement will only feature the depreciation of the asset.

Because this differs so much for startups, given your equipment and leasing costs (where applicable), no mandatory rule exists. It’s up to you on how you want to categorize your startup costs.

When can you write off startup costs?

Only some startup costs can be written off. Business owners can usually deduct one-time expenses for tax purposes, which can save you money on the final amount of taxes you owe.

Keep track of all your startup costs and set up a meeting with your accountant when it’s time for you to file your tax returns with the IRS.

How should my co-founders and I split up the company equity?

Sometimes, brilliant ideas are formed with the help of more than one person. When this happens, you have co-founders. It is generally not advisable to split the company 50/50.

That’s because it can lead to complications, such as lack of control and motivation. It can also be a source of frustration if one co-founder feels like they’re putting in more work than the other. There’s a method called the Founders Pie Calculator that can help you in your decision.

Establish this split early on, and always put it into writing. This can then be drawn up into a contract at a later date. Once you’ve had this open and honest conversation, you can begin starting your company.

Time to calculate your startup expenses

Now you’ve got an idea of your one-time costs and ongoing costs, you can begin to budget your overall startup costs. Follow these simple steps:

- Create a budget plan listing all initial expenses so you have an idea of upfront costs.

- Then, include ongoing expenses for the next six months.

- Once you have a rough idea of what starting your business will cost you, you can then consider funding options.

Don’t forget to cut-down startup costs by streamlining your apps and not necessarily jumping into renting an office space. With these helpful tips, you’ll be well on your way to giving your business the best chance of success.

Updated Mar 13, 2025