Highlights:

- After working remotely during the early months of the pandemic, many financial services workers aren’t eager to be back in the office, even for a hybrid work situation.

- If employers don’t find workable long-term solutions for hybrid and remote work, they risk losing employees to a job with more flexible arrangements, making worker shortages more severe.

- Employers should find ways to make remote work effective, including using a unified communications platform that makes it easy to locate needed information and resources at home or in the office.

👀 👀 Did you know that digital transformation in financial services is well underway? Grab our infographic to get the whole story.

During the COVID-19 pandemic, financial services were forced to go virtual while in-person work and services were paused, in some instances for many months or more than a year. In 2021, many offices began to bring workers back as vaccines became widely available or were even required for workers in some areas.

Despite most financial services leaders’ desire for employees to come back to an office environment, however, most employees are far less eager to do so. At the nine-month mark of working remotely, only 20 percent of financial services employees said they wanted to be in the office even three days a week. Worker sentiment hasn’t changed much since then. The majority, 60 percent, said being required to come back into the office could impact their willingness to stay in a particular job.

Given the difficulty many industries are having in finding enough workers as their businesses once again begin to grow, employees’ preferences for remote work and flexibility have taken on what amounts to a demand status. If financial services organizations don’t agree to these demands, they risk losing valuable employees.

Reasons for a partial return to the office

It may not be possible to return to previous business models, though, without employees spending at least some time in the office for the following reasons:

- To meet with customers who are now willing to meet in person again

- For in-person consultations required for compliance with best practices

- To collaborate with team members more effectively

- To access resources that aren’t available remotely

Employees acknowledge that certain functions are not as effective remotely as in-person. For example, many employees feel that certain collaboration tools limit the creativity and genuineness that in-person collaboration can bring.

Another major drawback to remote work is that it is more difficult to mentor and train new workers—and it is next to impossible to do some financial services jobs without intensive mentoring, at least at the beginning of the job.

For these reasons, a hybrid work model is the likely compromise between all-remote work and returning to a financial services office environment full-time.

What is needed for hybrid work?

The hybrid work environment may be necessary for workers to be willing to stay in a job, but that doesn’t mean hybrid work arrangements won’t be a challenge for both workers and their supervisors. Remote work during the height of the pre-vaccine pandemic was, in many cases, a stripped-down version of the “normal,” not a model with long-term sustainability in mind.

A permanent hybrid model requires the right technologies to facilitate necessary interactions between team members and with customers, and it is not as simple as assigning a company smartphone and email address.

What is really needed is a virtualized office environment—a place with multiple semi-private spaces where people can interact, including a lunch space, breakout or conferencing rooms, and even virtual “desks” where work can be done.

Another aspect of a virtual work environment includes support for making the home or remote environment conducive to work. While a remote or hybrid work arrangement is preferred by most workers today, it isn’t always easy to find distraction-free work time when schools may shut down suddenly or your child may have to stay home frequently with illnesses or after repeated exposure to COVID-19.

Problem: too many different tools

There is no shortage of tools available for virtual meetings, virtual collaboration, and a virtualized office environment. In short order, companies can be set up with a handful of such tools.

But the longer remote work continues, the more employees report that having many different tools can be confusing and cost them precious time when they need to find information and resources. It can take hours each week to navigate between four or five different communication and collaboration tools to find needed information when those tools don’t work together—time that could otherwise be used to get actual work done.

How many businesses can afford a 10-15 percent productivity loss due to a disconnected communications ecosystem? And how much more revenue could your financial services organization make if it could recover most or all of this lost time?

Solution: unified communications

There is a solution to the problem of disconnected communication tools, and it involves finding a platform that can unify the solutions employees need so they can recover lost productivity and have a more satisfying virtual experience.

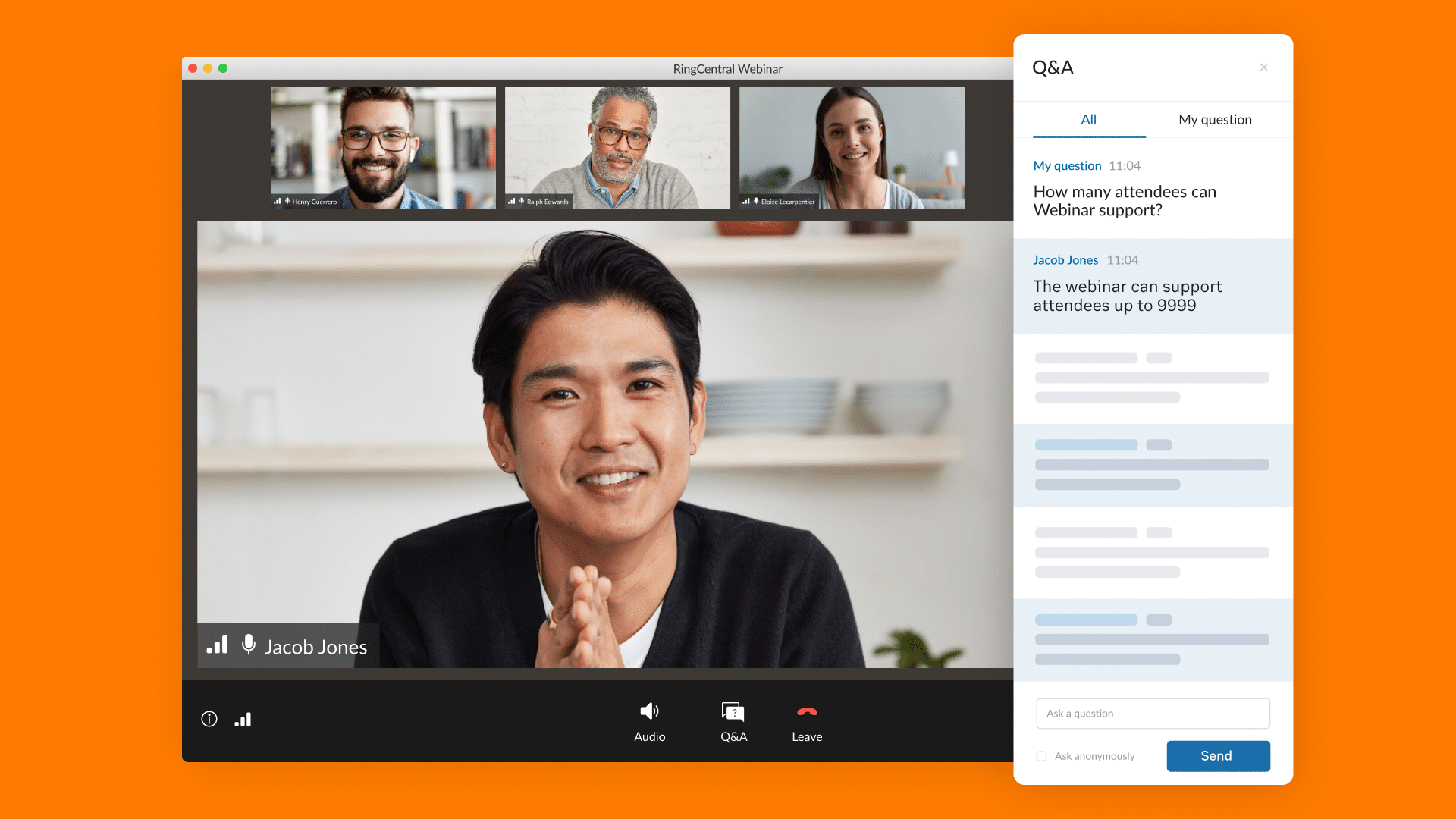

If various tech tools can be integrated into a unified system or handled by that system without a separate tool, it will make data and resources available all throughout the system. More than anything else in a remote work environment, a unified communications platform puts a virtual office environment on par with most in-person work situations—and can be used in or out of the office.

RingCentral provides secure communications for financial services

RingCentral for Financial Services is an industry leader in cloud-based communications platforms, with unparalleled security to protect sensitive and confidential client information. Everything you need for communication remotely or in-office is at your fingertips, including bank-grade encryption and integrations with popular third-party applications to keep everything functioning in one unified system.

Are you ready for an all-in-one cloud-based communications and collaboration solution for your financial services company? Contact RingCentral today and see how it works.

Originally published Feb 15, 2022, updated Nov 03, 2023